How rising inflation is impacting audiences

Rising inflation has put pressure on household budgets, with audiences attending slightly fewer events and spending less

-

Increasing interest rates and cost-of-living pressures are impacting consumer confidence around the country. This ‘Pulse Check’ explores how Australian arts audiences are responding to changing economic conditions, based on data from 1,318 past attendees.

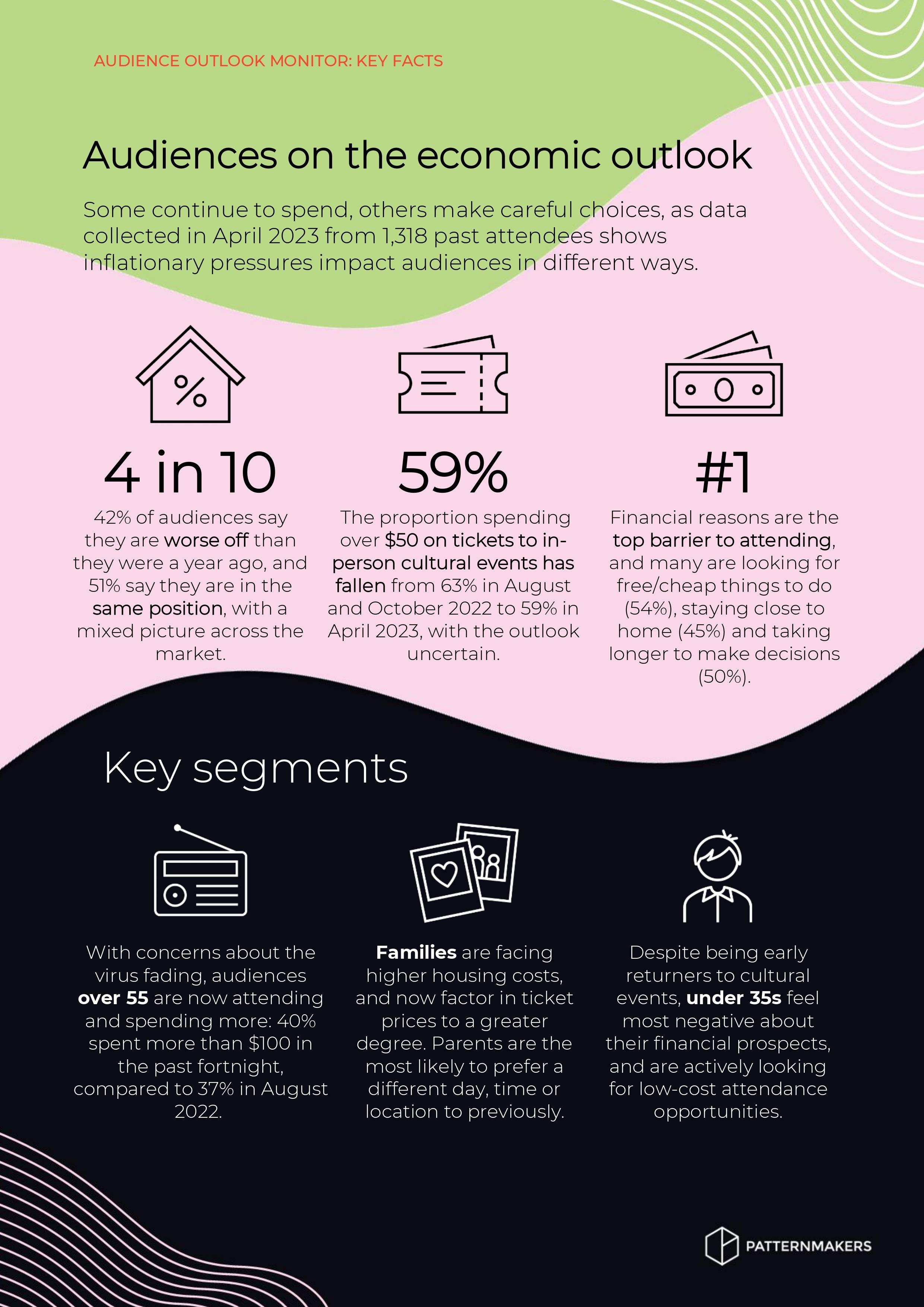

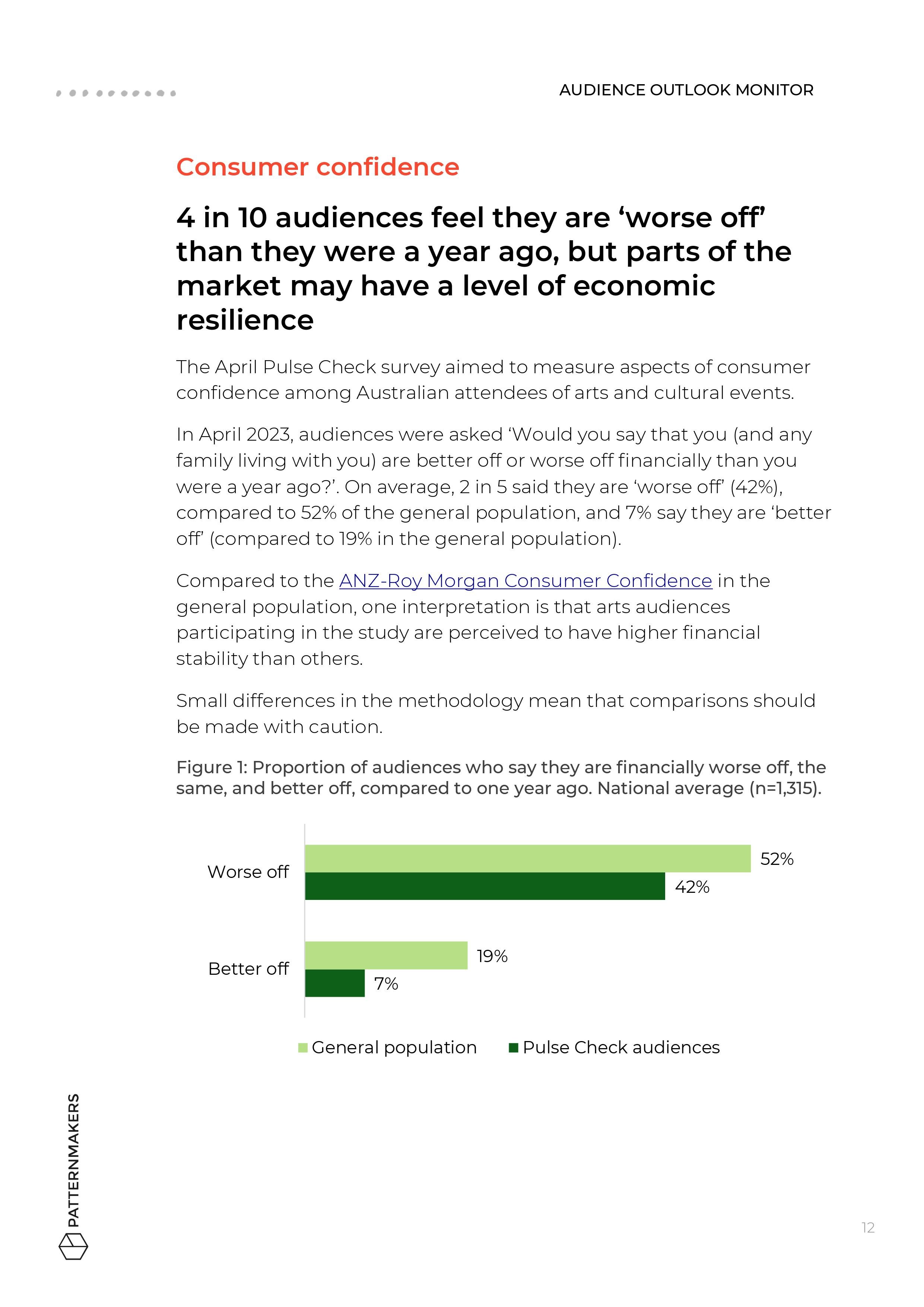

Around 4 in 10 (42%) audience members surveyed say they are ‘worse off’ financially compared to one year ago. 1 in 10 (7%) are ‘better off’ and 5 in 10 (51%) are ‘the same'.

Arts attendees appear to be faring slightly better than the general population, on average, but are more cautious about the country’s economic outlook, based on comparison of the results with the ANZ-Roy Morgan' Consumer Confidence index.

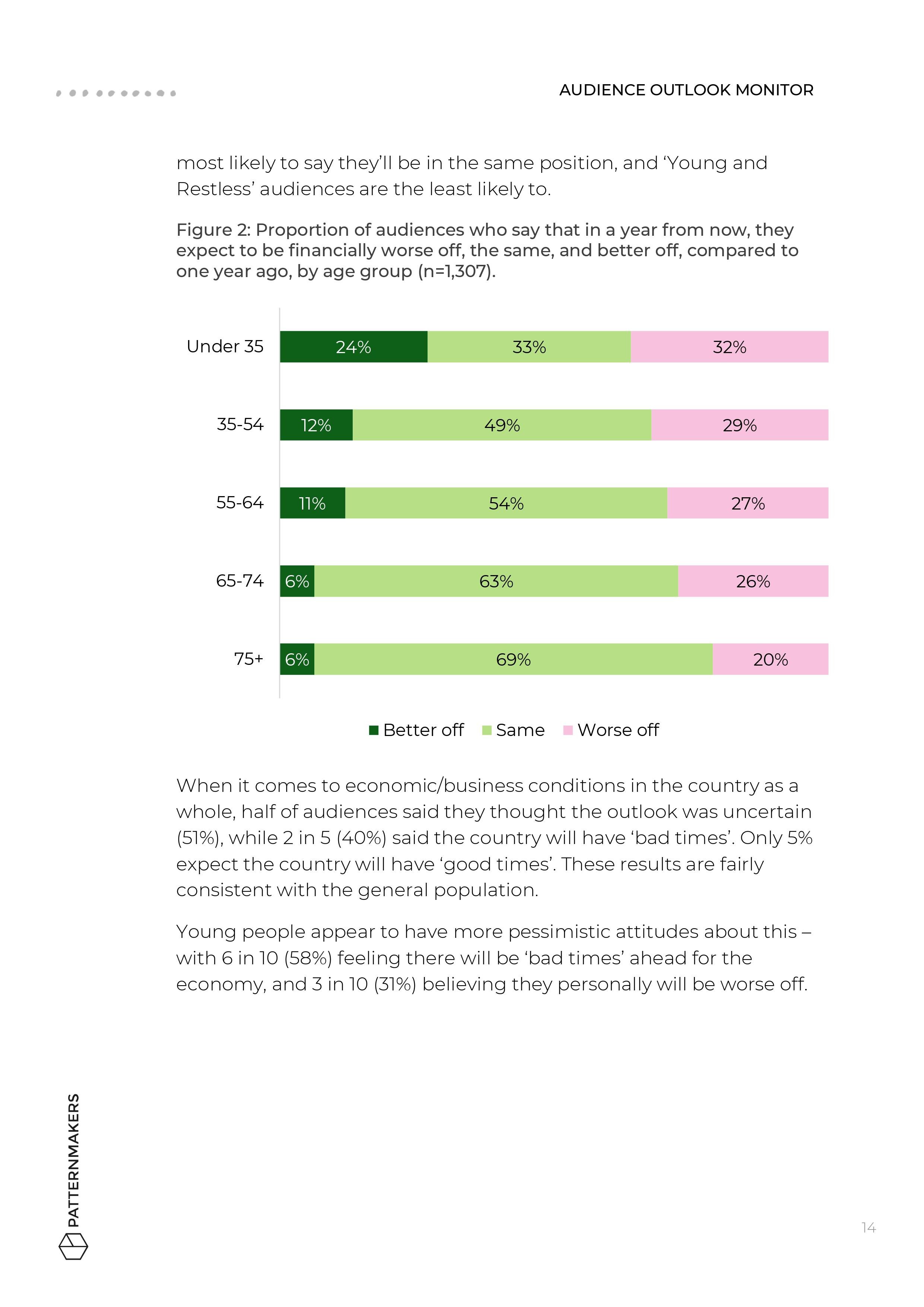

Trends vary across segments, confirming the need to tailor strategies for different audiences and events. Older audiences are the most likely to say their situation is the same (58%), while parents are the most likely to say they are ‘worse off’ (57%). Young audiences under 35 are most negative about the economic outlook.

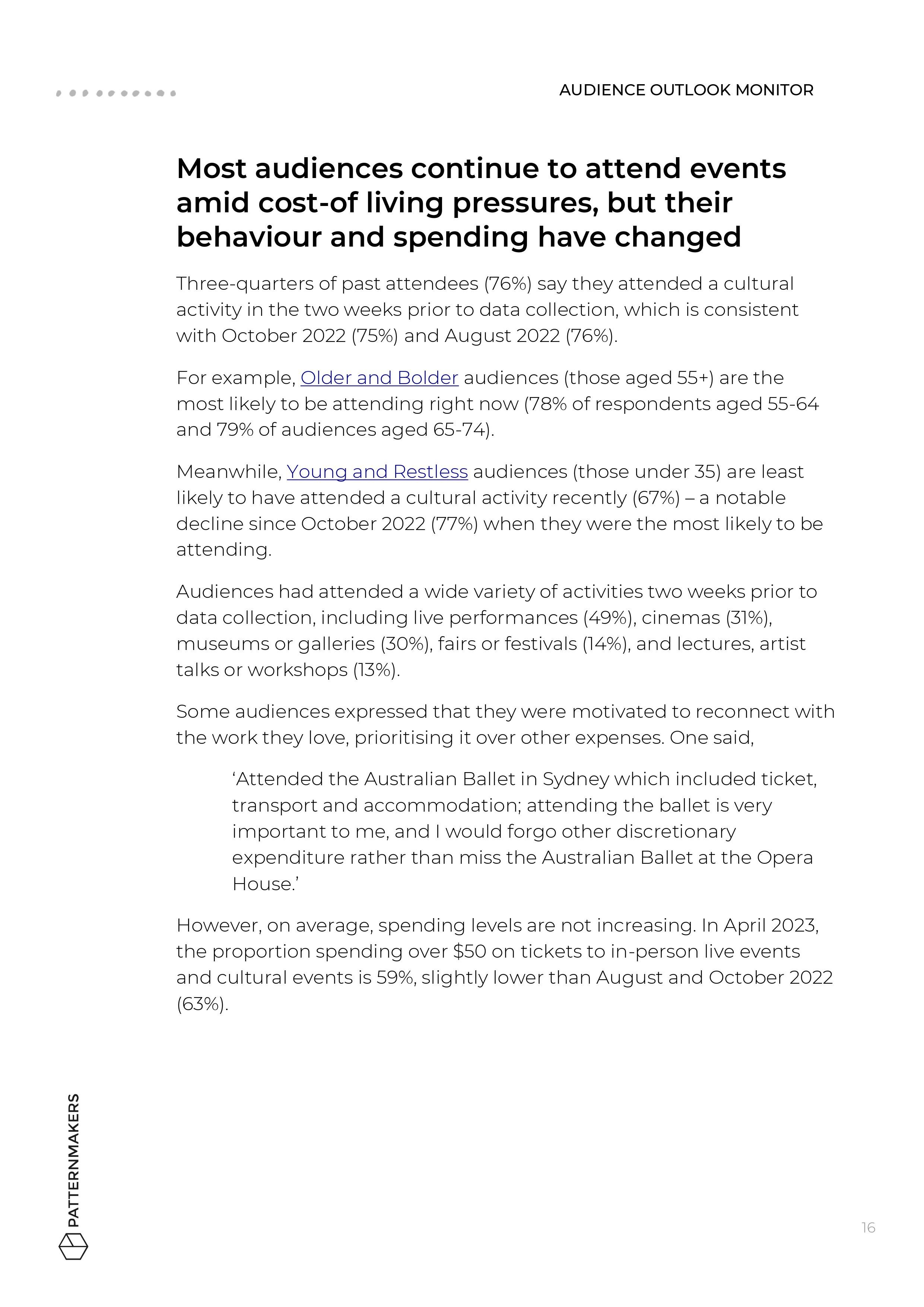

While three-quarters of past attendees (76%) attended a cultural event in the fortnight before data collection (19-23 April), consistent with October (75%) and August 2022 (76%), the profile of those attending, and their attendance preferences are changing.

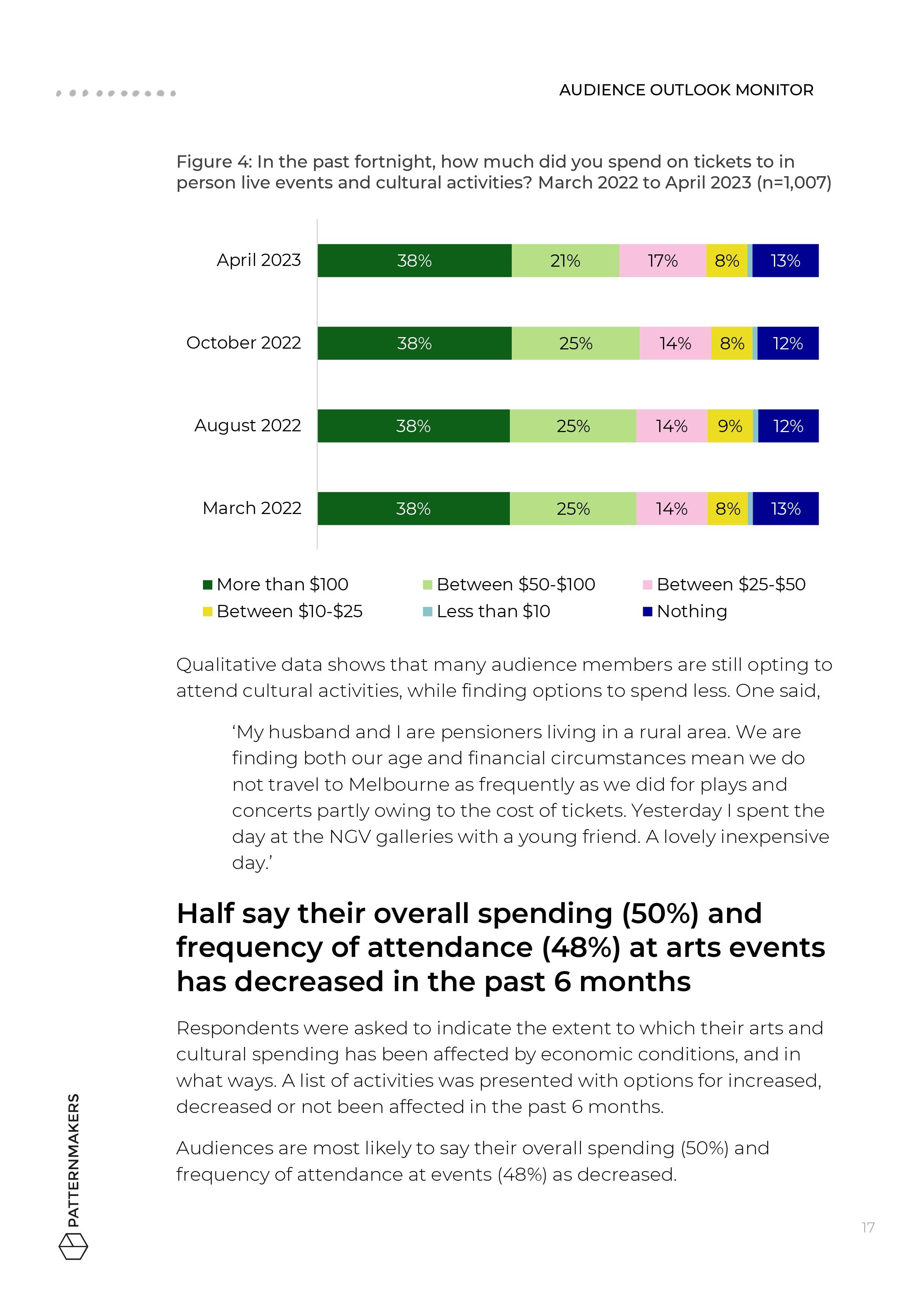

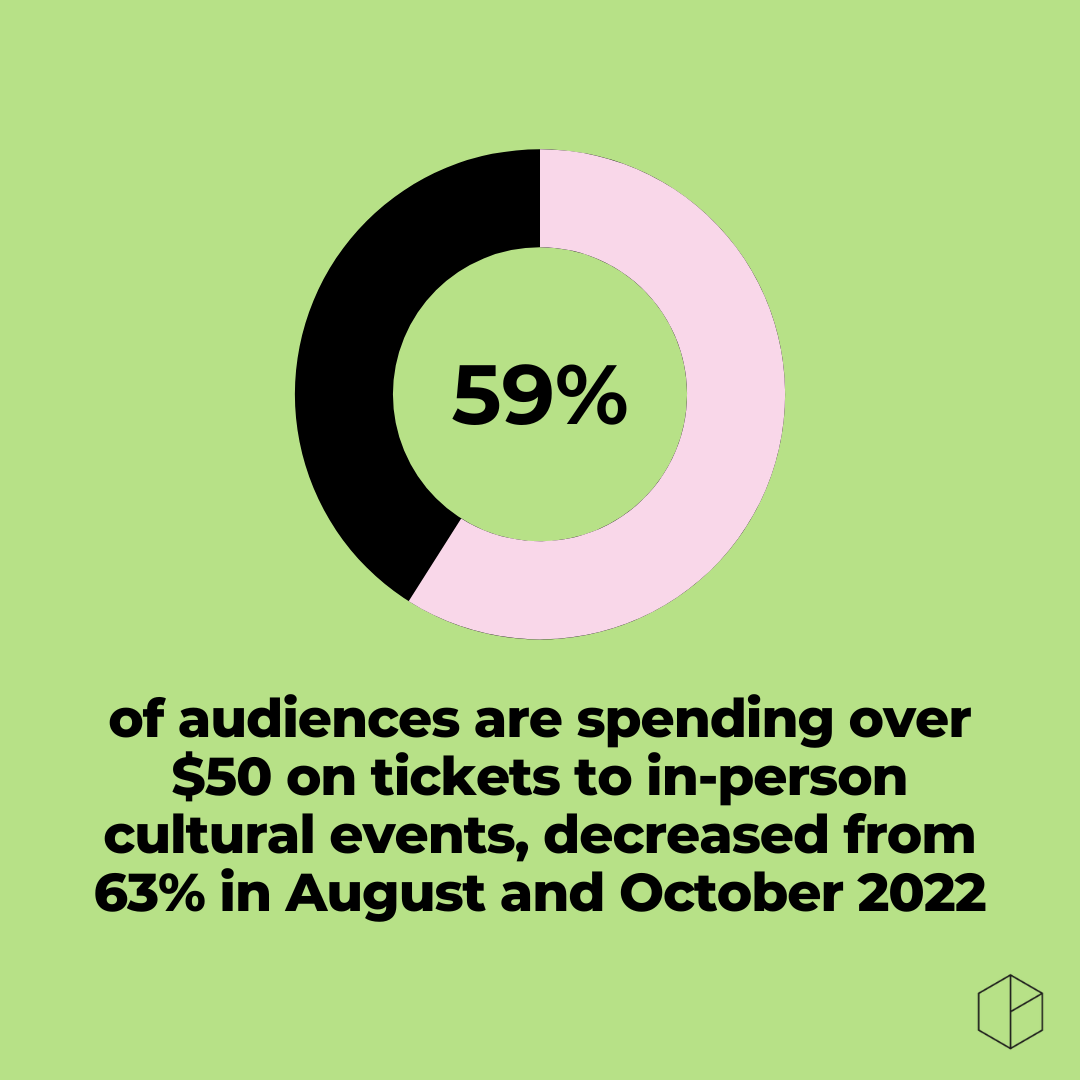

Average spending levels are decreasing, with 6 in 10 (59%) of those attending in the past fortnight spending over $50 or more, down slightly from August (63%) and October 2022 (63%). However, averages should be interpreted with caution, as some segments are actually spending more, and others less.

Read on or download the report for details on how different segments are behaving.

Click the buttons below to download the April 2023 Snapshot Report, as a PDF or the accessible Word version, or read on for more of the findings.

With financial limitations top of mind, many audiences are deliberating longer on factors such as price, location and overall value

-

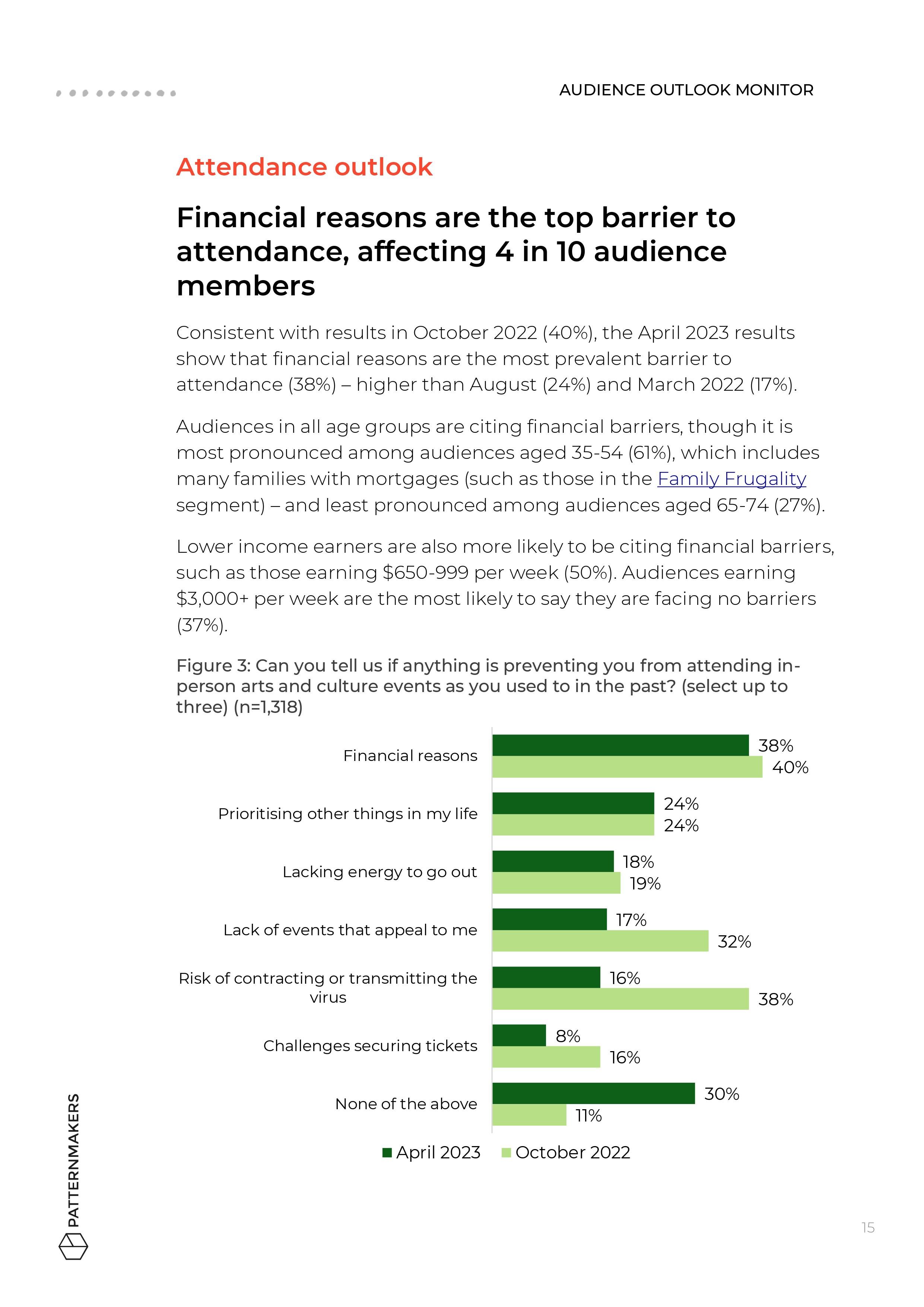

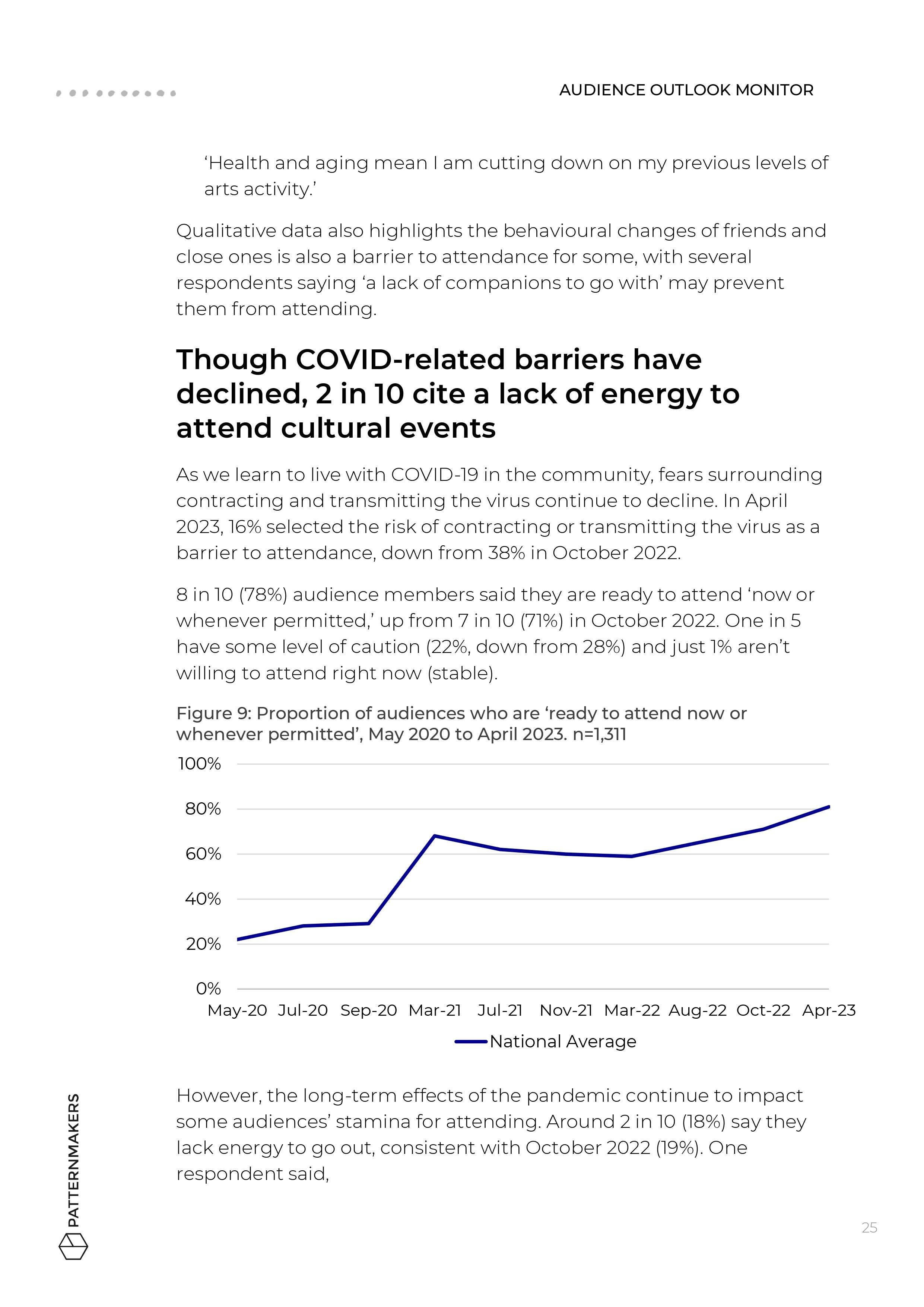

As COVID-related concerns continue to fade, financial reasons are the top barrier to attendance, affecting 4 in 10 audience members.

A lack of money is not the only consideration – the data also suggests a perceived lack of time and a lack of energy, as lifestyles continue to evolve after the pandemic. Many report feeling busier with the return of office working, commuting, travel and social events – and 24% say they are inhibited by ‘prioritising other things’.

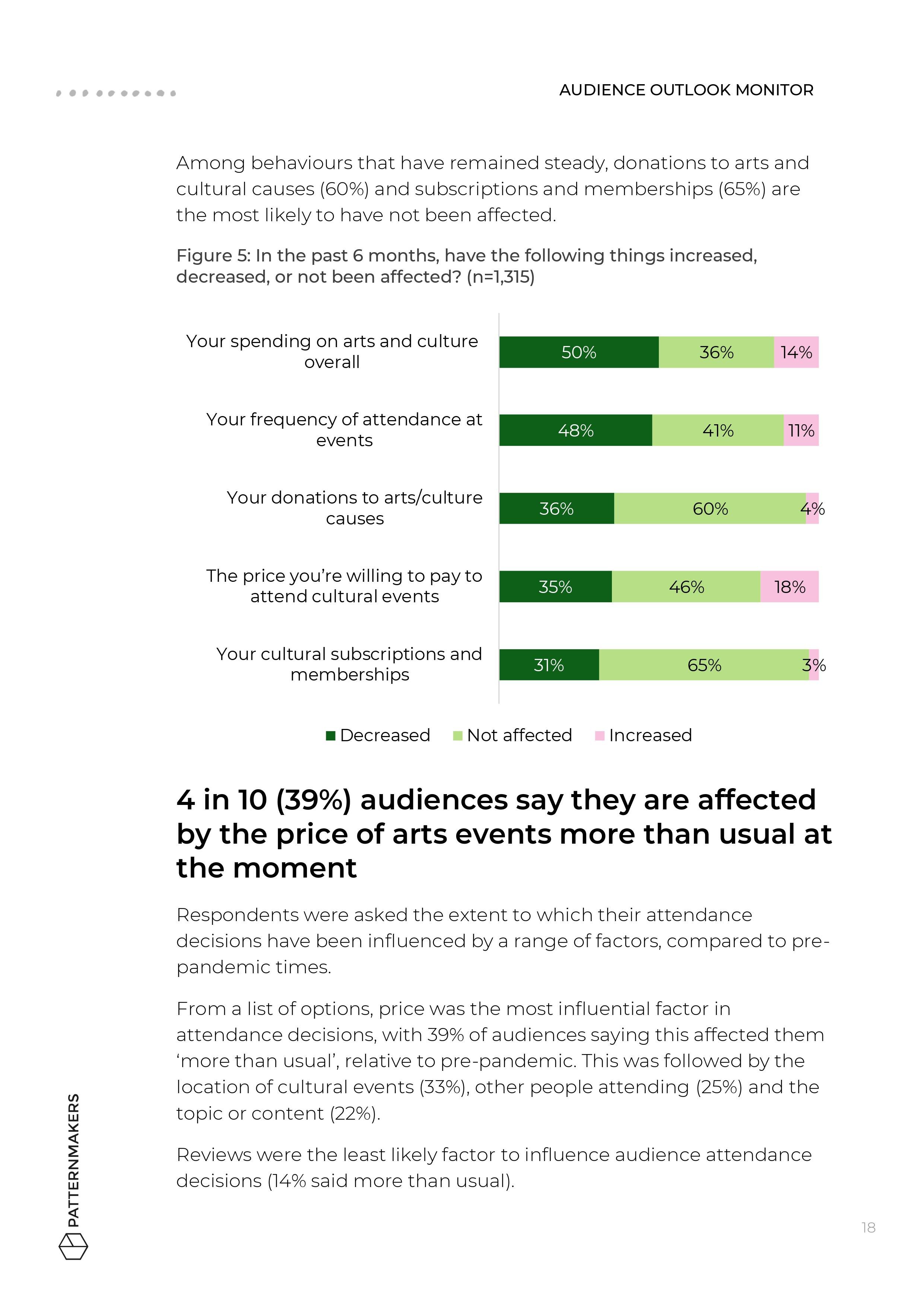

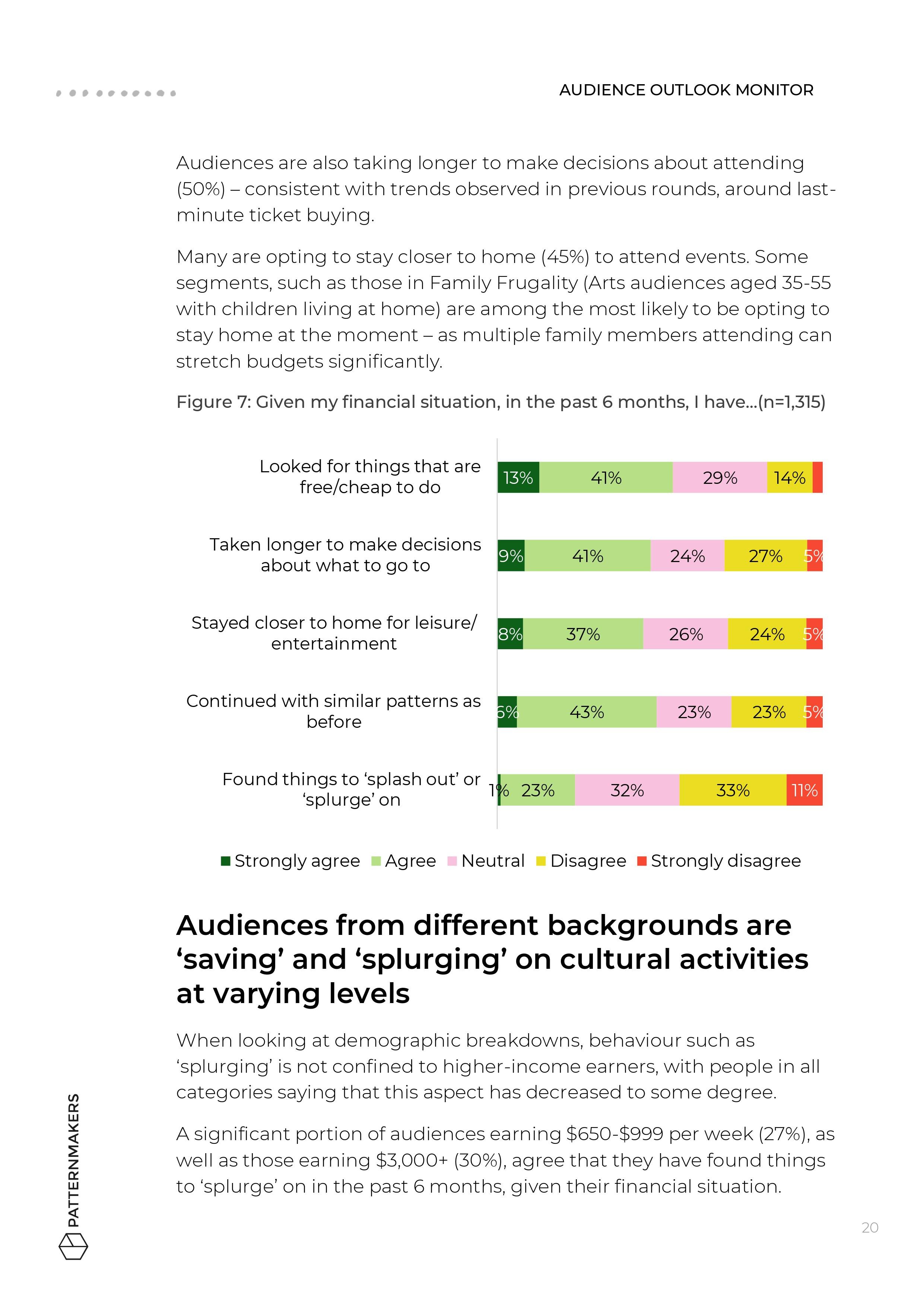

When asked about their cultural spending over the past 6 months, sizeable numbers say the price they are willing to pay to attend (35%) and/or their frequency of attendance (48%) have decreased.

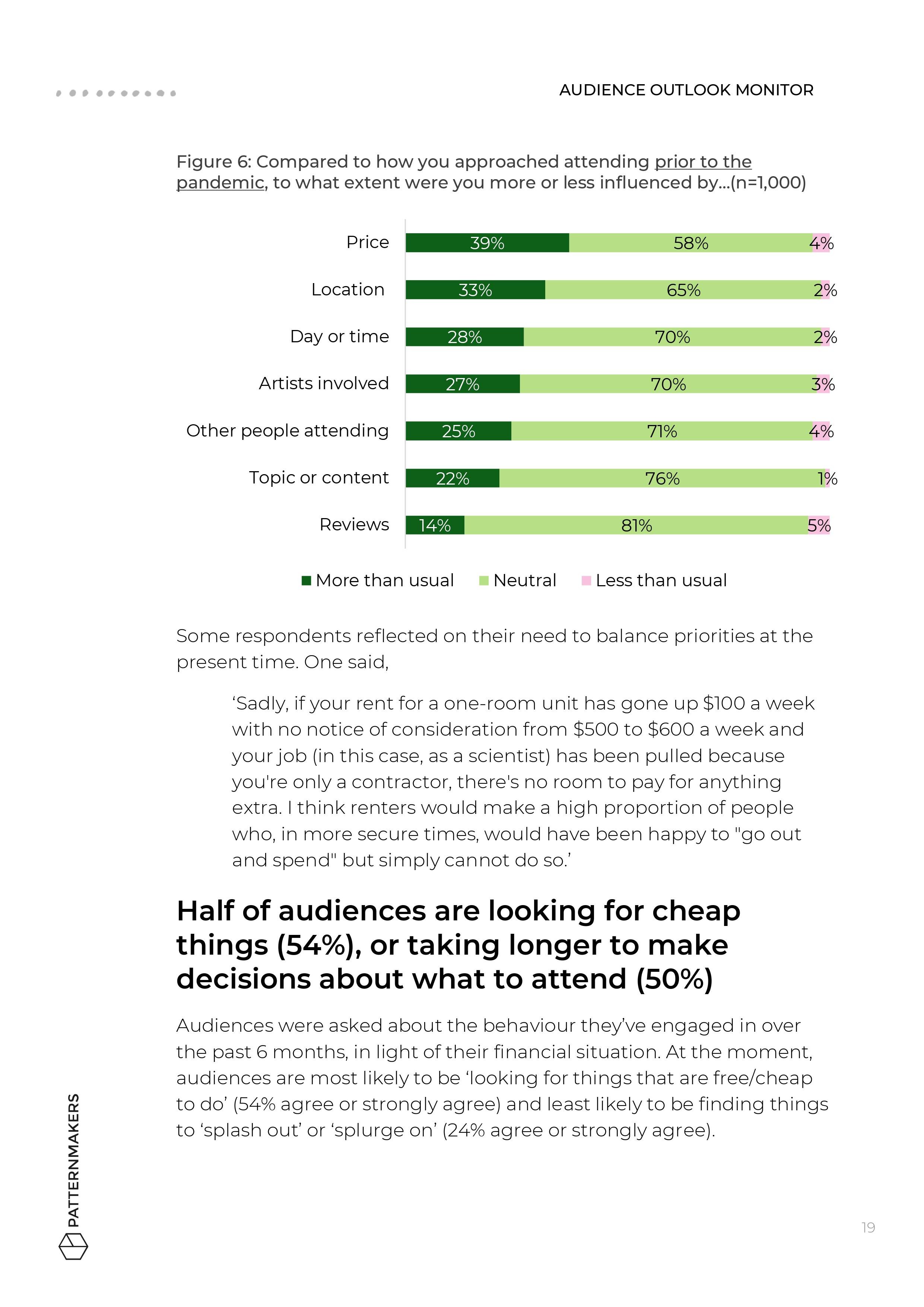

When reflecting on the most recent event they attended, 4 in 10 audiences said that price influenced them ‘more than usual’ (39%).

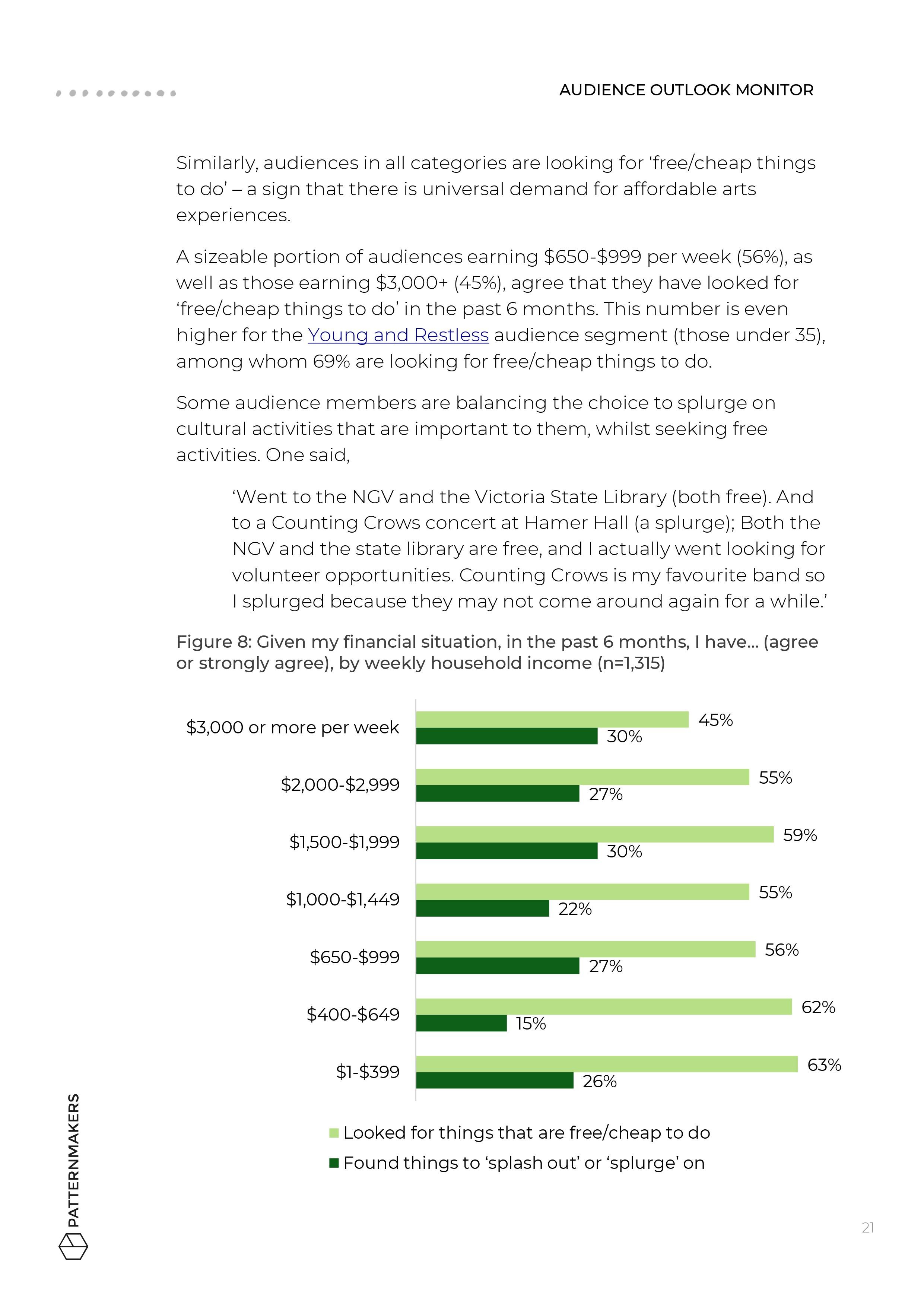

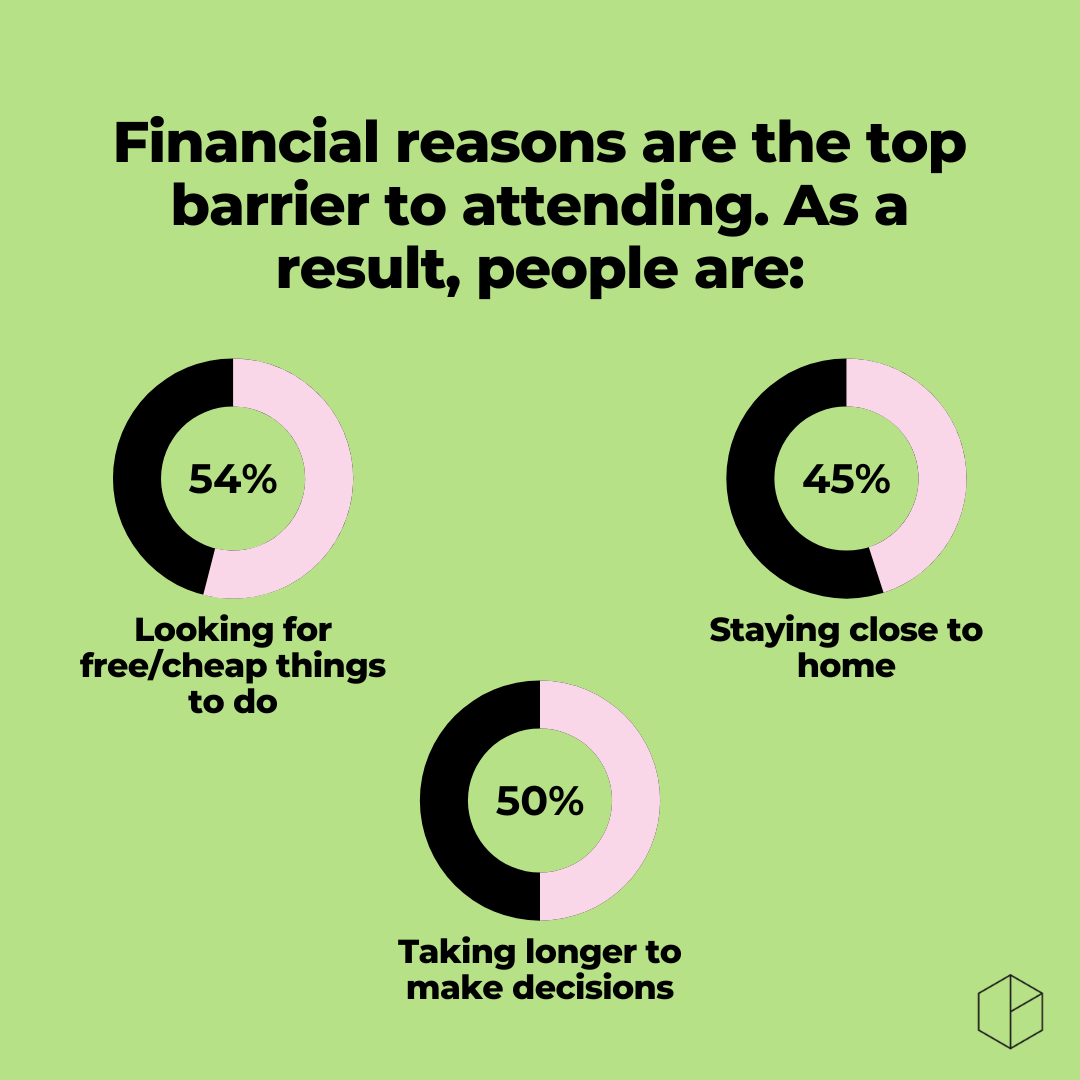

Around half are looking for free and cheap things to attend (54%) and qualitative data shows that discounts and pricing offers are factoring into a high number of decisions, particulary among families and young people.

People from different socio-economic backgrounds are ‘splurging’ and ‘saving’ to different degrees – and some are doing both, opting to splash out on events that are important to them, while making savings elsewhere by looking for free or low-cost alternatives.

Audiences say they have decreased spending on events (50%), donations (36%) and subscriptions/memberships (31%) – though many who engage in these forms of support say they plan to continue, acknowledging tough conditions for artists and a desire to show their support in tough times.

The uncertain economic outlook requires tailored strategies for different segments and scenarios

-

Many are taking longer to make decisions (50%), and last-minute ticket-buying appears here to stay for the time being.

The location of events is also impacting 33% of audiences more than usual and 45% say they are staying closer to home. Qualitative data suggests that proximity to events plays an important role – with costs of parking, fuel, air tickets and hospitality all increasing.

Some segments are more disadvantaged by travel costs than others, and logistical considerations in scheduling events will be important for catering to a range of audiences.

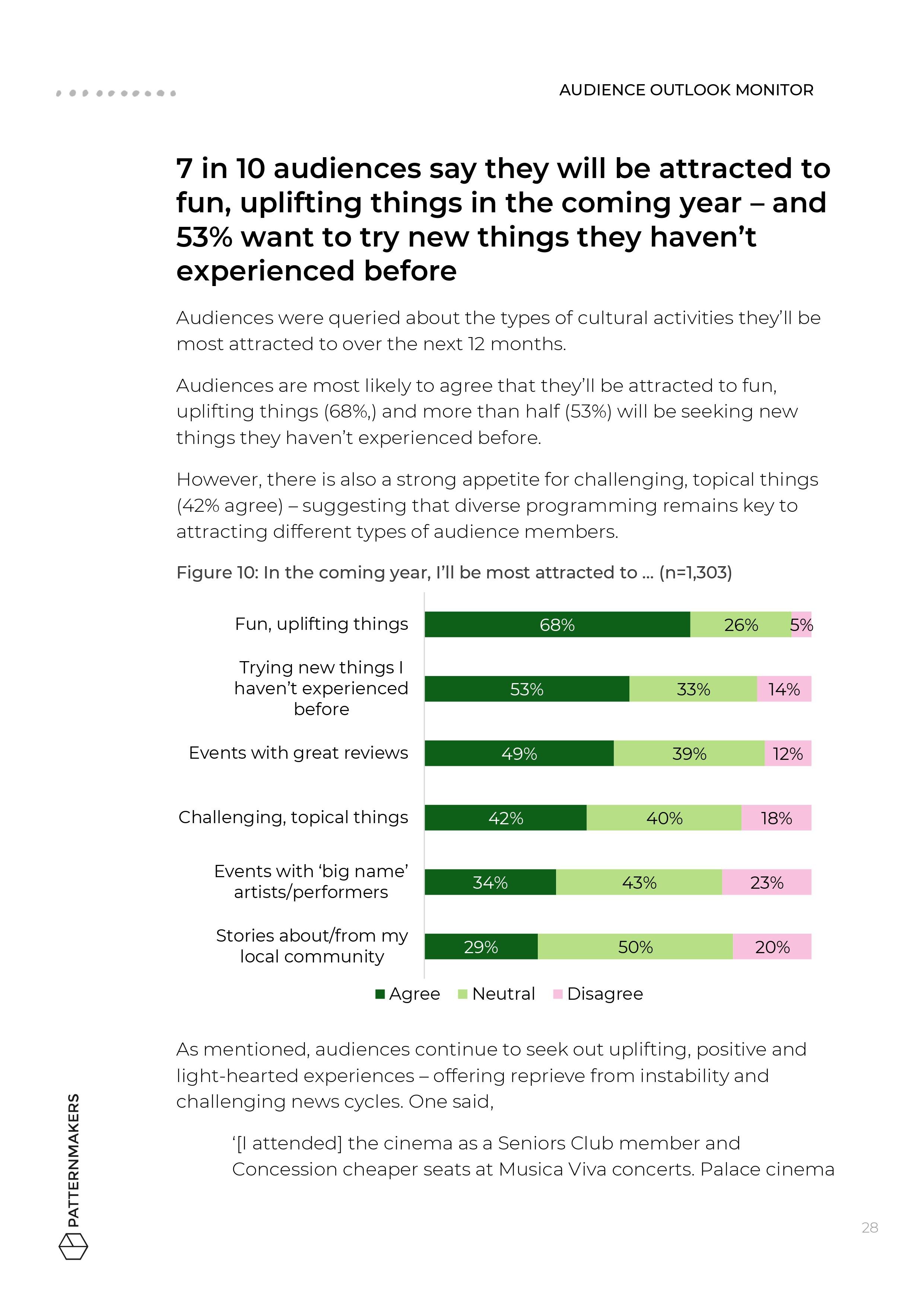

When asked about the next 12 months, audience responses confirm enduring appetites for new (53%), uplifting (68%) and challenging arts experiences (42%). Balanced programs are as important as ever.

When asked to share what they’ve attended recently, and why they prioritised those things, some common themes include a desire to support artists and organisations they value and wanting to return to the works they know and love. Some appear to want a ‘safe bet’ that they will have an enjoyable experience with friends/family.

Economic conditions are complex, and affect every household differently. However, looking at the trends in three key segments can assist with understanding some of the differences and identifying practical implications (overleaf).

With an uncertain outlook, and the possibility of a recession, it’s wise to stay flexible and consider how strategies and tactics can be adjusted as conditions change.

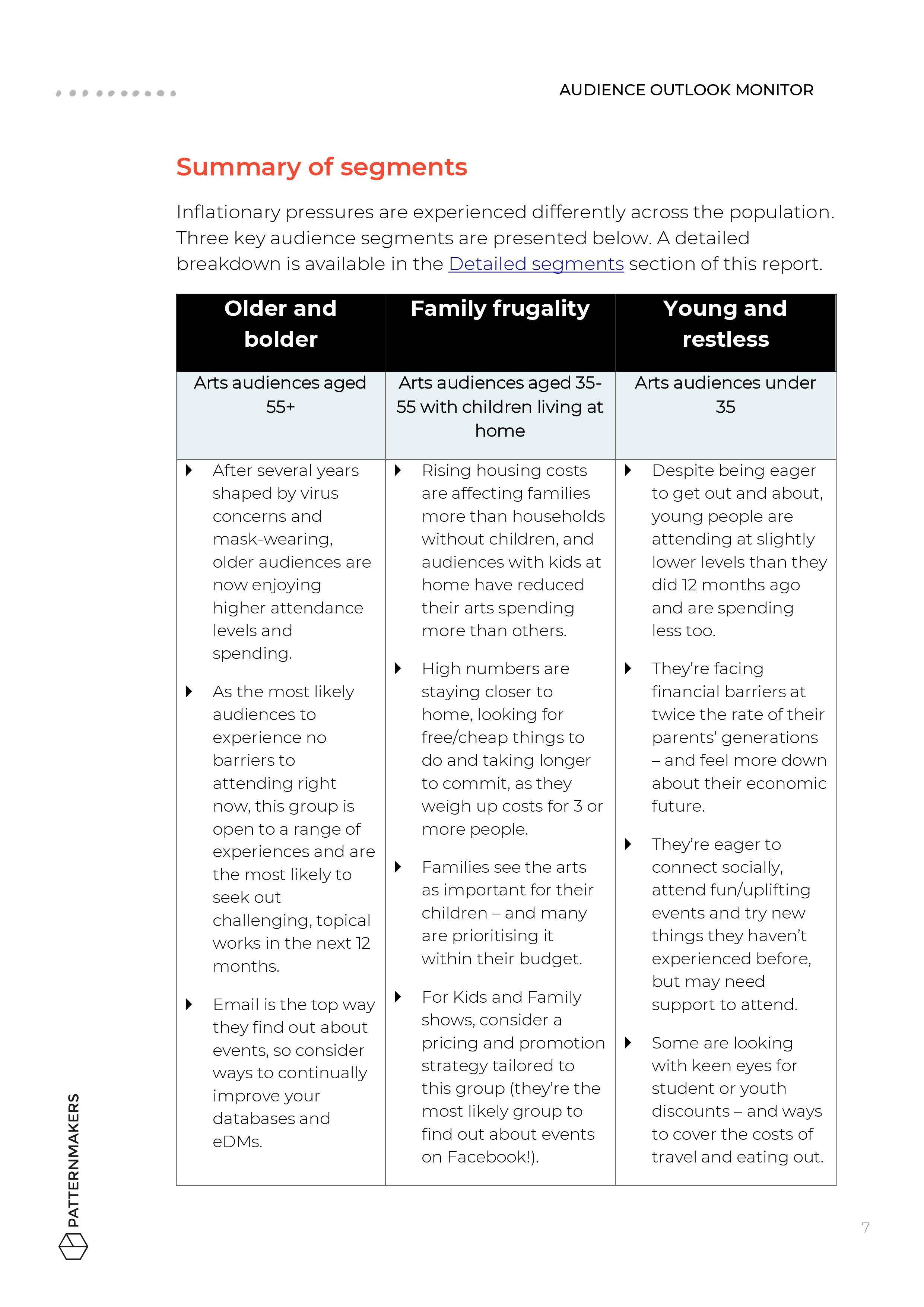

Summary of segments

Inflationary pressures are experienced differently across the population. Three key audience segments are presented below.

-

Arts audiences aged 55+

After several years shaped by virus concerns and mask-wearing, older audiences are now enjoying higher attendance levels and spending.

As the most likely audiences to experience no barriers to attending right now, this group is open to a range of experiences and are the most likely to seek out challenging, topical works in the next 12 months.

Email is the top way they find out about events, so consider ways to continually improve your databases and eDMs.

-

Arts audiences aged 35-55 with children living at home

Rising housing costs are affecting families more than households without children, and audiences with children at home have reduced their cultural spending more than other adults.

High numbers are staying closer to home, looking for free/cheap things to do and taking longer to commit, as they weigh up costs for 3 or more people.

Families see the arts as important for their children – and many are prioritising it within their budget.

For Kids and Family shows, consider a pricing and promotion strategy tailored to this group (they’re the most likely group to find out about events on Facebook!).

-

Arts audiences under 35

Despite being eager to get out and about, young people are attending at slightly lower levels than they did 12 months ago and are spending less too.

They’re facing financial barriers at twice the rate of their parents’ generations – and feel more down about their economic future.

They’re eager to connect socially, attend fun/uplifting events and try new things they haven’t experienced before, but may need support to attend.

Some are looking with keen eyes for student or youth discounts – and ways to cover the costs of travel and eating out.

Opportunities

As conditions continue to change, opportunities exist in terms of programming, marketing and ticketing. However, the right solutions will look different for every organisation. The ideas outlined below are put forward to get you thinking, and any action should be considered in terms of what’s right for you and your audience.

Programs featuring diverse topics and different price points are likely to reach the broadest audiences.

-

Keep in mind audiences’ desire for fun, uplifting events in the post-pandemic era, but don’t forget there are sizeable numbers wanting new, topical and/or challenging things – some audiences have expressed wariness of commercialisation or softening of the cultural activities they love at the expense of creative innovation

Review the price points of your offerings and consider how audiences in different segments will assess value for money

Research the demographic shifts affecting your area and explore as a team how behaviours like working from home, commuting and travel are changing

Keep on top of transport options to your area, such as public transport schedules and initiatives, and consider these when scheduling events

Consider programming earlier event options/matinees to encourage attendance among cost-conscious parents or outer metro/regional audiences who might catch public transport or drive but want to avoid travel rush or late-night travel

Looking ahead, consider the right frequency and volume of events for the economic conditions. It might be helpful to plan for different scenarios such as a fast rebound or prolonged recession.

Clear and helpful marketing campaigns can help get indecisive audiences over the line.

-

Look at ways to take pressure off audiences by spelling out instructions on how to get to and from events, on your websites, newsletters or pre-event emails

Consider researching and promoting any money saving transport or parking initiatives, to encourage regional or outer metro attendance at inner city events, or metropolitan attendance at regional or outer metro events

Consider creating and promoting itineraries for a ‘night out’ based on different budgets e.g., suggested transport, pre-show drink destination and post-show dinner destination

Take time to get digital marketing right and wherever possible tailor the words, imagery and channel, based on things like prior attendance, post code, age, family status or income (sometimes reaching a smaller group with the right campaign will deliver better engagement than a broad campaign to a bigger group)

Where one event ticks various boxes, consider A/B marketing tactics to communicate the same event to different segments in different ways – for example, highlight the ‘challenging, topical’ content of a show in an email to over 55s, while featuring any ‘big name artists’ in an email to under 55s.

Ticketing initiatives to support more price sensitive audiences are important, but last-minute discounting may not be the answer. Also, with some arts audiences doing well financially and others struggling, it might be time to introduce alternative payment models.

-

Look at ways of rewarding early bookers with earlybird discounts or newsletter subscriber pre-sales, rather than resorting to last minute ‘panic’ discounting

Consider offering cheaper ticket prices for young audiences and reviewing age limits – i.e. under 35 may be more appropriate than under 30 or under 25 given current conditions, and some artforms may have a case to extend this to under 40

Consider offering group discounts or family ticket offers (e.g., 2 adults, 2 kids or 1 adult, 3 kids) to relieve cost pressures from price sensitive parents and caregivers, and encourage group bookings

Review the approach to booking fees and consider a per ticket fee or a scaled offer e.g. percentage of total purchase instead of a set per transaction fee, which has a higher impact on single ticket purchasers

Clearly communicate where booking fee money is going, and consider investigating a payments solution like ArtsPay, – some audiences are put off by high booking fees but many are keen to support the arts and artists

Investigate ways to facilitate ‘pay it forward’ tickets, where people in more comfortable financial positions can purchase or subsidise tickets for people more affected by cost of living pressure

If feasible, options to pay in instalments could take the pressure off audiences splashing out big purchases, and encourage more to book in advance

For lower cost events, consider a ‘pay what you want’ model with a small pre-purchase deposit to encourage more risktaking from audiences to see something new, topical or challenging, but avoiding risks around no-shows

Cover Image Credit: Audience at Future History Runway. Melbourne Fringe Festival 2022. Photo by Duncan Jacob, courtesy of Melbourne Fringe.

Want to hear more about the findings? Join us for a webinar with the Australia Council on 17 May, 12:00 PM AEST.

Click the button below to register your attendance.

Use the dashboard to get results for your artform and region

Survey data from over 1,300 respondents has been uploaded to the dashboard, which now contains insights from 100,000 Australian participants.

You can use the dashboard to explore the findings by state/territory, artform and audience segment.

It’s freely available to access, just click the image below and use the login details provided on the dashboard page.

About the Audience Outlook Monitor

The Audience Outlook Monitor provides the results of a study that has tracked audience sentiment over the course of the COVID-19 pandemic.

Data was collected in six phases throughout 2020-2022 and is again being tracked in 2023.

Government agencies across Australia are collaborating with research agencies Patternmakers (Sydney) and WolfBrown (USA) to produce this resource. The dashboard is freely accessible and designed to help artists and cultural organisations of all kinds to make the best possible decisions.

How to find out more

To receive new releases directly into your inbox, as soon as they are available, you can opt in to receive Audience Outlook Monitor news below.

Subscribers to our regular Culture Insight & Innovation Updates will need to update their preferences to receive all updates about the Audience Outlook Monitor. Just enter your email below and follow the instructions provided.

If you have a question, or an idea for using this data, please contact Patternmakers at info@thepatternmakers.com.au

Subscribe for updates

About the Author

Bianca Mulet

Senior Research Analyst

Delivery partners

Supporting partners

Past posts on this blog

Archive

- 2023 21

- Dance 3

- Research 99

- Audience development 79

- Arts 73

- COVID-19 70

- Culture 72

- Data culture 69

- Evaluation 75

- Innovation 78

- Thought leadership 16

- About Patternmakers 35

- Privacy 6

- Project updates 25

- Culture Panel 1

- Resources 6

- Toolkit 5

- Beyond the Bio 8

- 2022 23

- Career Advice 9

- Opportunities 4

- Tips & Tricks 13

- 2021 7

- 2024 1

- First Nations 3

- Indigenous 2

- Strategic Planning 5

- Trends 3

- Performing Arts 5

- Manifesto 1

- Education 2

- Capacity building 3

- Digital art 4

- Interviews 3

- Coronavirus 2

- 2020 3

- Tandi Palmer Williams 7

- Theory of Creativity Podcast 1

- 2019 11

- Top 5 2

- 2018 12

- Case Studies 2

- Our services 4

- Postcode Analysis 1

- Accessibility 4

- Touring 3

- Publications 1

- 2017 8

- Data art 2

- 2016 5