City lights to red dirt: Connecting with audiences across Australia

In this Audience Outlook Monitor report, ‘City Lights to Red Dirt’, we look at the geographic trends in data collected from past attendees to cultural events, comparing audiences in big cities, outer suburbs and the regions.

Our cities, suburbs and regions are different places today and audiences are responding in interesting ways.

Attendees of arts and cultural events are feeling the pressure of the housing crisis, changing work and commuting patterns, navigating weather events and approaching travel and leisure differently.

In this new report, ‘City Lights to Red Dirt’, we look at the geographic trends in data collected from past audiences of cultural events.

Click the buttons below to download the report, as a PDF or accessible Word version, or read on for more of the findings.

Three chapters, three geographic audience segments

The report compares audiences in three main geographic areas, providing insights for connecting people with culture where they live and the places they visit.

Download the chapters as separate fact sheets below.

Audiences in Big Cities

Arts audiences in big cities are experiencing the arts at high levels, but with market saturation and the shifting dynamics of Australia's CBDs post-pandemic, new challenges have emerged for organisations to cut through.

-

In Australia’s big cities, more people are attending arts events more often, but resident arts organisations are competing in a congested market. The data from past attendees shows that:

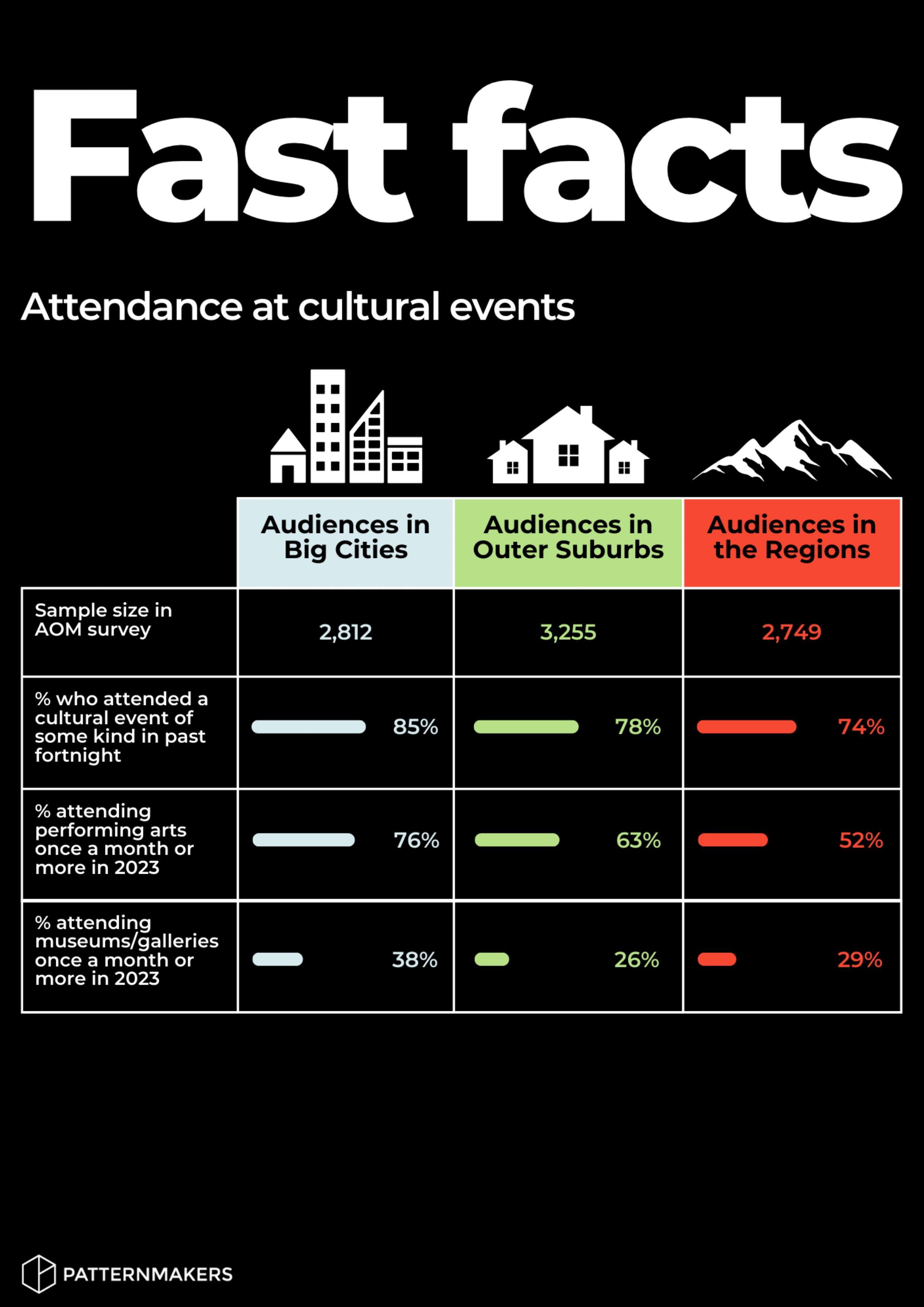

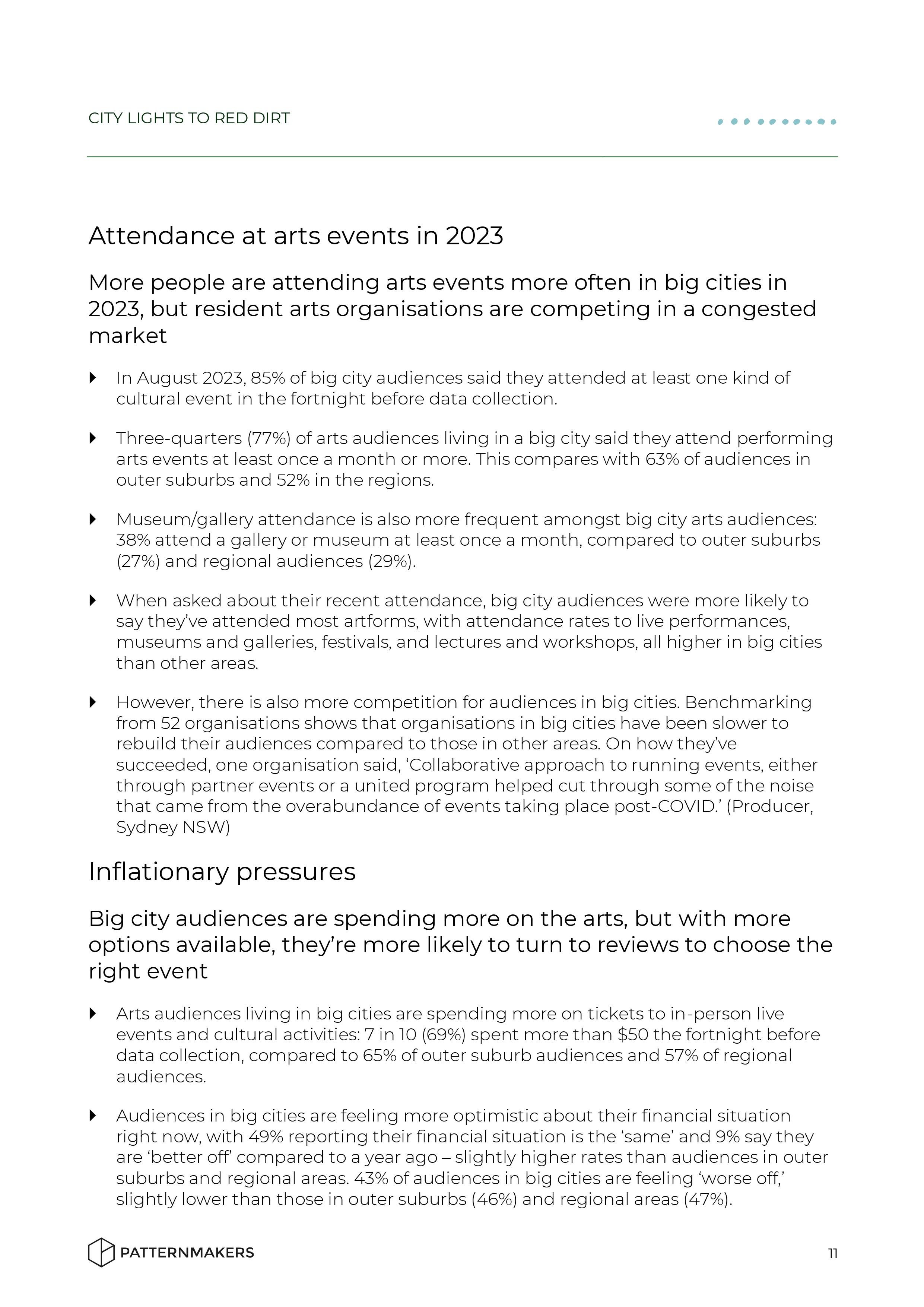

85% of big city audiences said they attended at least one kind of cultural event in the fortnight before data collection. Attendance is also more frequent amongst big city arts audiences: 38% attend a gallery or museum at least once a month, compared to outer suburbs (27%) and regional audiences (29%).

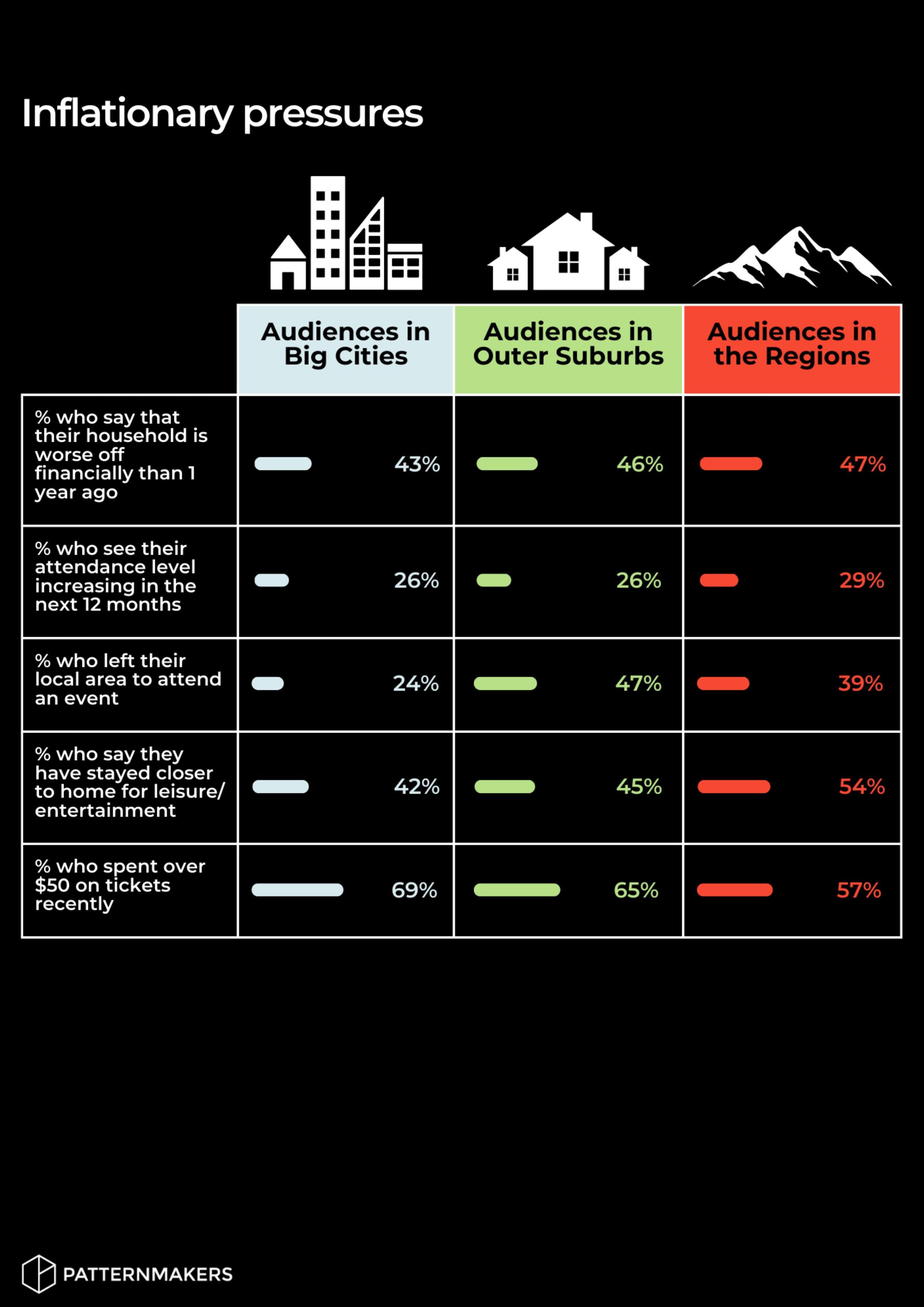

Arts audiences living in big cities are spending more on tickets to in-person live events and cultural activities: 7 in 10 spent more than $50 the fortnight before data collection (69%), compared to 65% of outer suburb audiences and 57% of regional audiences.

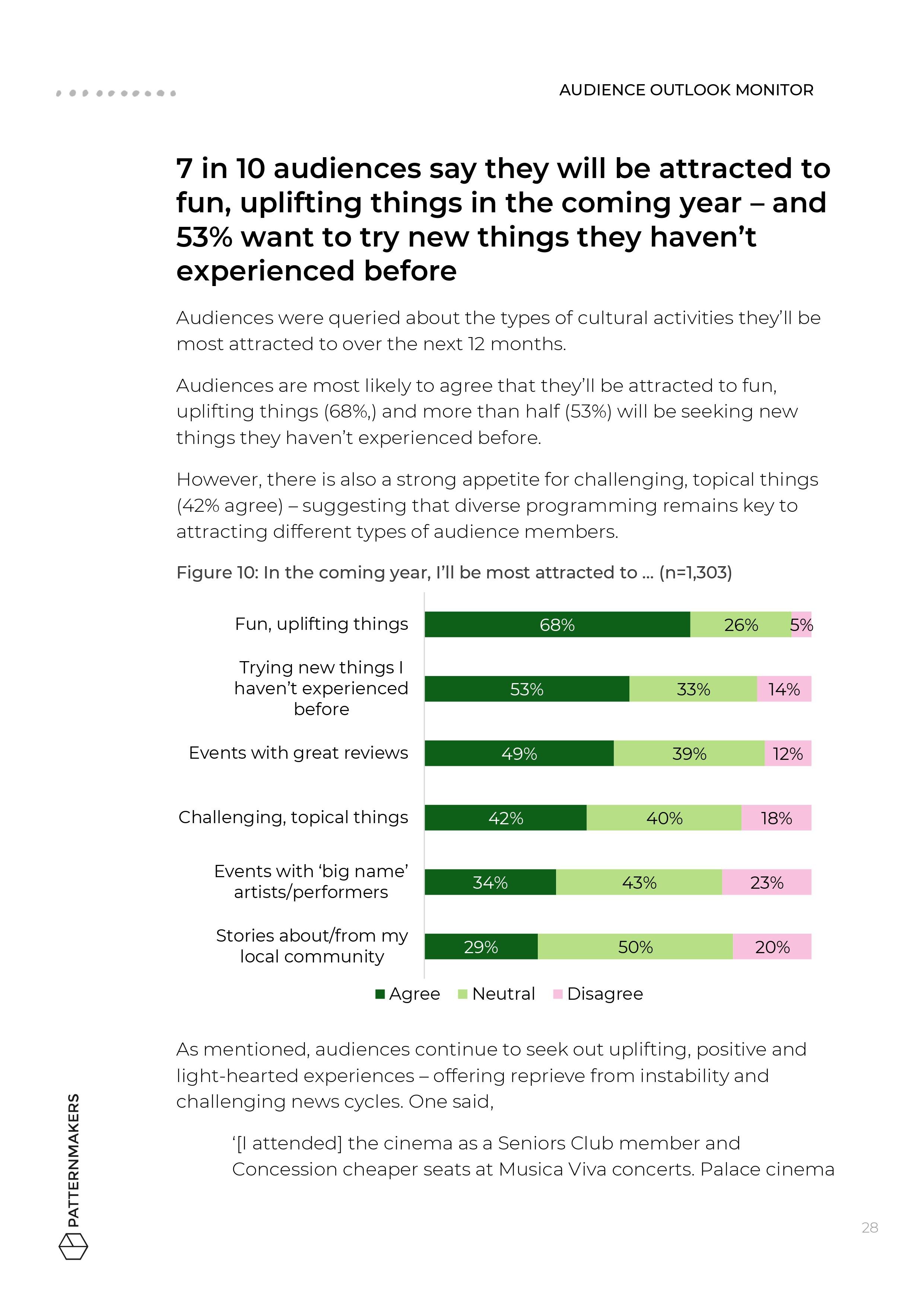

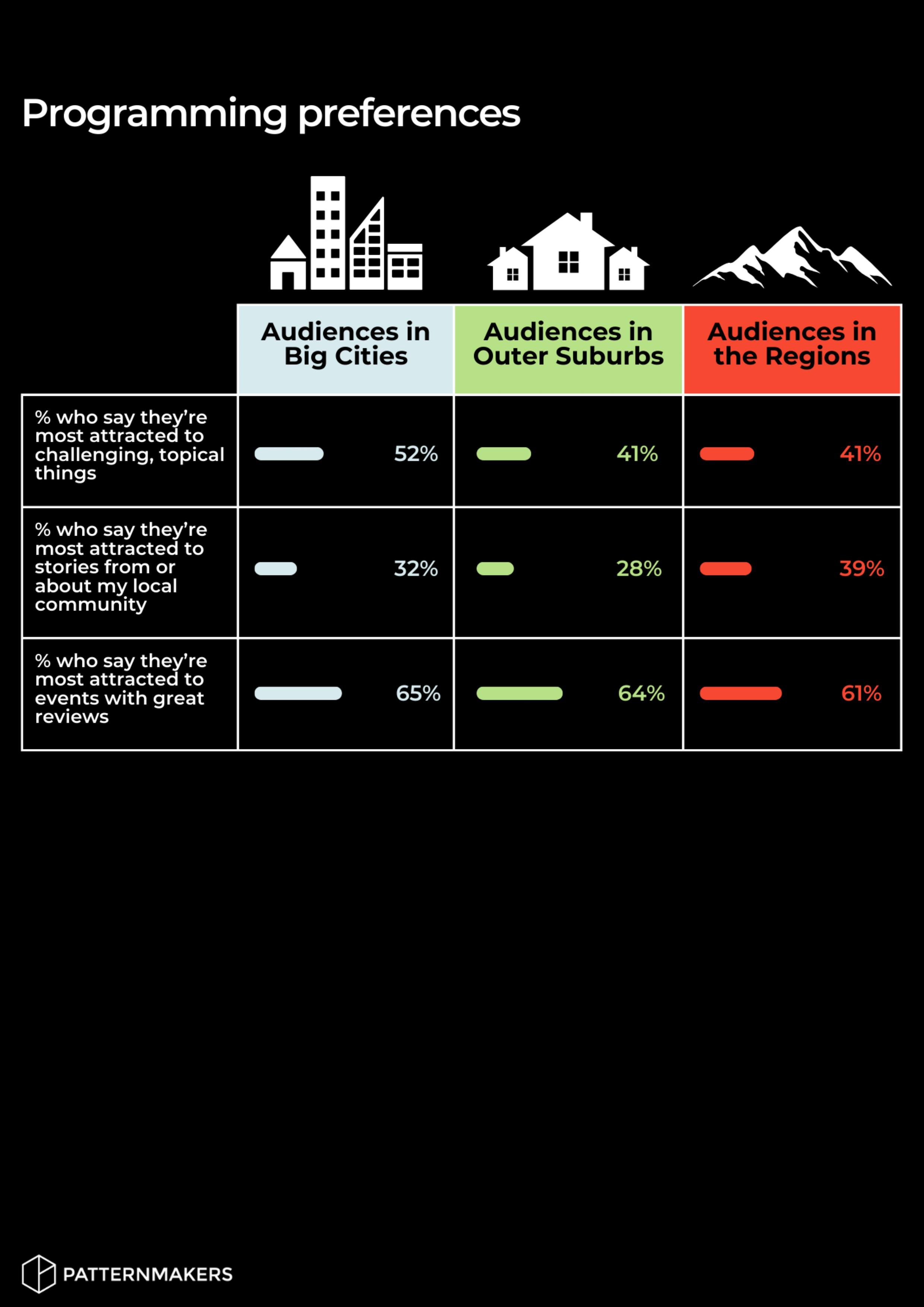

While most audiences are drawn to fun, uplifting and even escapist content right now, big city audiences are showing a greater appetite for challenging, topical content in the next 12 months (52%), compared to audiences living in outer suburbs and regional areas (both 41%). With more options on offer, they are also more likely to tune into reviews when considering what to attend.

Audiences in Outer Suburbs

Outer suburbs are the biggest growth areas in Australia right now, and have an expanding arts audience looking for more cultural experiences closer to home — but don't yet have enough venues nearby to accommodate.

-

In the outskirts and outer suburbs of big cities, the rate and frequency of attendance are slightly lower than big cities, but the market is growing, as more people move to more affordable areas where families can enjoy different lifestyles. The data from past attendees of events shows:

Audiences in outer suburbs are feeling slightly more pessimistic than optimistic about their financial situation, with almost half (46%) say they’re worse off than they were a year ago, and 25% expect to be financially worse off in the coming year.

Audiences in outer suburbs (combining both residents and visitors) were most likely to attend a cinema locally (59%), whereas big city audiences were comparatively more likely to attend a local live performance. Audiences in the regions were most likely to attend a fair/festival locally (40%) or visit a museum or gallery (51%).

Audiences in outer suburban areas are the least likely to be participating in online events right now. Half of outer suburbs residents say online arts events and experiences are playing a small (43%) or substantial role (8%) in their life, while another 49% say they play no role.

Audiences in the Regions

Across Australia's diverse regions, audiences are experiencing access to arts and culture differently. Factoring in extra time and travel costs means heightened barriers in 2023, but with a decentralising trend, more options could be on the cards.

-

Regional Australia is changing, with demographic shifts seeing some regional places grow dramatically in recent years – but rising costs of travel are leaving some isolated. There are different patterns for large towns, smaller villages and bush or outback areas, but on average, the data shows that:

Regional audiences indicated feeling less stable financially and more pessimistic about their future finances than those in outer suburbs and big cities, and many are being selective about what they attend right now. Almost half (47%) say they are ‘worse off’ financially than they were one year ago, and 26% expect to be ‘worse off’ in the coming year.

Regional audiences have lower levels of access to some types of events, like live performances, and therefore attend less often: 52% of audiences in the regions said they attend performing arts events at least once a month or more, lower than proportions in big cities (77%) and outer suburbs (63%).

Some art forms appear to reach audiences in regional areas better than others. For instance, in the past 12 months, 51% of regional audiences have attended contemporary music and 57% have attended libraries, which are similar to attendance rates in urban areas.

Four in ten regional audience members say that in the coming year, they’ll be most attracted to stories that are ‘about or from my local community’ (39%), slightly higher than the rate in big cities (32%) and outer suburbs (28%).

Get the data at a glance

Click the button below to download our Fast Facts for attendance, inflationary pressures, programming preferences and ticketing and marketing behaviour.

Read the ‘Audiences 2023+’ report

In case you missed it, click the button below for the key insights from the August 2023 National Snapshot.

Use the dashboard to get results for your artform and region

Survey data from Phase 9, which heard from over 8,800 respondents, has been uploaded to the dashboard, which now contains insights from over 100,000 Australian participants.

You can use the dashboard to explore the findings by state/territory, artform and audience segment.

It’s freely available to access, just click the image below and use the login details provided on the dashboard page.

About the Audience Outlook Monitor

The Audience Outlook Monitor provides the results of a study that has tracked audience sentiment over the course of the COVID-19 pandemic.

Data was collected in six phases throughout 2020-2022 and is again being tracked in 2023.

Government agencies across Australia are collaborating with research agencies Patternmakers (Sydney) and WolfBrown (USA) to produce this resource. The dashboard is freely accessible and designed to help artists and cultural organisations of all kinds to make the best possible decisions.

How to find out more

To receive new releases directly into your inbox, as soon as they are available, you can opt in to receive updates below.

If you have a question, or an idea for using this data, please contact Patternmakers at info@thepatternmakers.com.au

Audiences at the Heart: Key takeaways from the AMA Conference 2023

Our Senior Research Analyst, Bianca Mulet, attended the AMA Conference 2023, with the theme being ‘audiences at the heart’. Read the article for her 4 key insights from the conference.

I recently had the incredible opportunity to attend the 2023 AMA Conference in Leeds, UK. Industry professionals from around the UK gathered for a two-day melting pot of ideas and teabags, delving into this year’s theme: audiences at the heart.

Today I’m sharing just a few of the insights from the jam-packed programme that struck me. As an Aussie in a sea of British accents, I’m grateful for the friendly faces and inspiring speakers I encountered who are paving the way for arts marketers, researchers and comms professionals in all stages of their career.

Scroll on for my highlights from four sessions.

Catching feelings

In “Exploring Emotion and Audience Behaviour”, cultural researcher Dr Ron Evans uncovered the integral role of emotion in the audience experience.

Audiences attend performances with the expectation of having an emotional experience – but only 43% report that they achieved that goal, raising a crucial question for organisations: Are your audiences finding the emotional experiences they seek?

We might get this information from a post-show survey, but this only captures part of it. Over the length of a performance there might be a range of things experienced. So, do you measure the most recent emotion? The strongest?

Dr Evans presented new research in measuring audience emotion during live performance. Participants wore a wristband that collected physiological data over the course of the show, including heart rate, skin conductivity and skin temperature, and at the end they were interviewed about their emotional experience at various points in the performance.

The experiment revealed that there was an increase in physiological reaction during the climax of the performance, most people predominately felt surprise and sadness – and there was crying. Moreover, the tools revealed some valuable insights for arts organisations:

Triggering content has the potential to captivate audiences and spark discussions and reflections about their own life experiences – and we cannot always predict what topics will be sensitive for individuals

Encouraging post-show discussions and feedback through digital or face to face talkbacks can be an effective audience engagement tactic

Organisations can experiment with innovative tools like live word clouds, asking “What do you think the main character was feeling at the end of the first act?”

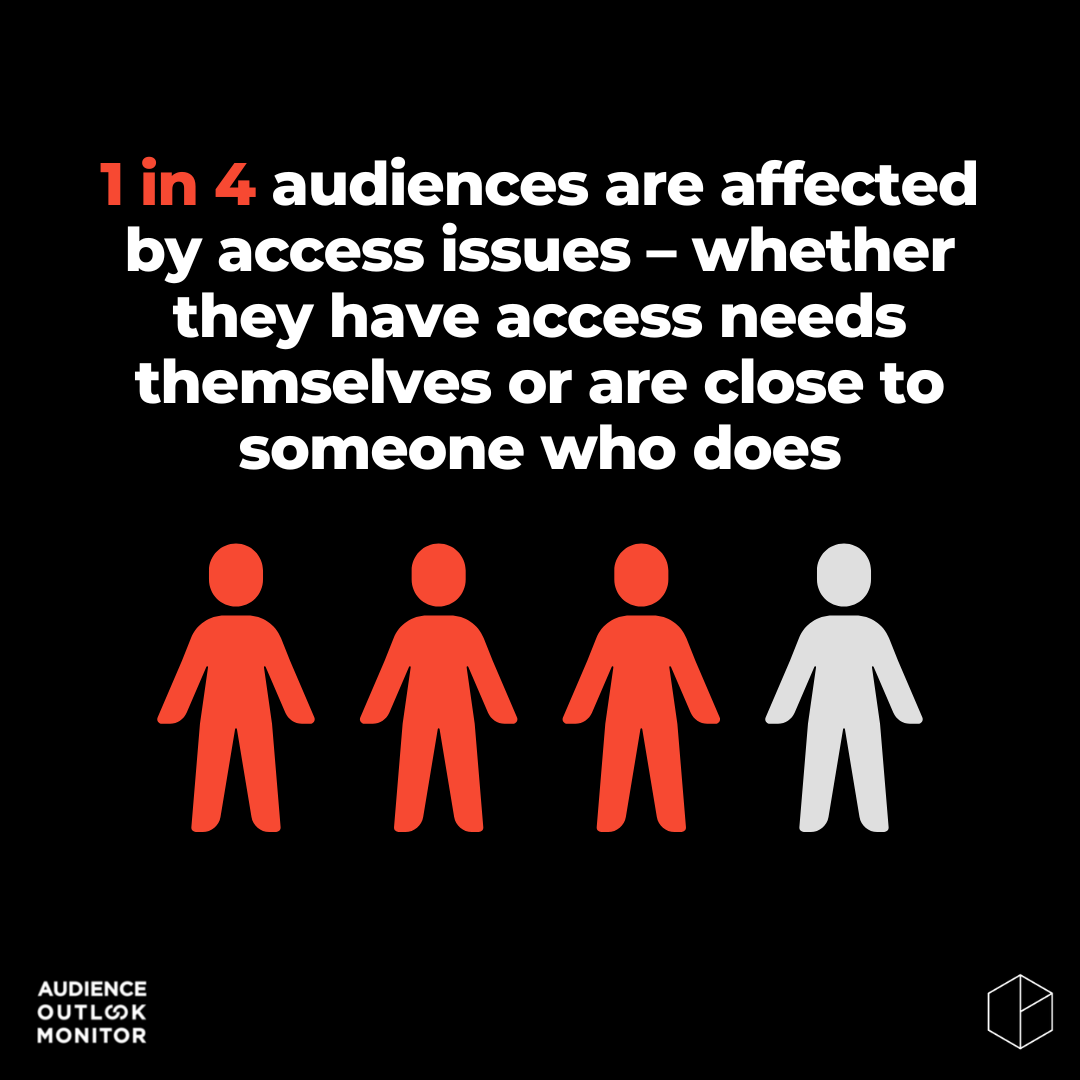

Monitoring the return of audiences, such as those with access needs, can help organisations tailor their content and offerings.

The future of audiences

The Audience Agency presented the latest findings from the Cultural Participation Monitor (CPM) on what audiences are saying about how they engage with arts and culture. Similarly to our Audience Outlook Monitor, the CPM started out tracking audience sentiment throughout the pandemic and has since evolved to capture further insights around programming preferences, cost-of-living concerns and more.

The recent wave of research shed light on some of the generational differences in audience segments and opportunities look out for when engaging future audiences, as well as insights around the rise of participatory experience and digital/hybrid formats.

The session presented new patterns in values, taste and experiences, underscoring the prevalence of generational and life-stage factors. As the Audience Agency says, “Our future audiences are already here, they’re just younger.”

Here’s what they found about values, tastes and experiences:

Young audiences care about issues like climate change and social justice in a way that people always have – but they’re going to care whether or not the organisations they engage with care about those things (almost double that of older groups - see the British Social Attitudes survey)

Arts organisations should think about how they can transition to being a community resource and a part of the conversations that are already happening

The next generation are shifting from hierarchical traditional artforms to having a more eclectic and unpredictable taste and this is heightened with algorithm-driven content

The experience is going to become more important as we continue to be engulfed in content. Audiences will be more discerning about the ‘how’ than the ‘what’, and there will be emphasis on things worth getting out for.

The post-pandemic era means having a mix of FOMO (fear of missing out) and FOGO (fear of going out). If people are going out it needs to be something different - liveness, presence in a place, intensity: “It’s just a bit harder to get around to doing things. In the past if it was 6.5/10 it would be worth going to – and now it needs to be an 8/10, it has to really grab you”.

What it means for arts organisations:

Don’t shy away from prototyping, testing and experimenting with different audience experience formats, alongside your new content ideas. As the experience takes centre-stage, it’s worthwhile to trial what works for different audience segments.

Become a place of conversation and engage in dialogue with your audiences. Asking “Do you enjoy things that feel and look like this?” instead of “do you like opera?” could reveal more about your audiences habits, desires and interests.

Keep being curious, creative and courageous!

AI: friend, not foe?

AI is demanding our attention, whether we love it or loathe it. Marketing consultant Jo Burnham described how we’re currently in a golden moment to acquaint ourselves with the nuances of AI - even if it's just a few minutes of trialling and testing here and there. Burnham’s session delved into the pragmatic uses of different AI tools to empower arts marketing professionals, along with delving into the crucial aspects of its ethics and challenges.

Burnham asserted that arts marketers hold a distinctive advantage to embolden how we communicate with our audiences in new and captivating ways – and encouraged them to:

Be curious: Most AI tools are free to use – don’t let yourself be sold. A key platform Burnham shared is www.futuretools.io, which collects all the emerging AI software in a user-friendly interface, equipped with categories and audience up-votes. Don’t get deterred by the ‘taboo’ – experiment to build up your own knowledge and even explore how using multiple tools together could empower your work.

Be creative: GPT4, Ask Your PDF, Bing Chat, MidJourney and DALL-E2 are just a few examples of tools that Burnham says arts marketers should be aware of. In terms of what they’re good for, getting a handle on prompt engineering for GPT4, for instance, can assist you with creating social media posts to signpost longform content, critiquing your own copywriting, reducing copy length, directing your own learning and helping you plan marketing outputs.

Be critical: As with any new way of working, it’s important to continually interrogate AI and weigh up its costs and benefits. When traversing this unfamiliar path, some aspects and questions Burnham invited us to start think about include: Is this tool actually producing good content? What’s real and what’s hype? What am I being sold? Data security (when in doubt – don’t!) and systemic bias.

Here are a few reflections from arts marketers shared via Burnham’s presentation:

“These tools are useful for getting keyword and hashtags without paying for an expensive service. It often comes out with answers that are far too verbose. You must be specific.” – Anna Whelan, Head of Marketing and Communications at Tara Theatre

“AI speeds up writing and it sounds more engaging than what I write, but you have to be careful with the accuracy of info and plagiarism.” – Marketing and Communications Manager at a theatre in Wales.

“There is potential that in 10 years’ time, people will look back on his moment and see AI as a transformative event in culture. It feels like there are huge developments happening at phenomenal speed. It feels like a refocusing or a re-framing taking place.” – Steven Franklin, Social Media Manager at the National Archives.

Be Bold; Be Brave

The Conference keynote by Leeds5 – a group of female black and brown cultural leaders – underscored the importance of getting to know your audience before inviting them to buy your tickets.

An analogy by Keranjeet Kaur Virdee, from South Asian Arts and one-fifth of Leeds5, summed it up perfectly: Would you accept an invitation to a wedding if you didn’t know the bride and groom? (Short answer: no.)

It takes time, effort and energy to develop relationships with diverse communities that you want to reach, ensuring you’re conscious of cultural sensitivities requires an on-stage and off-stage approach. Here are some things to consider:

Ditch the familiar: Cultural exchange thrives when we step outside of our comfort zones and reach beyond our safe space. Complacency keeps us tethered to what we know – and hampers our ability to understand the unique needs and perspectives of diverse audiences.

Unlock new perspectives: Kully Thiari of Leeds5 said ‘We know audiences are at the heart, but we continue to make assumptions about them.’ Listening and understanding the community you want to engage with is more than ticking a box – it’s an invitation to take part in real dialogue, absorb diverse experiences and foster meaningful connections.

Solutions over symbols: Leeds5 used the example of Blackout Tuesday to remind us of the importance of moving beyond grand gestures towards concrete actions – and be proactive to foster positive change in our accessibility, inclusivity and sustainability goals.

Despite the challenges of post-pandemic rebuilding and cost-of-living pressures, I left the AMA conference feeling affirmed that the future is as promising as it is dynamic. Armed with inspiration from our colleagues across the pond, I’m excited about how Patternmakers can help shift and shape the landscape of audience research as we look to the next chapter.

Categories

Archive

- 2016 5

- 2017 8

- 2018 12

- 2019 11

- 2020 3

- 2021 7

- 2022 23

- 2023 21

- 2024 1

- About Patternmakers 35

- Accessibility 4

- Arts 73

- Audience development 79

- Beyond the Bio 8

- COVID-19 70

- Capacity building 3

- Career Advice 9

- Case Studies 2

- Coronavirus 2

- Culture 72

- Culture Panel 1

- Dance 3

- Data art 2

- Data culture 69

- Digital art 4

- Education 2

- Evaluation 75

- First Nations 3

- Indigenous 2

- Innovation 78

- Interviews 3

- Manifesto 1

- Opportunities 4

- Our services 4

- Performing Arts 5

- Postcode Analysis 1

- Privacy 6

- Project updates 25

- Publications 1

- Research 99

- Resources 6

- Strategic Planning 5

- Tandi Palmer Williams 7

- Theory of Creativity Podcast 1

- Thought leadership 16

- Tips & Tricks 13

- Toolkit 5

- Top 5 2

- Touring 3

- Trends 3

Be in the loop

A state-specific breakdown of Australian audiences in 2023 and beyond

Download the August 2023 State Snapshot reports to discover the top trends in audience behaviour at a state-level.

Read our State Snapshots to discover the top trends in audience behaviour at a state-by-state level.

Based on data from the August 2023 Audience Outlook Monitor, the State Snapshots explore how audience behaviour is impacted across different parts of the country, especially as economic pressures persist.

Attendance levels have stabilised across the states since the pandemic began, with three states reaching their highest rate of attendance since 2020. However, as disposable income gets squeezed, audiences nationwide are grappling with tough decisions about what, how and when to attend.

There are some important distinctions. New South Wales audiences are attending the most and spending the highest on cultural events. Meanwhile, those in Victoria and Queensland are most likely to be acting more frugal and taking longer to make decisions, staying closer to home and looking for cheap/free things to do. In Western Australia and South Australia, the outlook appears most stable, with audiences the most likely to say their rate of attendance will stay the same in the next 12 months.

Download the NSW, VIC, QLD, SA, ACT and WA reports below for the latest look — including the story on last-minute booking, subscriptions/memberships and online participation — and to explore the opportunities for strategic thinking in 2023 and beyond.

Download the snapshots

Click the buttons below to access the snapshots for each state.

Thank you to the following state arts agencies for their support in delivering the State Snapshots: Creative Victoria, Create NSW, Arts Queensland, Department of the Premier and Cabinet (Arts SA), Department of Local Government, Sport and Cultural Industries (WA) and ArtsACT.

Cover Image Credit: Cecilia Martin, courtesy of Spaghetti Circus.

Read the ‘Audiences 2023+’ report

In case you missed it, click the button below for the key insights from the August 2023 National Snapshot.

Use the dashboard to get results for your artform and region

Survey data from over 8,800 respondents has been uploaded to the dashboard, which now contains insights from 100,000 Australian participants.

You can use the dashboard to explore the findings by state, artform and audience segment.

It’s freely available to access, just click the image below and use the login details provided on the dashboard page.

About the Audience Outlook Monitor

The Audience Outlook Monitor provides the results of a study that has tracked audience sentiment over the course of the COVID-19 pandemic.

Data was collected in six phases throughout 2020-2022 and is again being tracked in 2023.

Government agencies across Australia are collaborating with research agencies Patternmakers (Sydney) and WolfBrown (USA) to produce this resource. The dashboard is freely accessible and designed to help artists and cultural organisations of all kinds to make the best possible decisions.

How to find out more

To receive new releases directly into your inbox, as soon as they are available, you can opt in to receive Audience Outlook Monitor news below.

Subscribers to our regular Culture Insight & Innovation Updates will need to update their preferences to receive all updates about the Audience Outlook Monitor. Just enter your email below and follow the instructions provided.

If you have a question, or an idea for using this data, please contact Patternmakers at info@thepatternmakers.com.au

About the Author

Peta Petrakis

Research Analyst

Delivery partners:

Supporting partners:

Past posts on this blog

Archive

- 2023 21

- Dance 3

- Research 99

- Audience development 79

- Arts 73

- COVID-19 70

- Culture 72

- Data culture 69

- Evaluation 75

- Innovation 78

- Thought leadership 16

- About Patternmakers 35

- Privacy 6

- Project updates 25

- Culture Panel 1

- Resources 6

- Toolkit 5

- Beyond the Bio 8

- 2022 23

- Career Advice 9

- Opportunities 4

- Tips & Tricks 13

- 2021 7

- 2024 1

- First Nations 3

- Indigenous 2

- Strategic Planning 5

- Trends 3

- Performing Arts 5

- Manifesto 1

- Education 2

- Capacity building 3

- Digital art 4

- Interviews 3

- Coronavirus 2

- 2020 3

- Tandi Palmer Williams 7

- Theory of Creativity Podcast 1

- 2019 11

- Top 5 2

- 2018 12

- Case Studies 2

- Our services 4

- Postcode Analysis 1

- Accessibility 4

- Touring 3

- Publications 1

- 2017 8

- Data art 2

- 2016 5

The top trends shaping Australian audiences in 2023 and beyond

August 2023 results from the Audience Outlook Monitor are now available. Explore 7 topics around current audience behaviour, presenting the datapoints you need for strategic planning, forecasting attendances, remodelling subscriptions and targeted marketing in 2023 and beyond.

Read about the findings and download the National Snapshot report.

1. Attendance trajectories

Attendance rates across the country continue their slow recovery since the pandemic, and with a challenging year ahead, it’s wise to set sights on the right targets.

-

In 2023, attendance is reaching its highest point since 2020, and the frequency of attendance is increasing, but the recovery process continues.

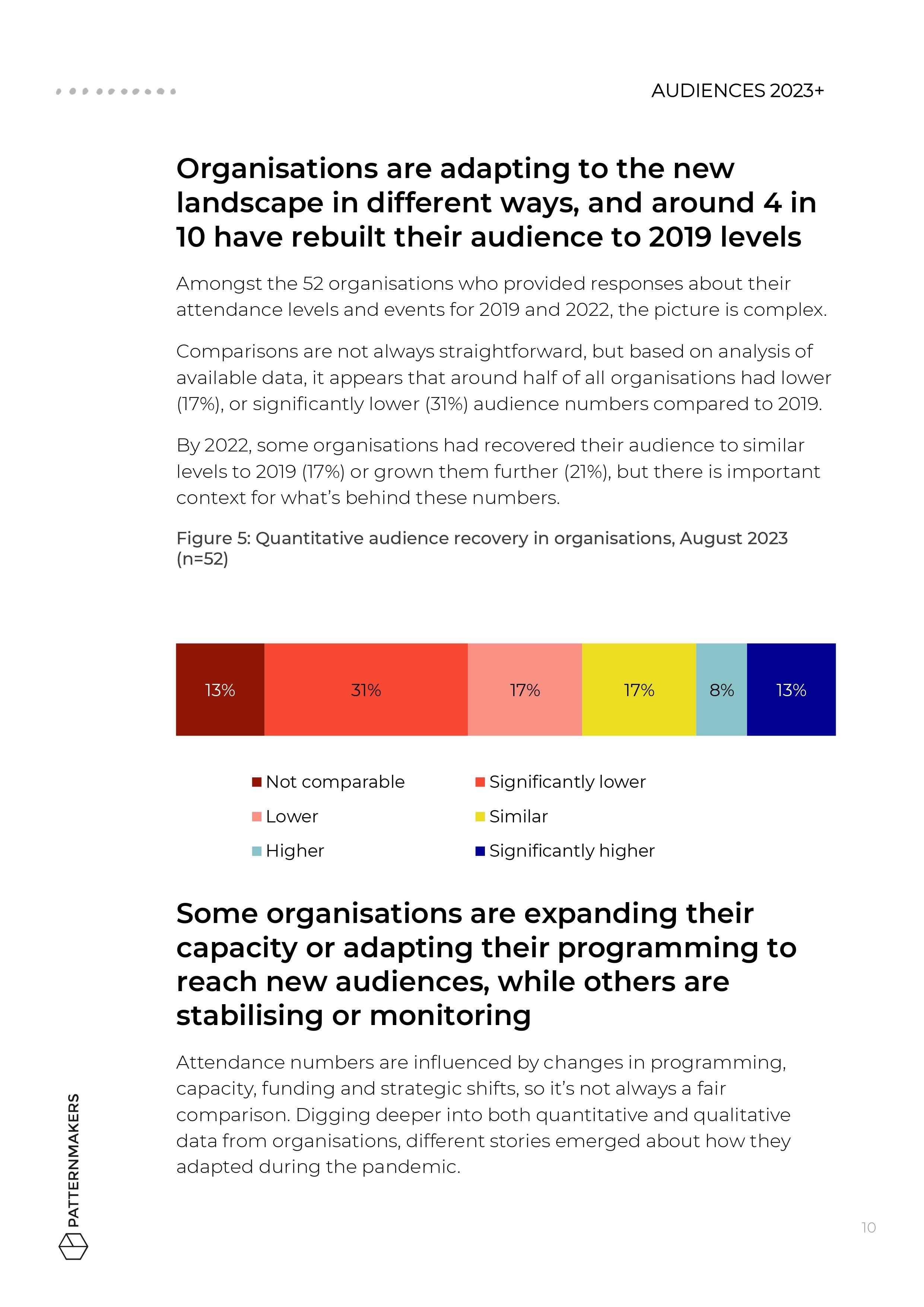

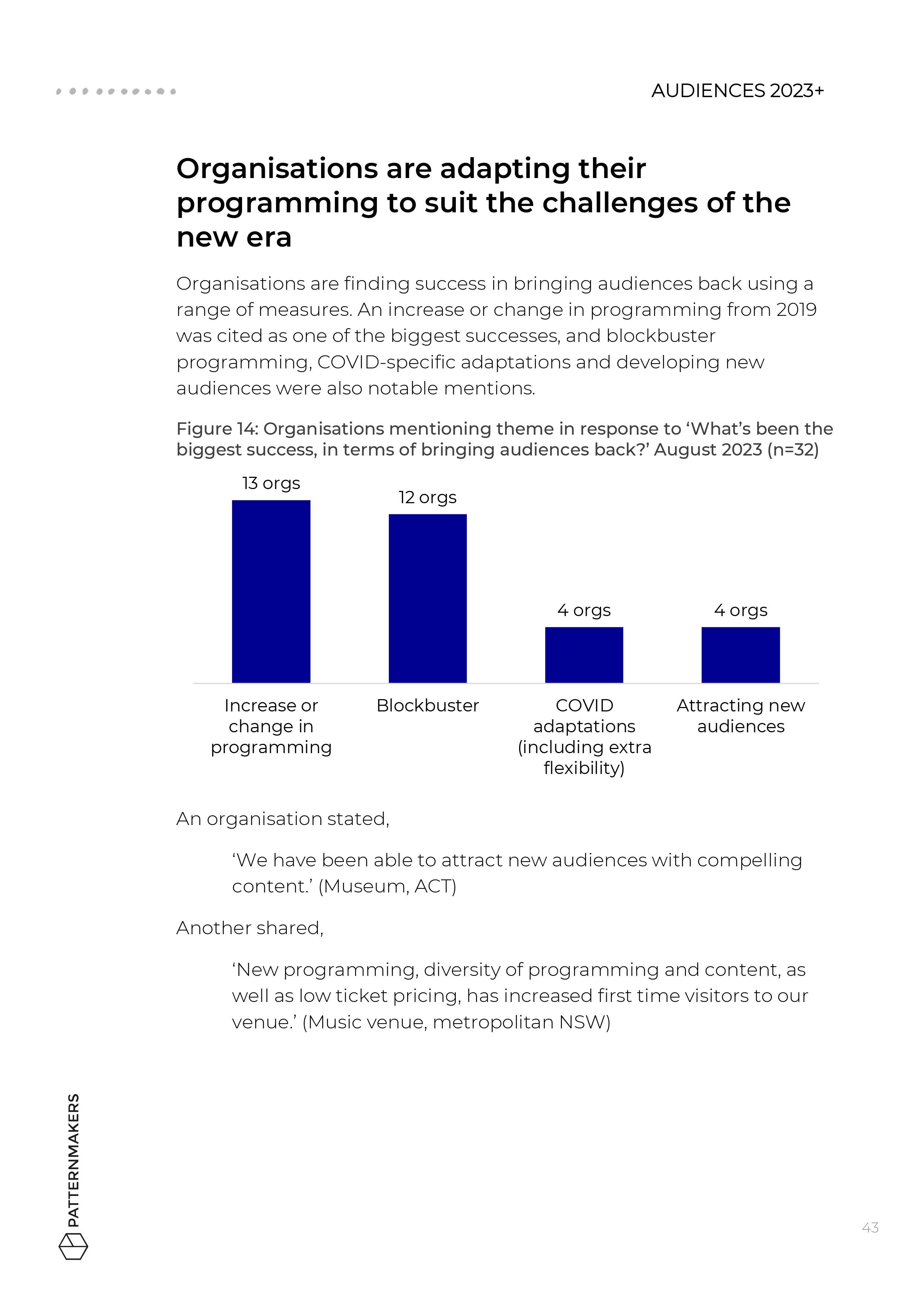

Strategic investment and programming shifts have helped many organisations sustain or increase their capacity in 2022 and 2023, but charting recovery is complex, with mixed attendance results across the market.

Big jumps in attendance appear unlikely in the next 12 months, with 2 in 3 audience members expecting their attendance levels will stay the same amid a challenging economic outlook.

Making space to review measures of success and share learnings – internally and externally – may help organisations focus on the right challenges over the coming year.

Click the buttons below to download the August 2023 Snapshot Report, as a PDF, accessible Word version or RTF, or read on for more of the findings.

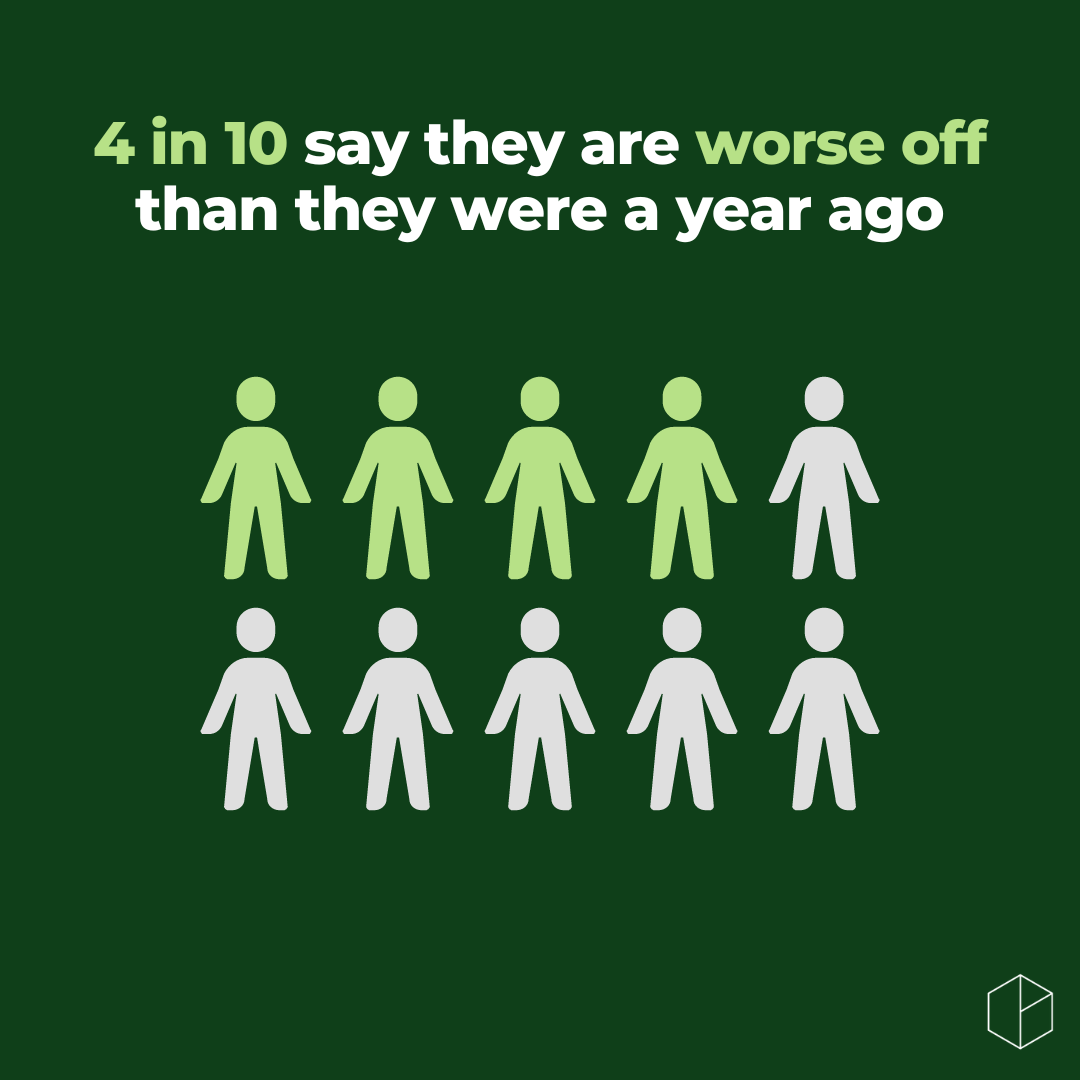

2. Inflationary pressures and pricing

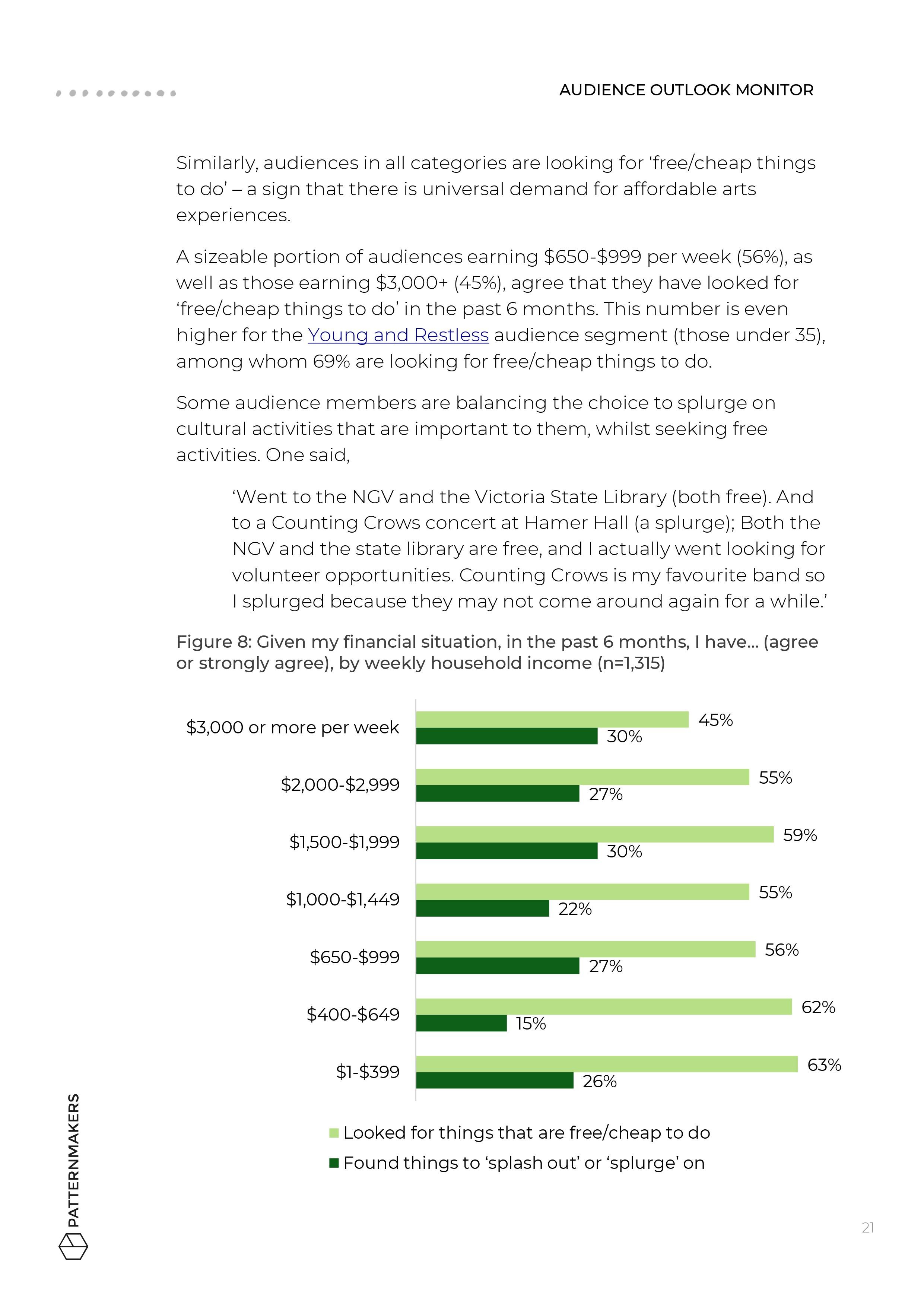

Economic conditions are limiting what Australian audiences can spend on events, and some segments need targeted thinking to ensure access to arts and culture.

-

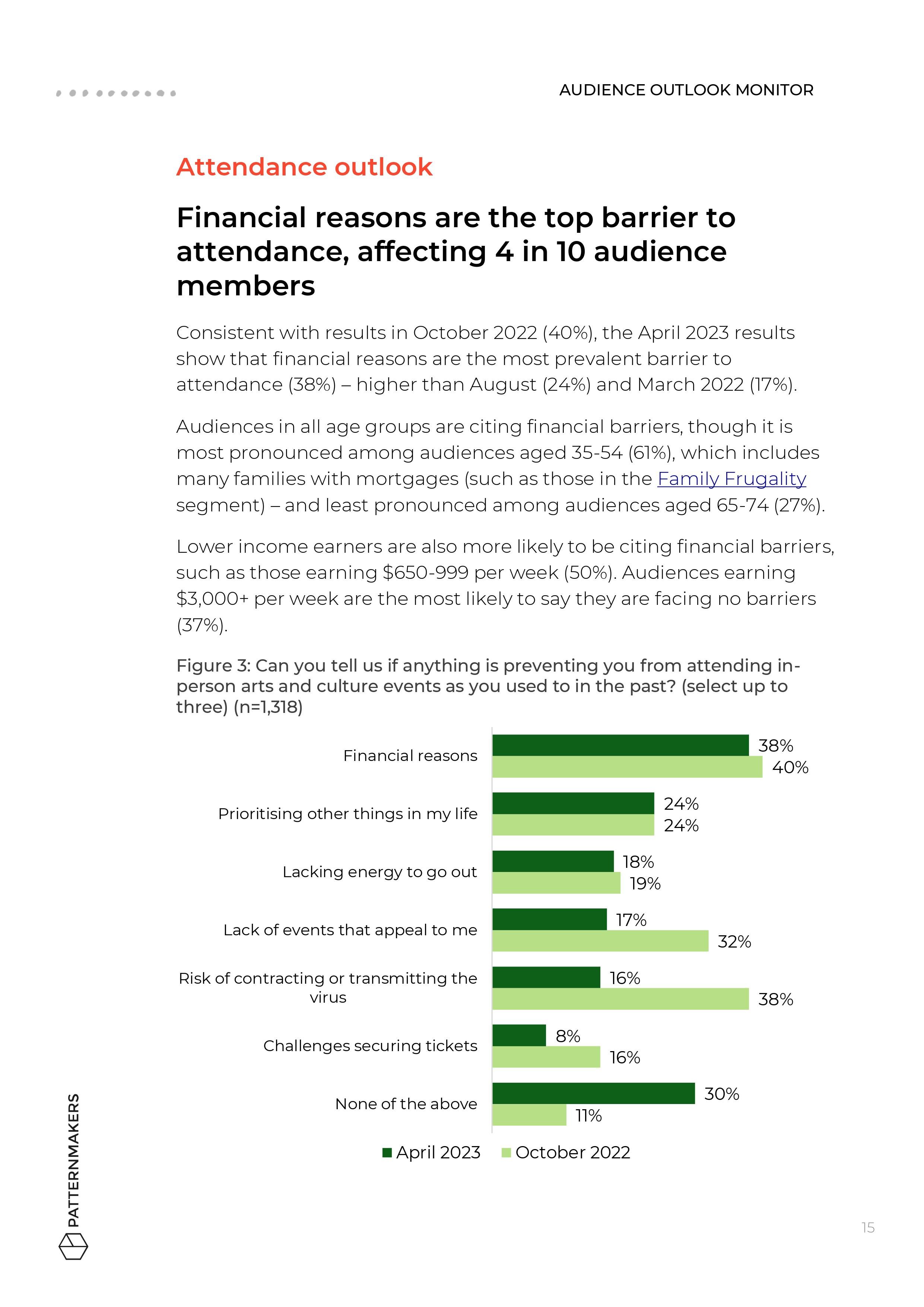

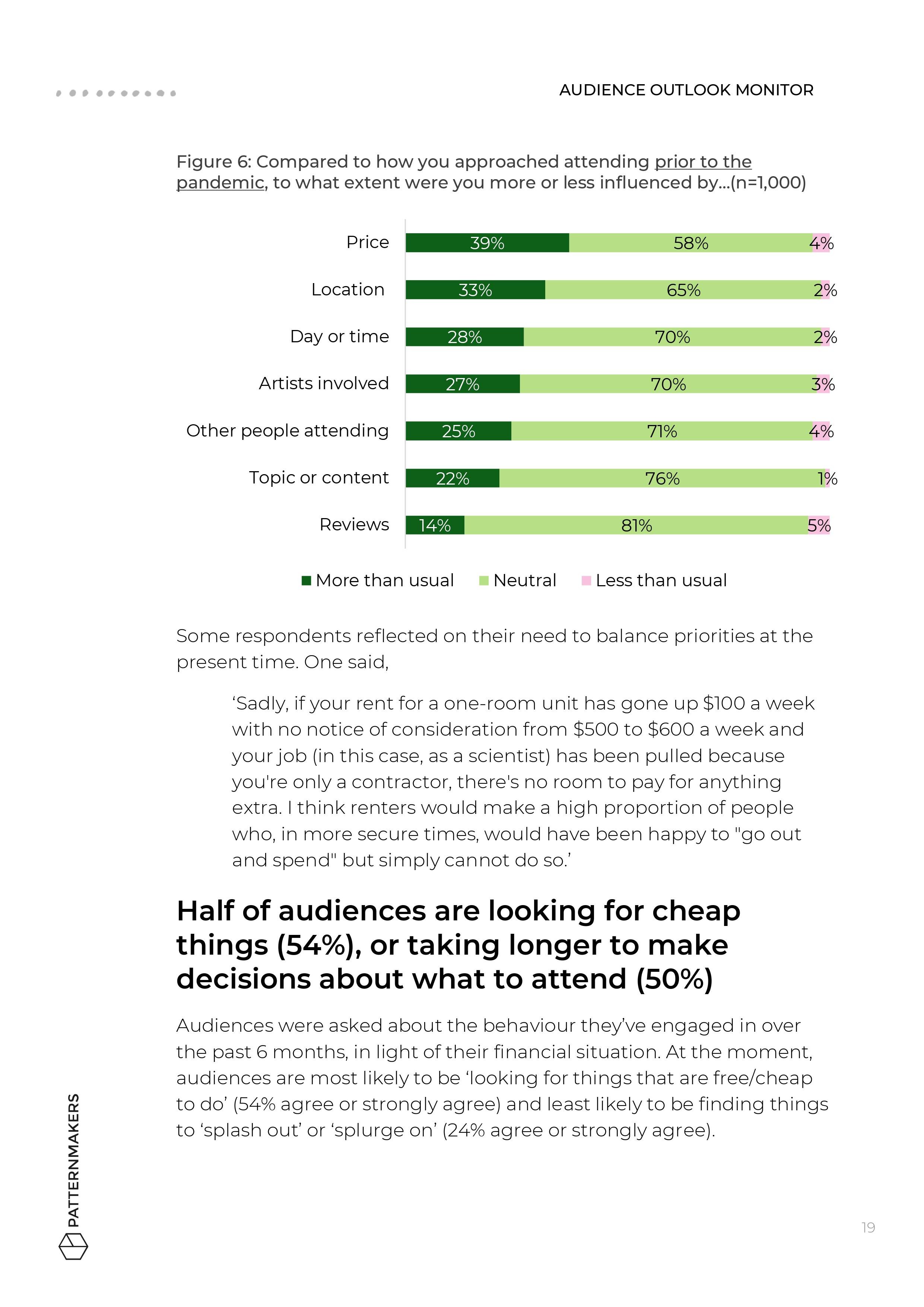

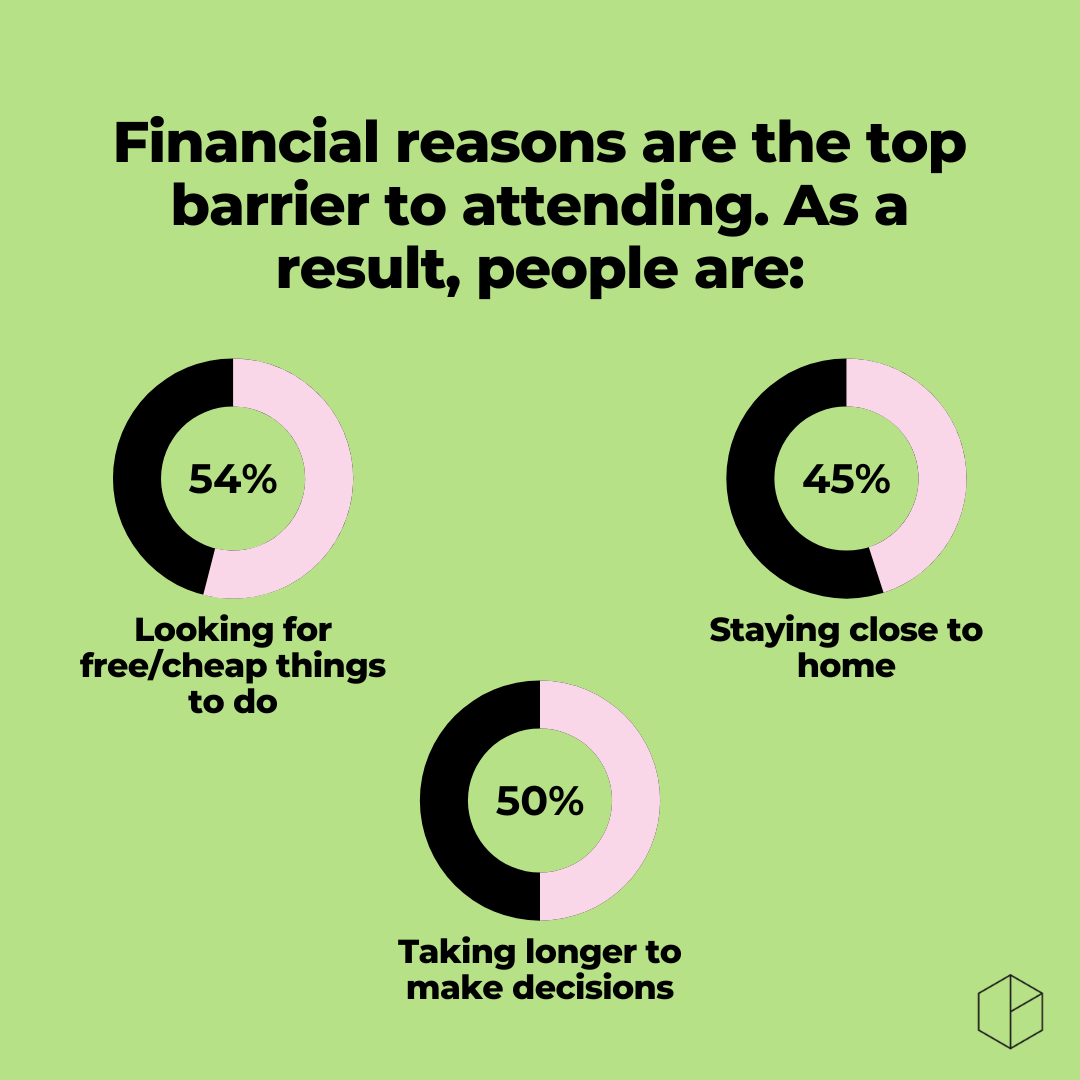

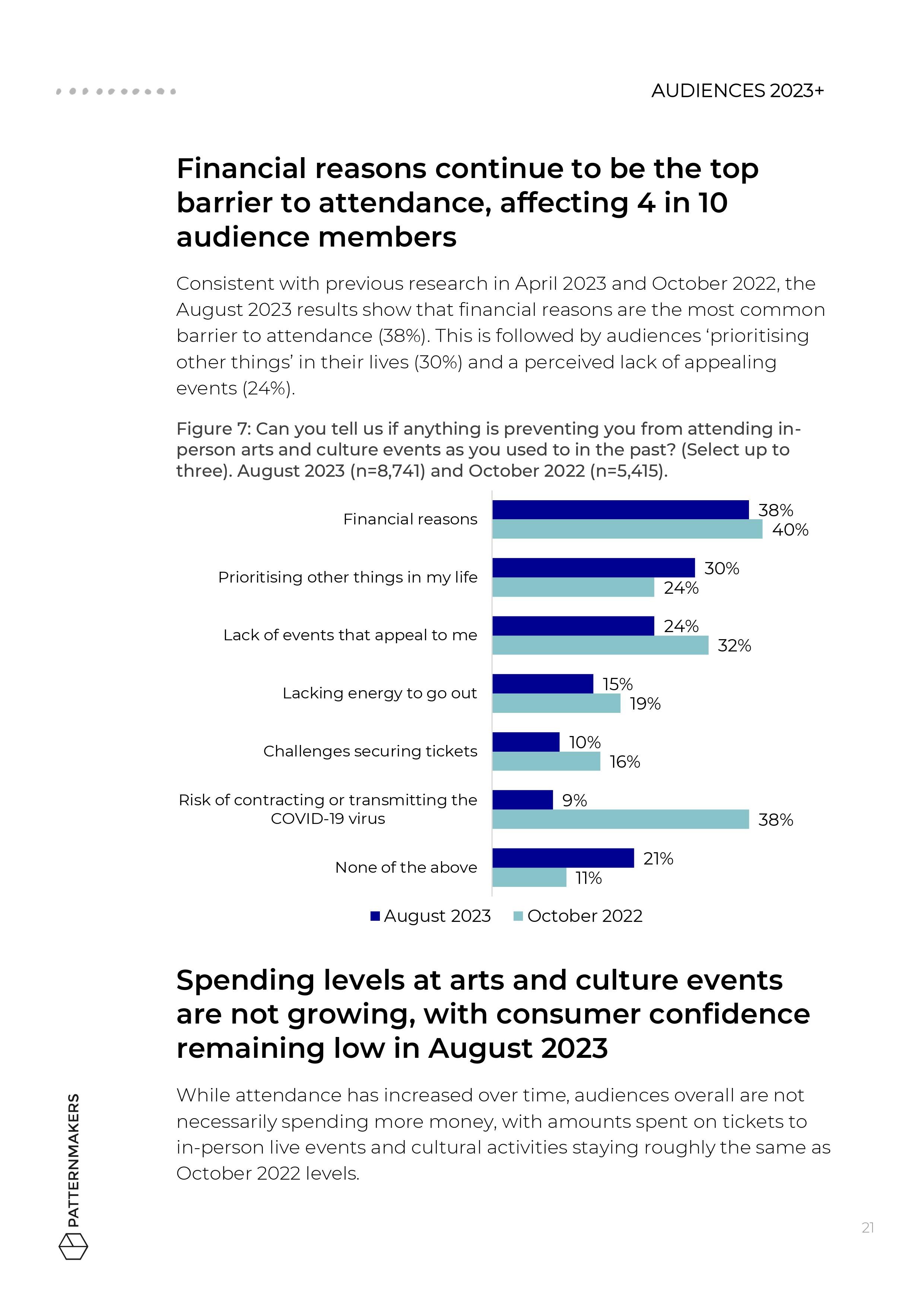

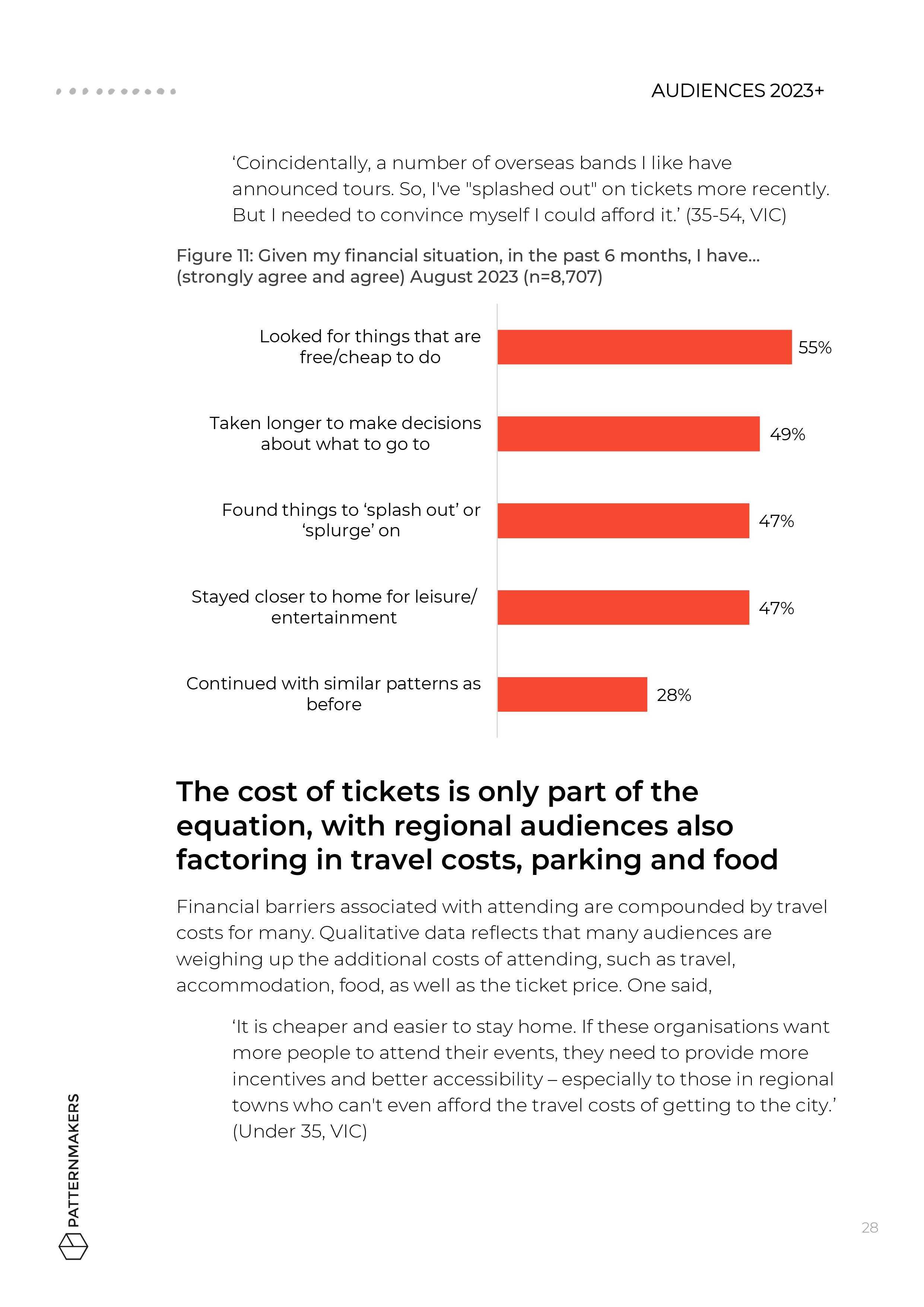

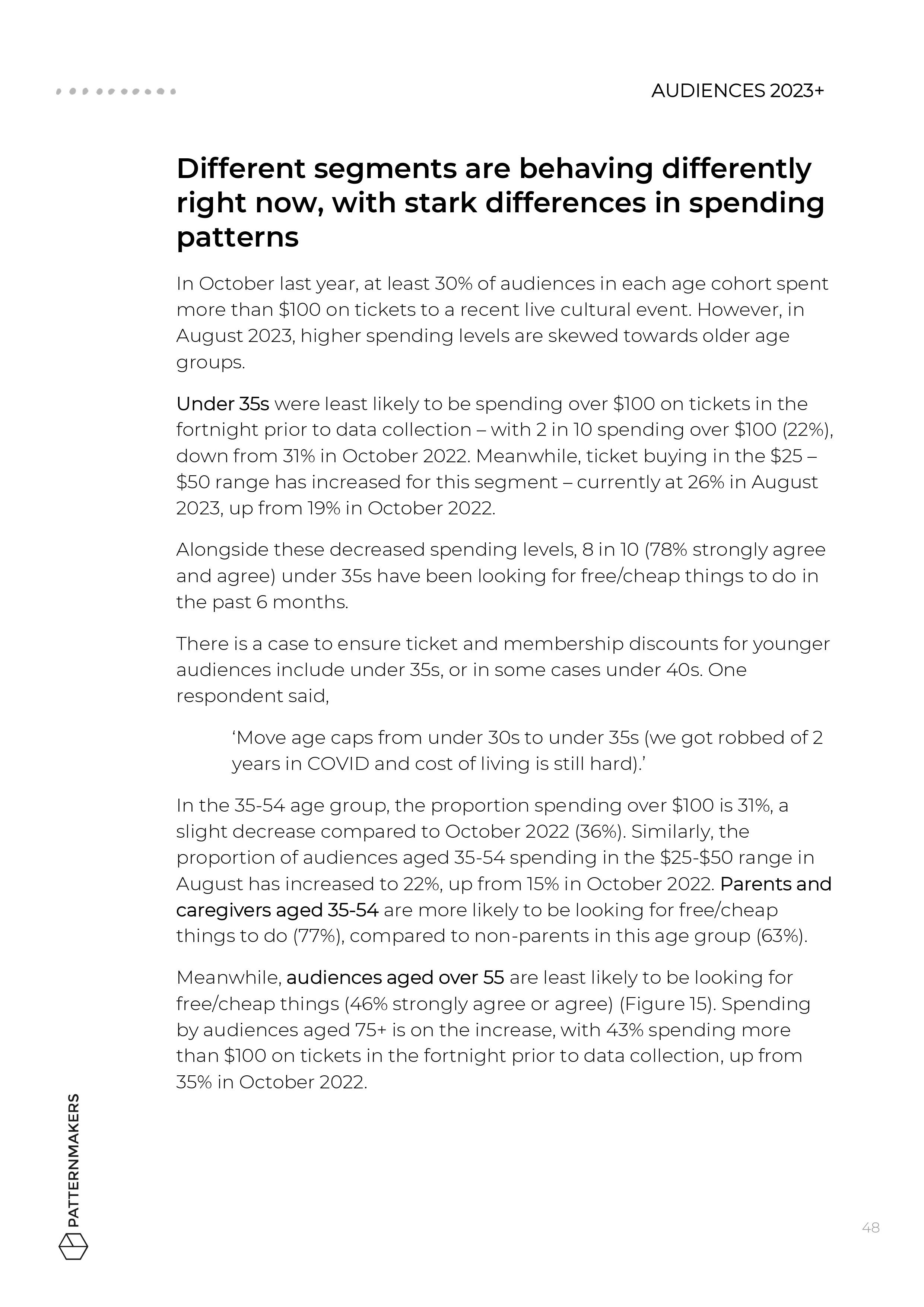

Financial reasons are the top barrier to attendance, and inflationary pressures are expected to continue in 2023 and 2024.

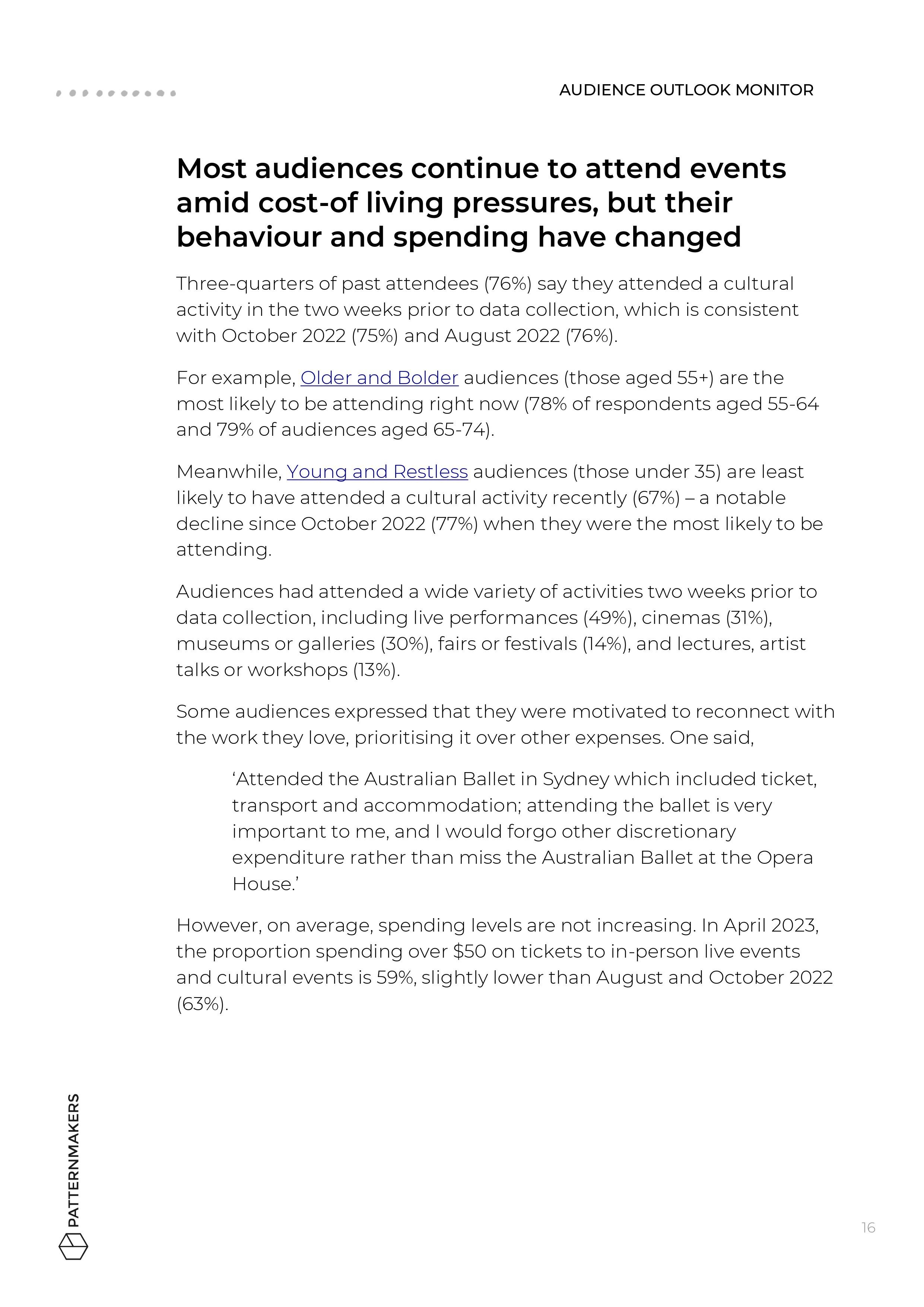

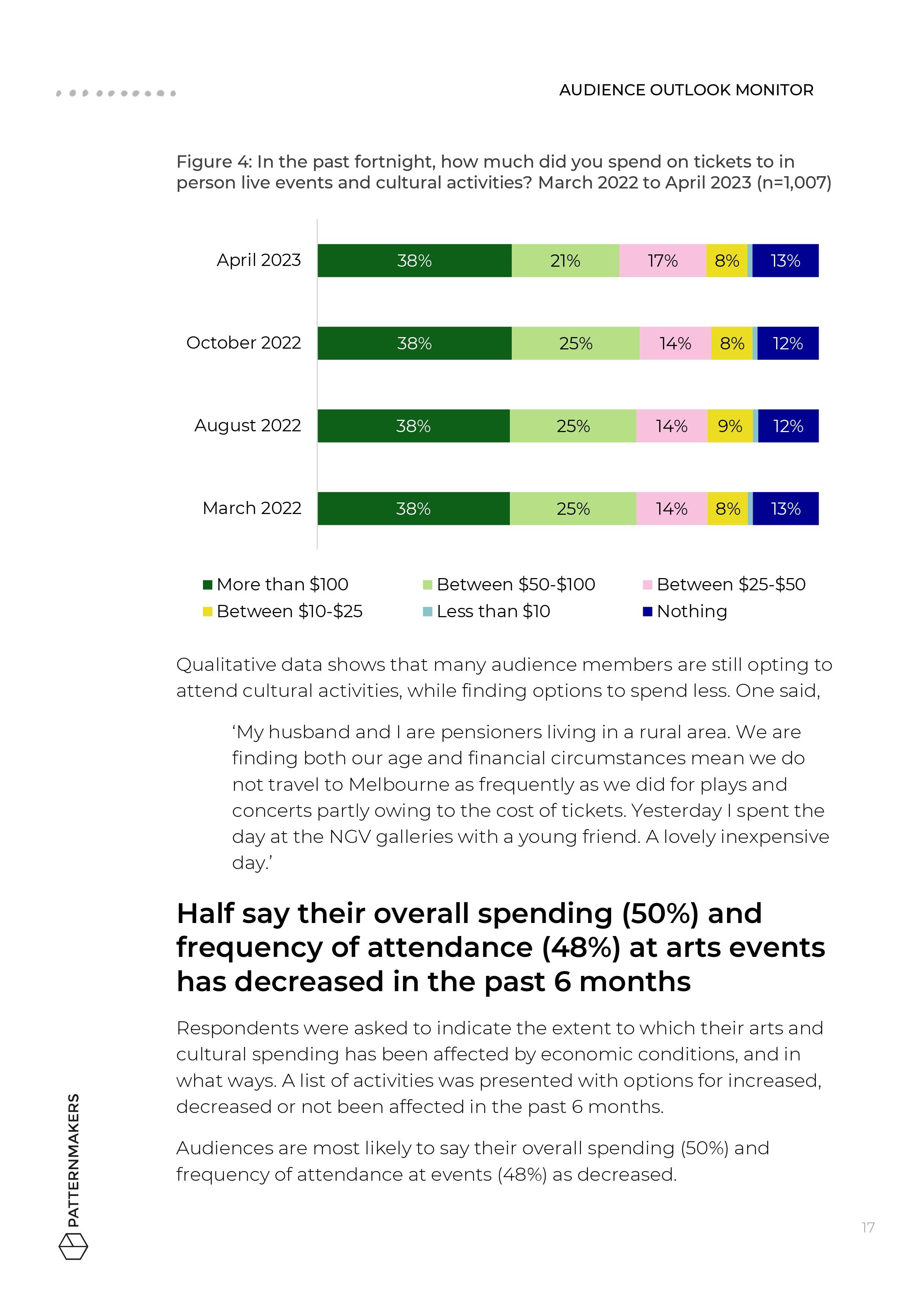

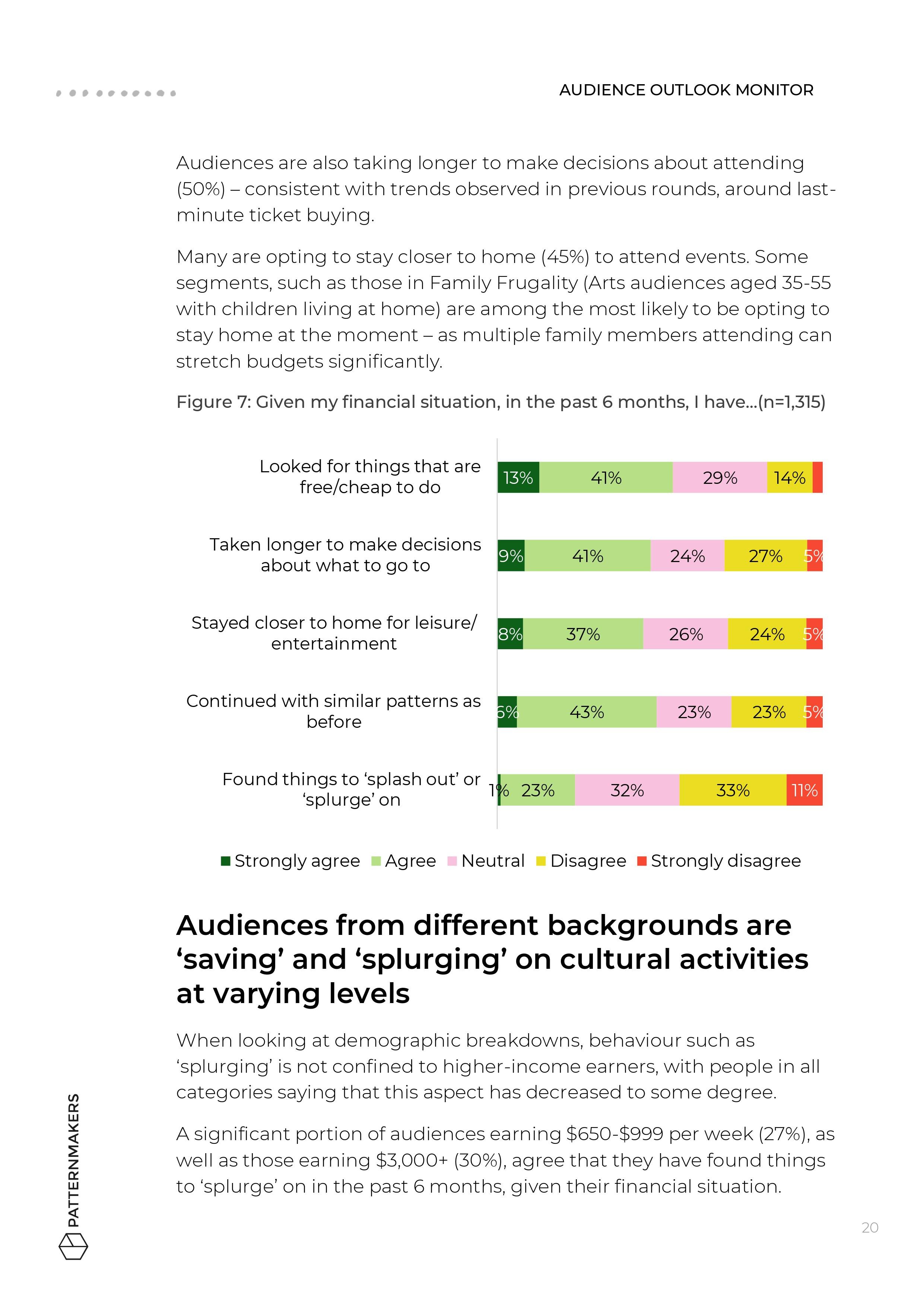

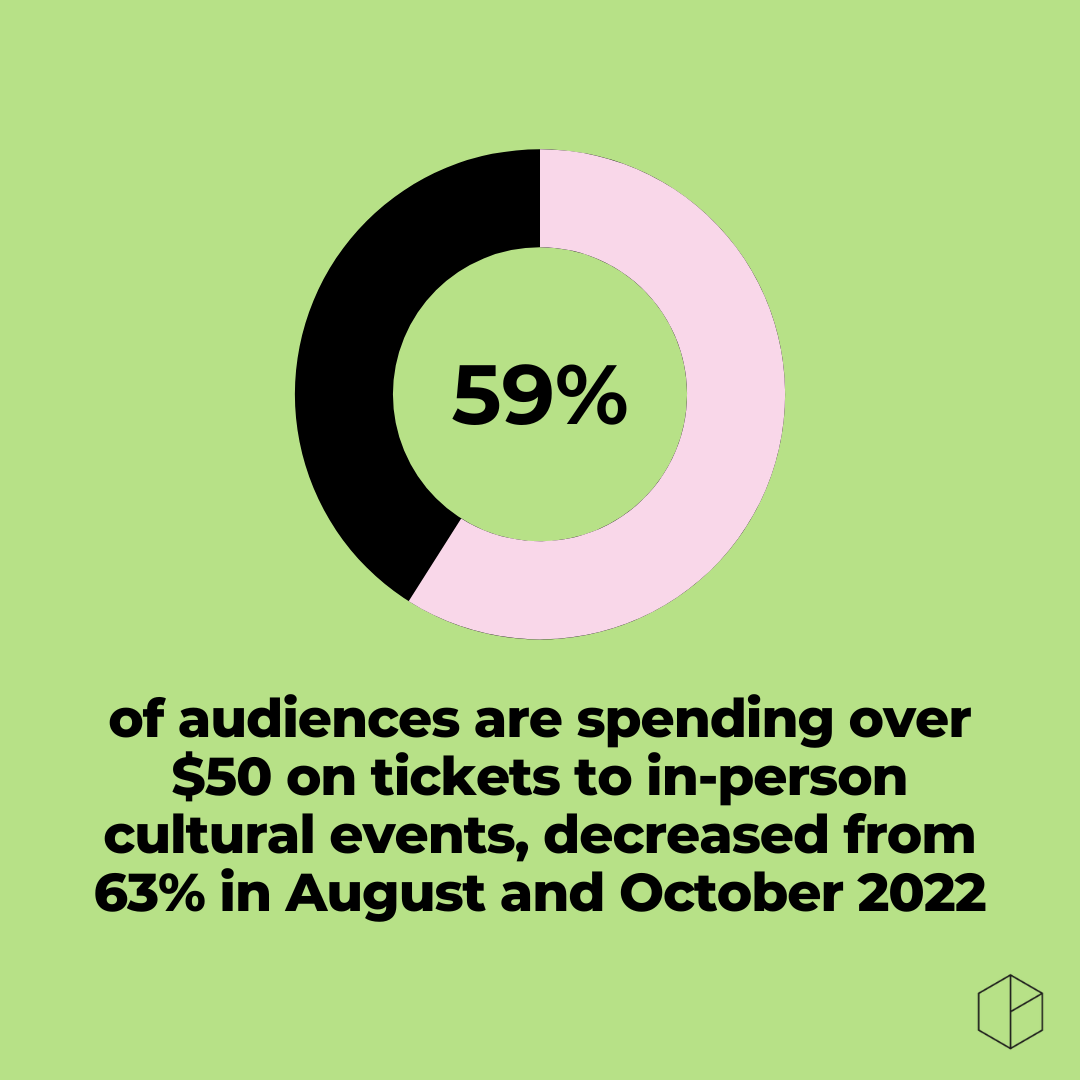

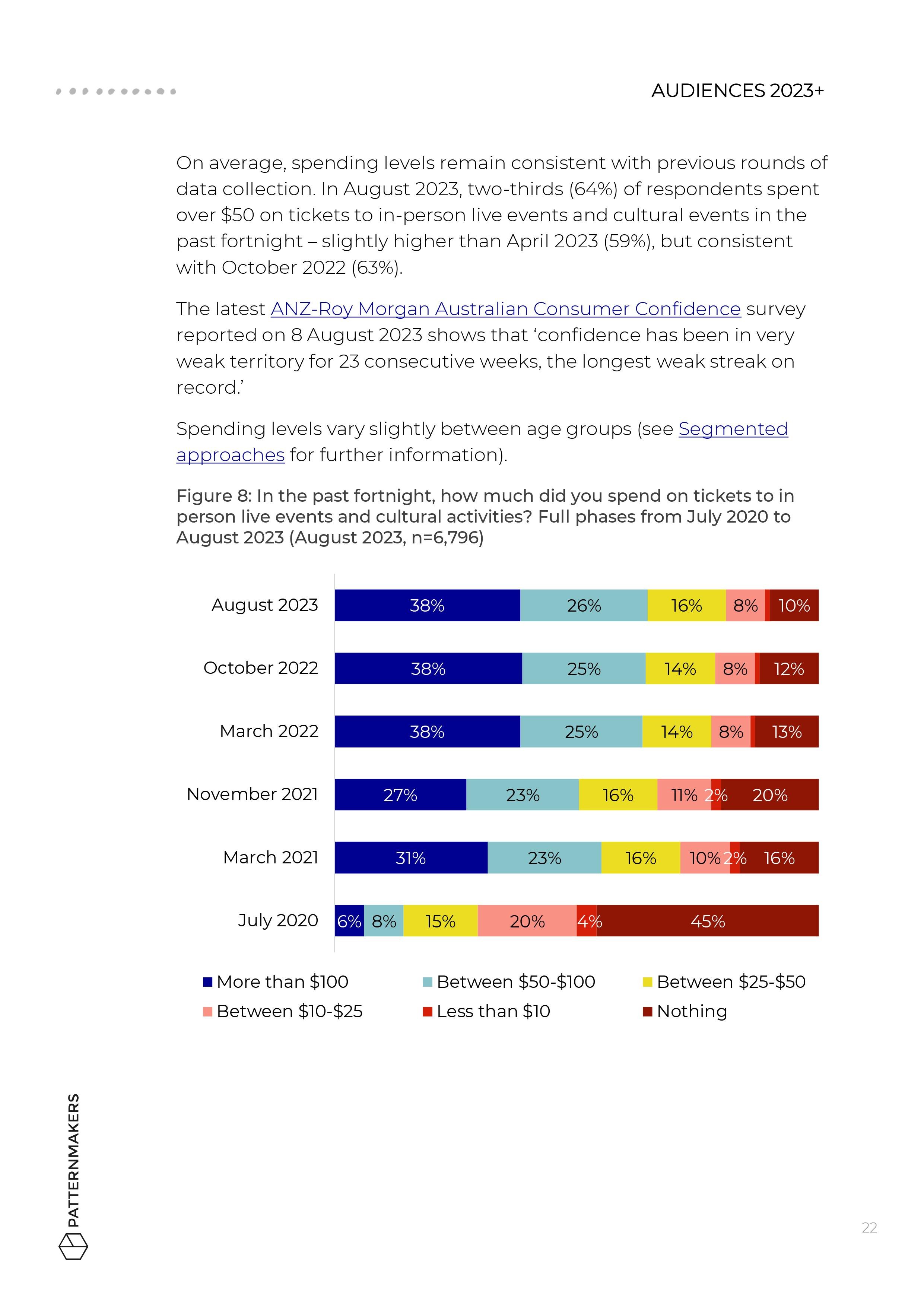

Spending levels at arts and culture events are not growing, as audiences weigh up value for money and take longer to make decisions.

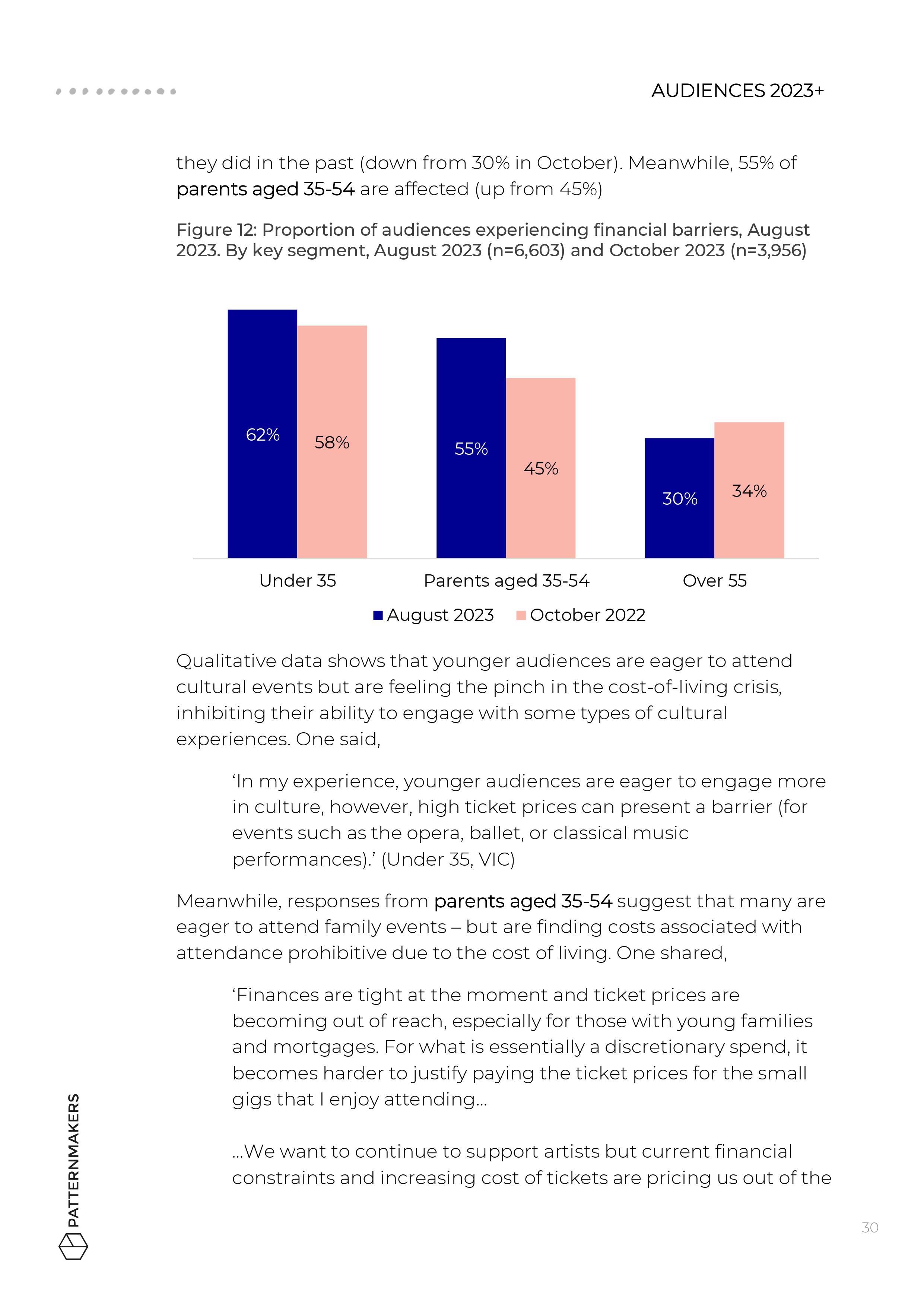

Younger audiences and families continue to be the most impacted.

A key opportunity is developing sustainable strategies for targeting disadvantaged segments.

3. The desire to inspire

In the wake of the pandemic, audiences are in the mood for uplifting experiences — requiring event organisers to think strategically about creating meaning and building trust in difficult times.

-

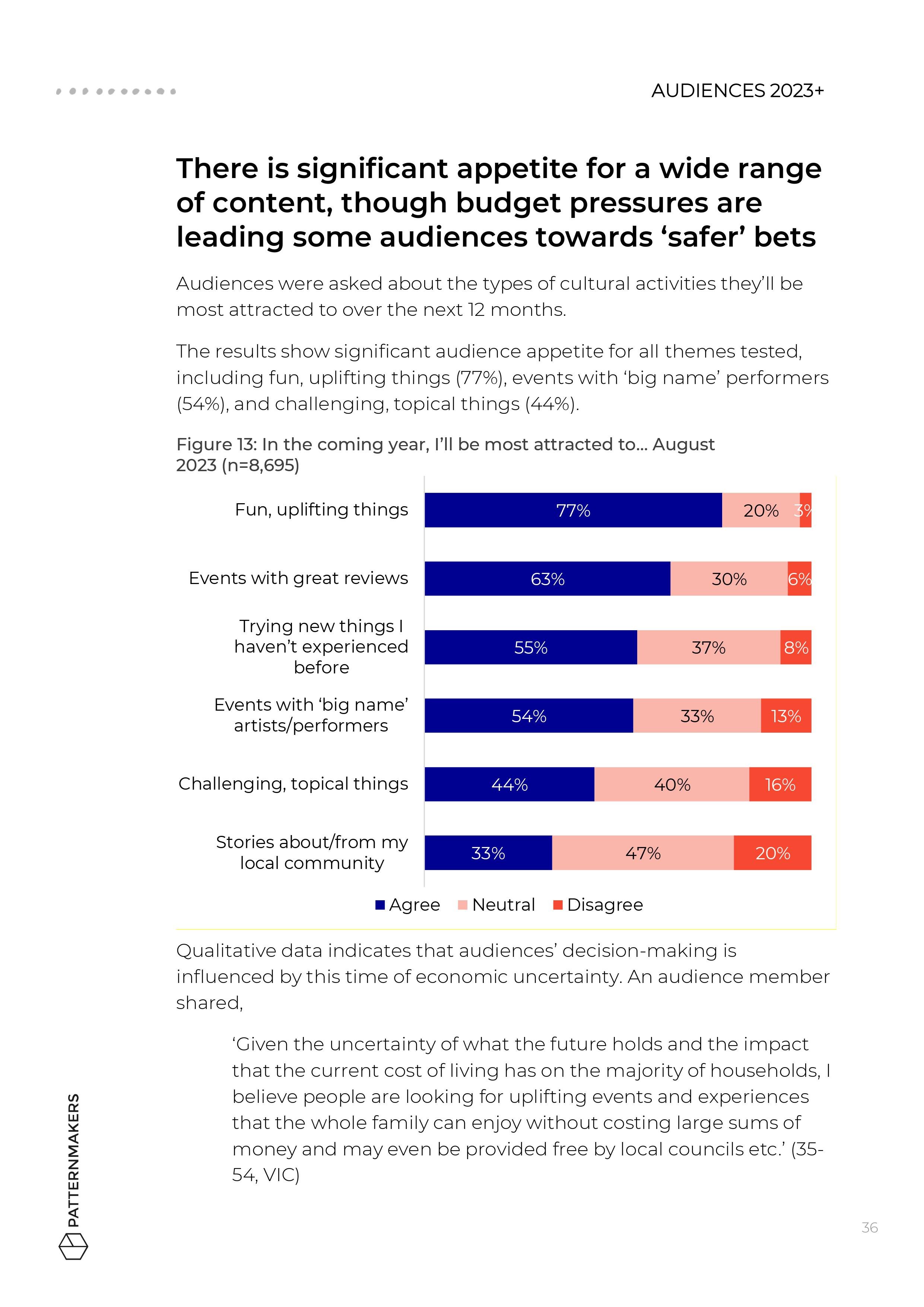

Australian audiences are showing significant appetite for a wide range of content, though budget pressures are leading some audiences towards ‘safer’ bets or ‘guaranteed fun’.

Social, uplifting experiences and events with great reviews will continue to reach the widest audience in the coming year.

Many audiences are hungry for meaning, but care and tact may be needed to when approaching challenging topics.

Organisations that understand the mood can please crowds today while building trust for tomorrow.

“The arts are so important to keeping my spirits up and my mental health well.

It’s really challenging when you can’t afford to go to an event every now and again that you know will keep you well.”

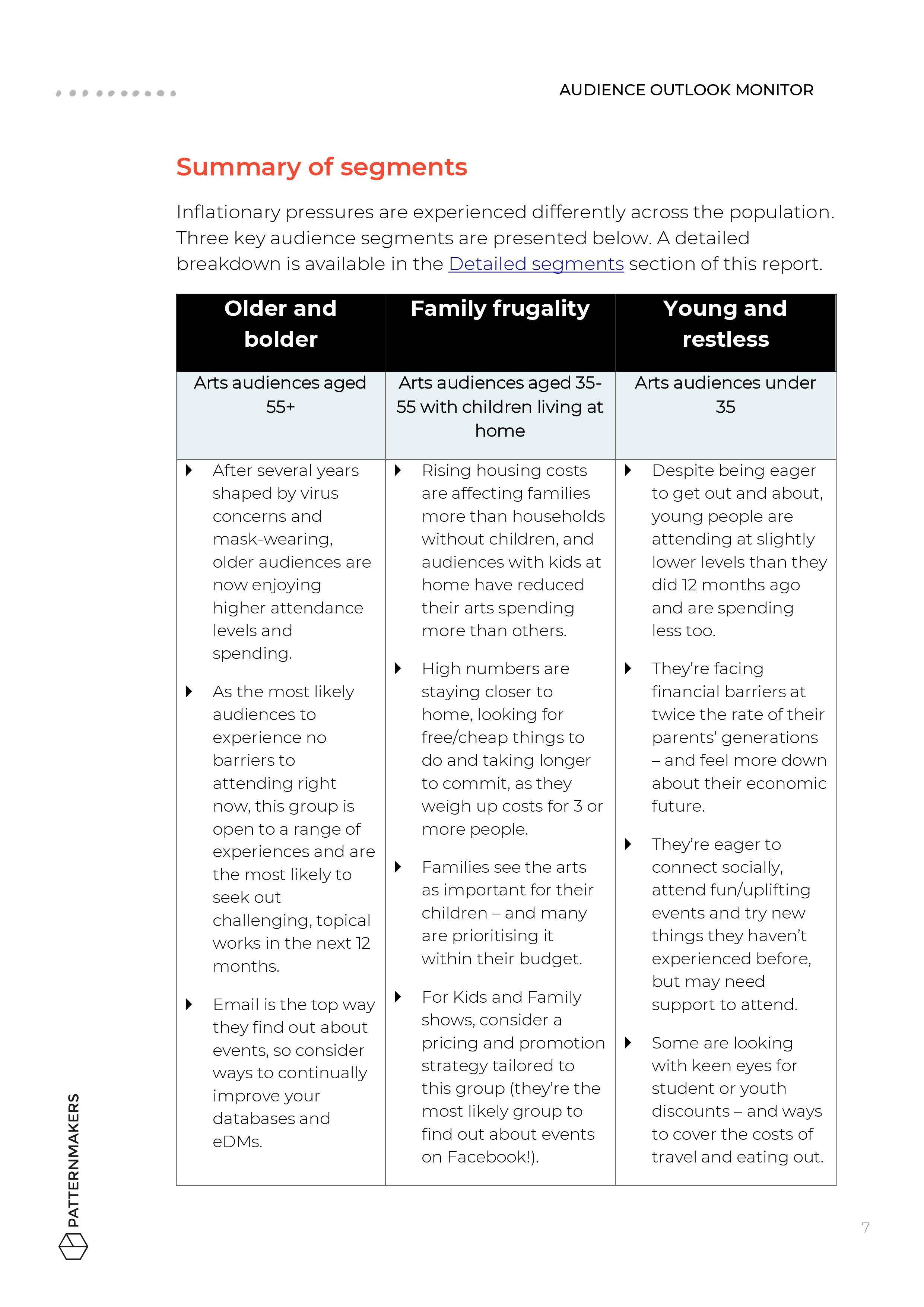

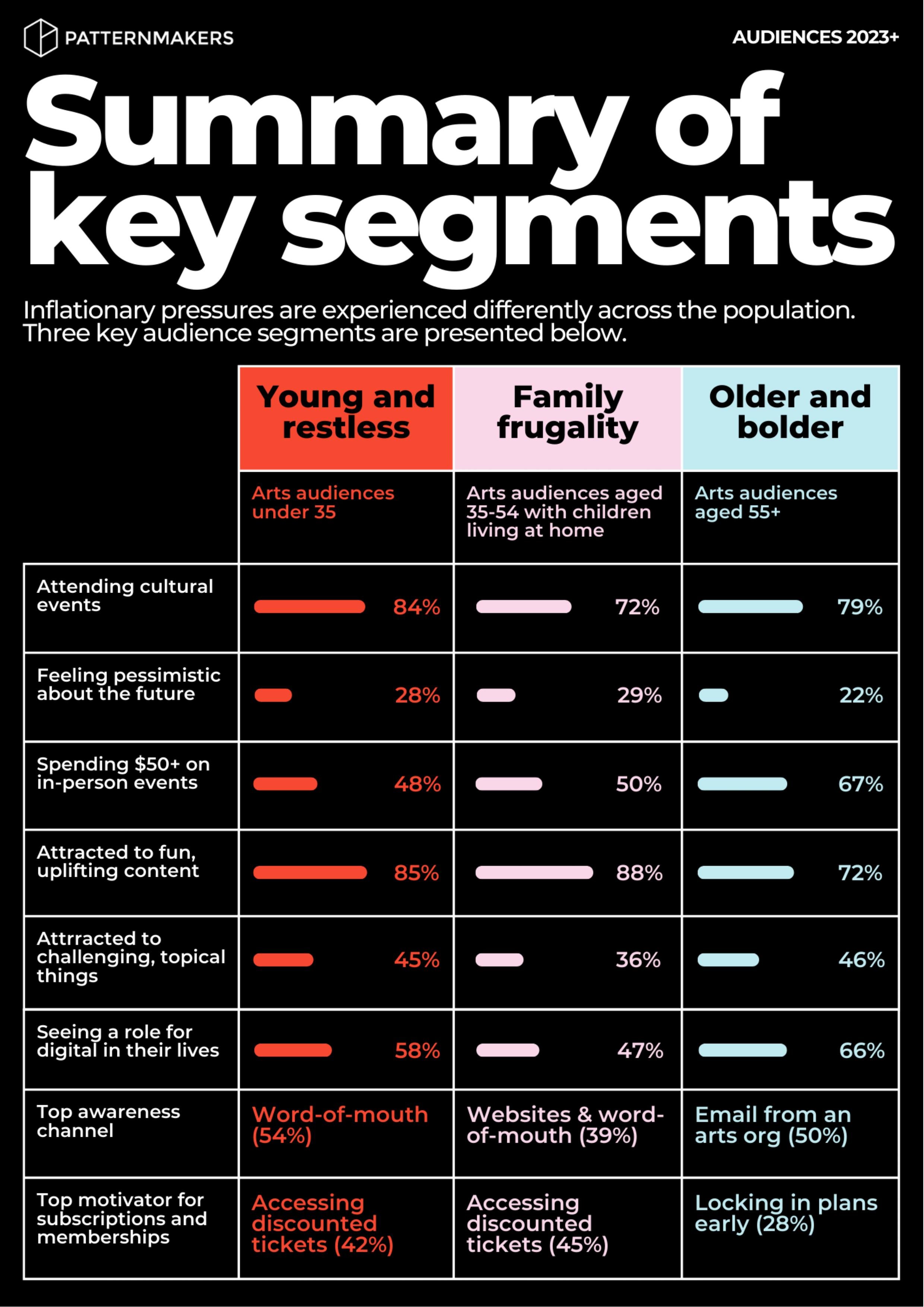

4. Three segments to know

Younger audiences, families and older audiences are thinking and behaving very differently in 2023, and organisations must build capacity for new ways of working.

-

Social and economic pressures impact different generations in different ways, and this is reflected in three key audience segments.

Young people, families and older audiences show stark differences in mood, entertainment priorities, spending patterns and media consumption.

Organisations must consider how to create and execute strategies for different segments and build in flexibility to adapt as conditions evolve.

For easy viewing, click below to download the summary of all three key segments.

5. Online trends

Audiences continue engaging online in large numbers, and in 2023, online content is helping audiences find out about events, discover new artists and participate in digital experiences.

-

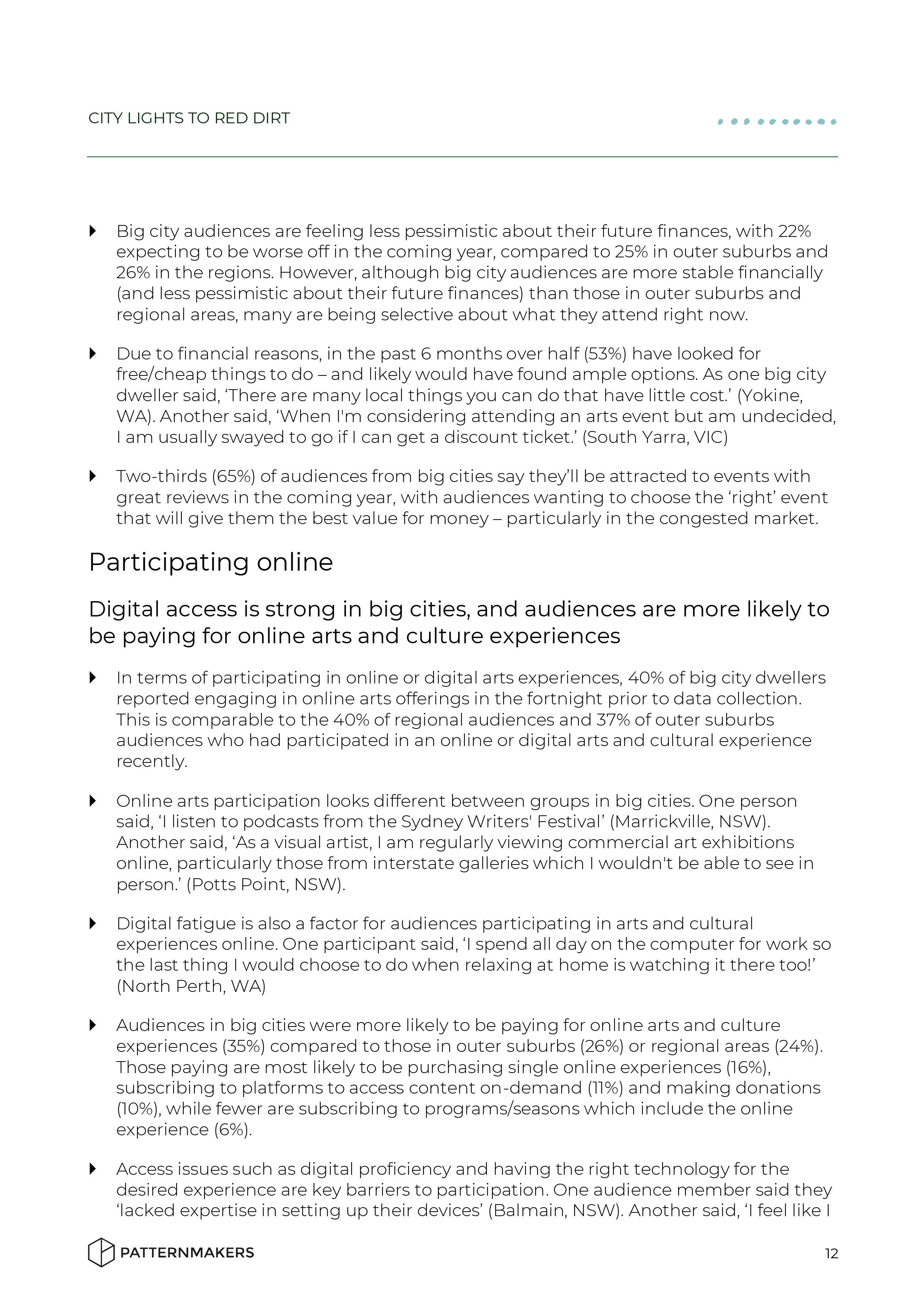

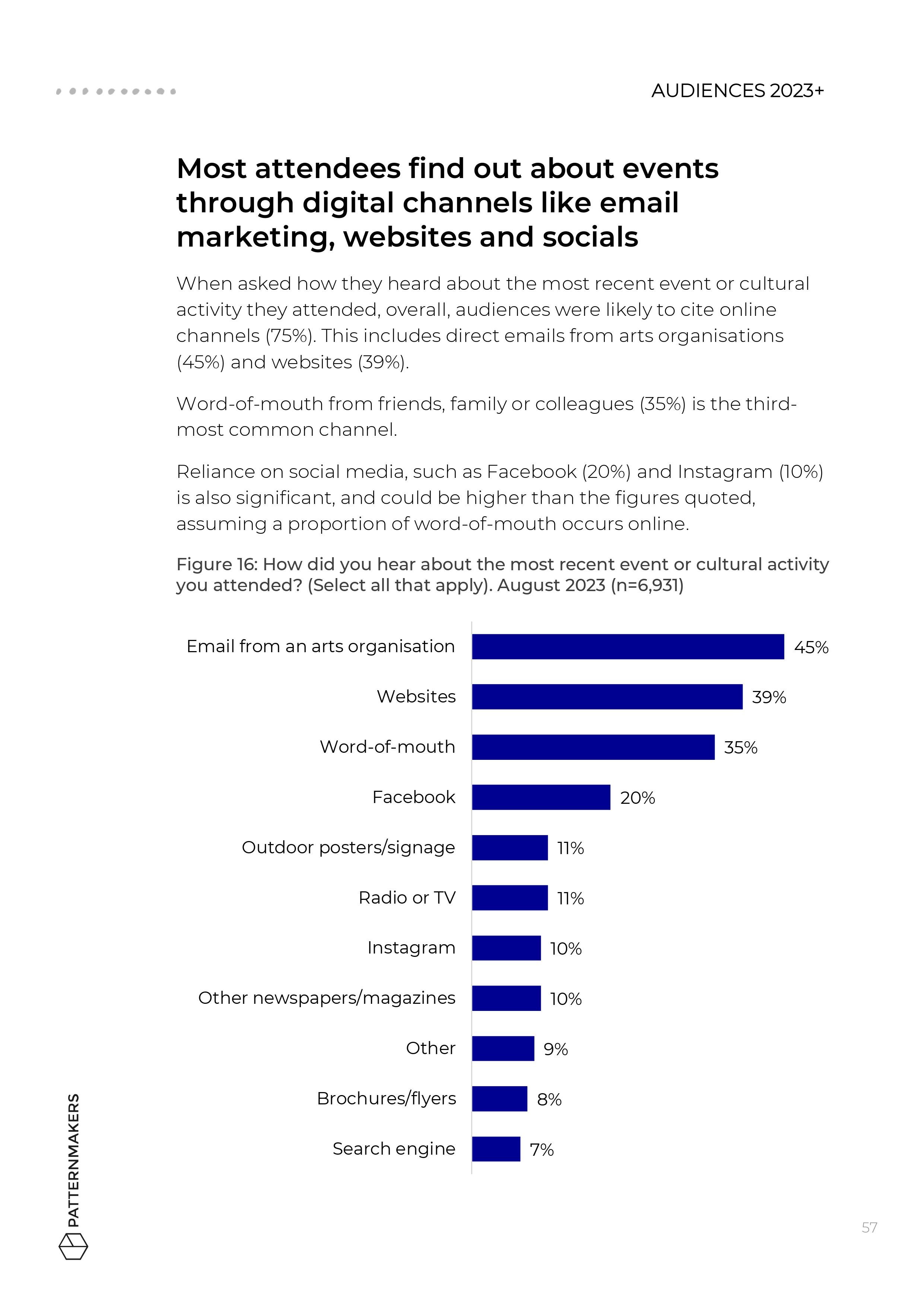

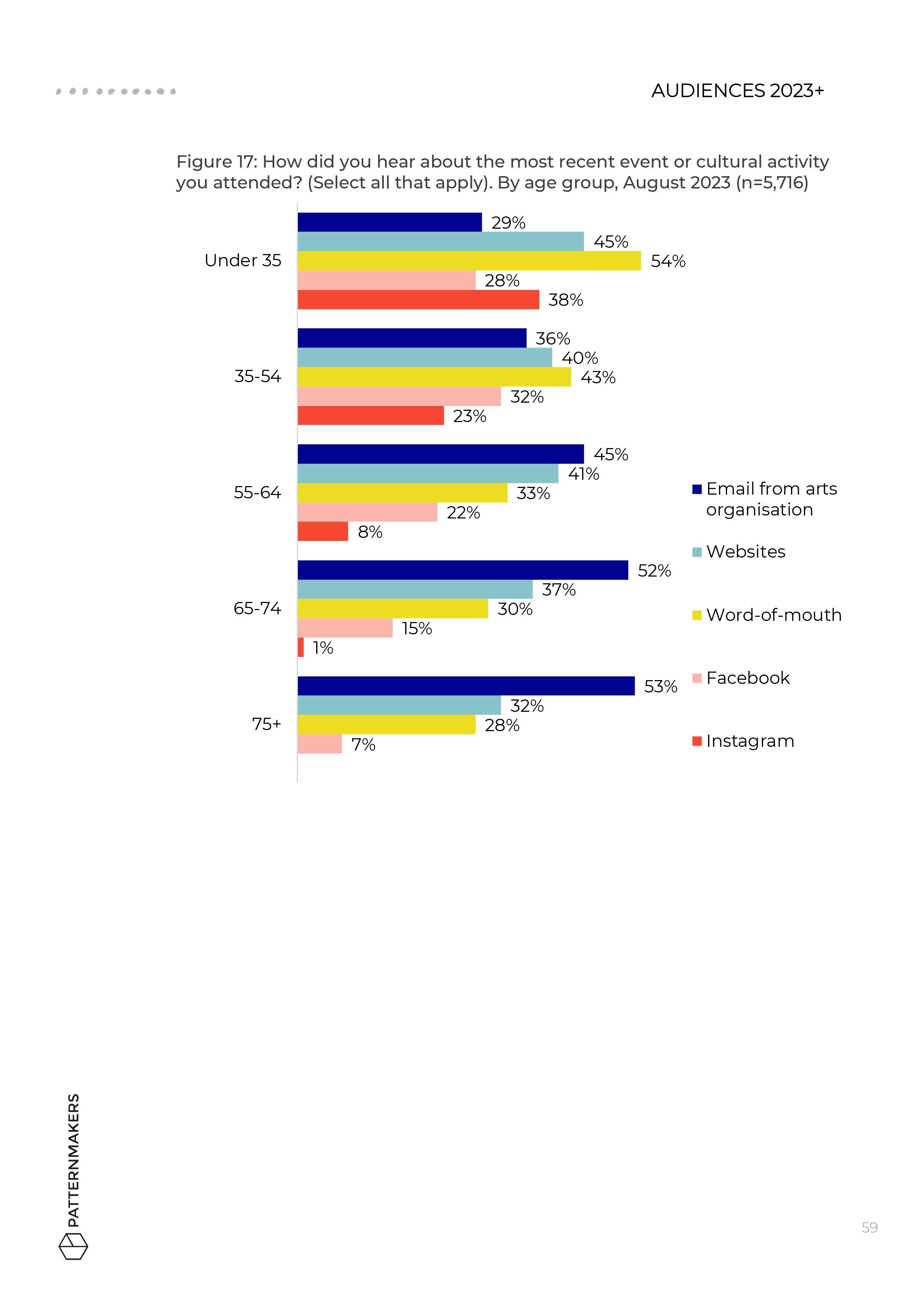

Digital channels are paramount to audience engagement – with 75% of recent attendees finding out about arts and culture events online.

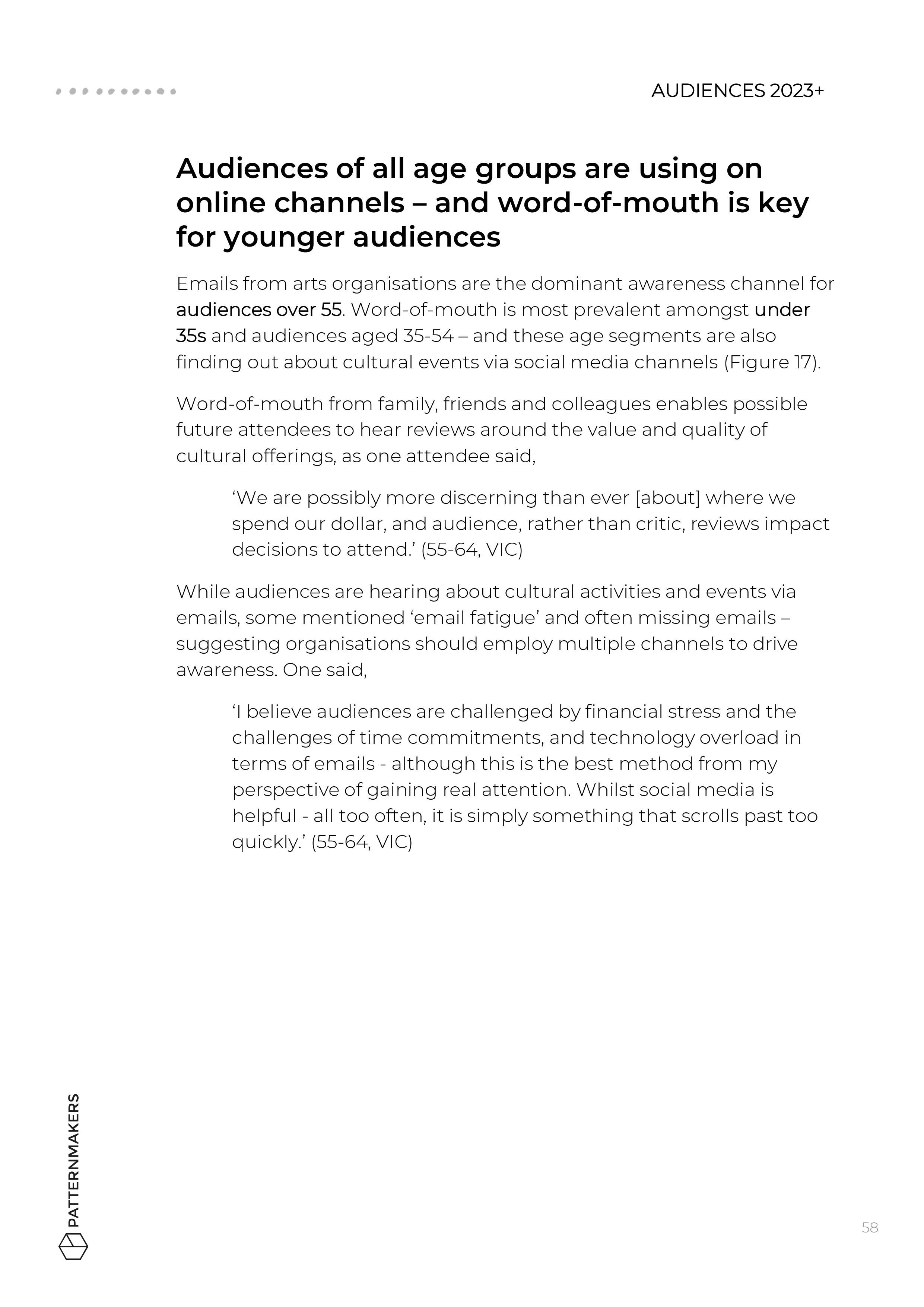

Preferred platforms look very different across age groups: email marketing is the priority for 55+, while word-of-mouth and socials are key for under 35s.

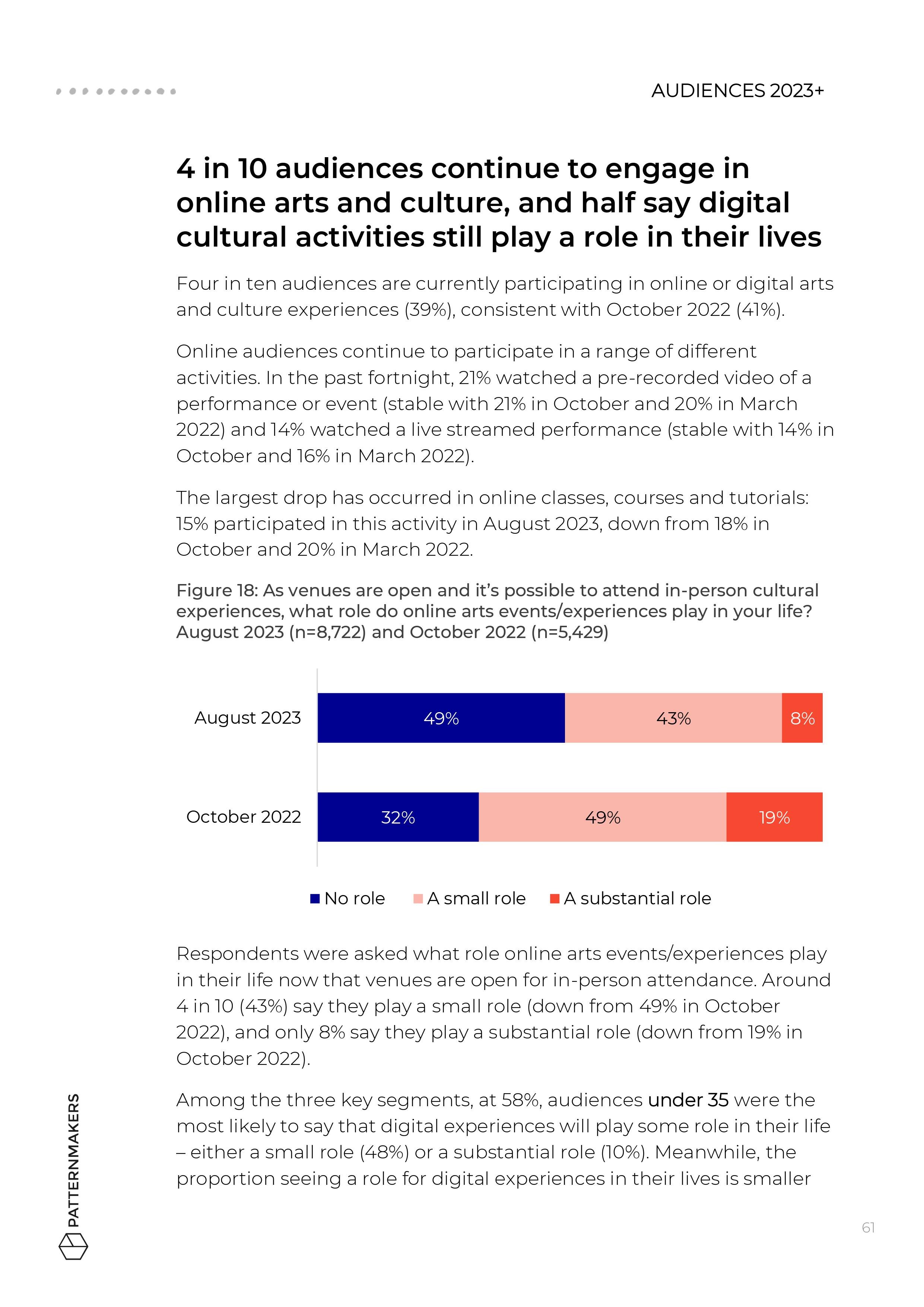

4 in 10 audiences continue to engage in online arts and culture, and half say digital cultural activities still play a role in their lives, despite spending less.

It might be time to review online offerings, scrapping what's not working and freeing up resources for more targeted approaches.

“Australian arts audiences are intelligent and open to be challenged...

...This is essential for the future health and development of arts in this country.”

6. Late decision-making

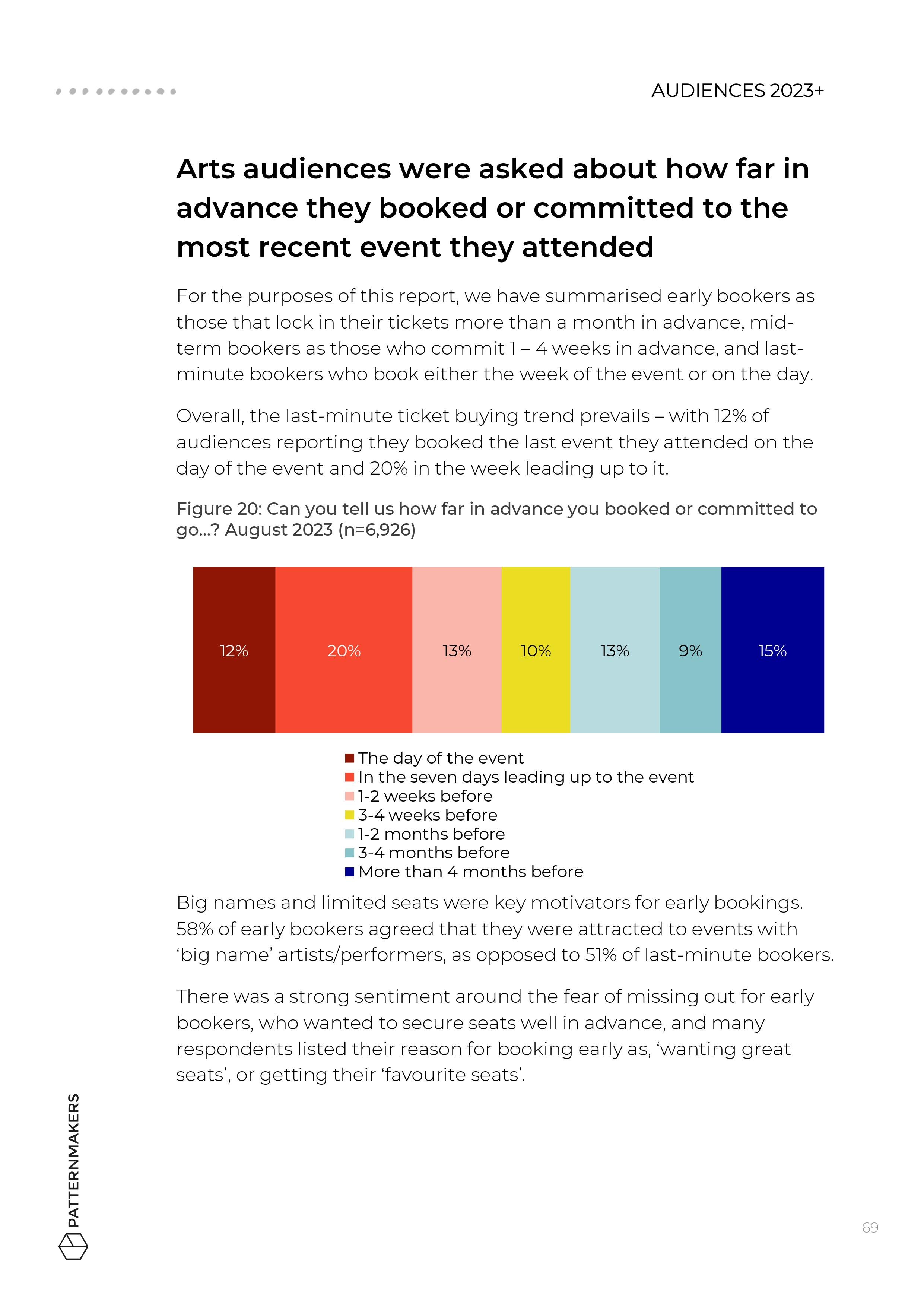

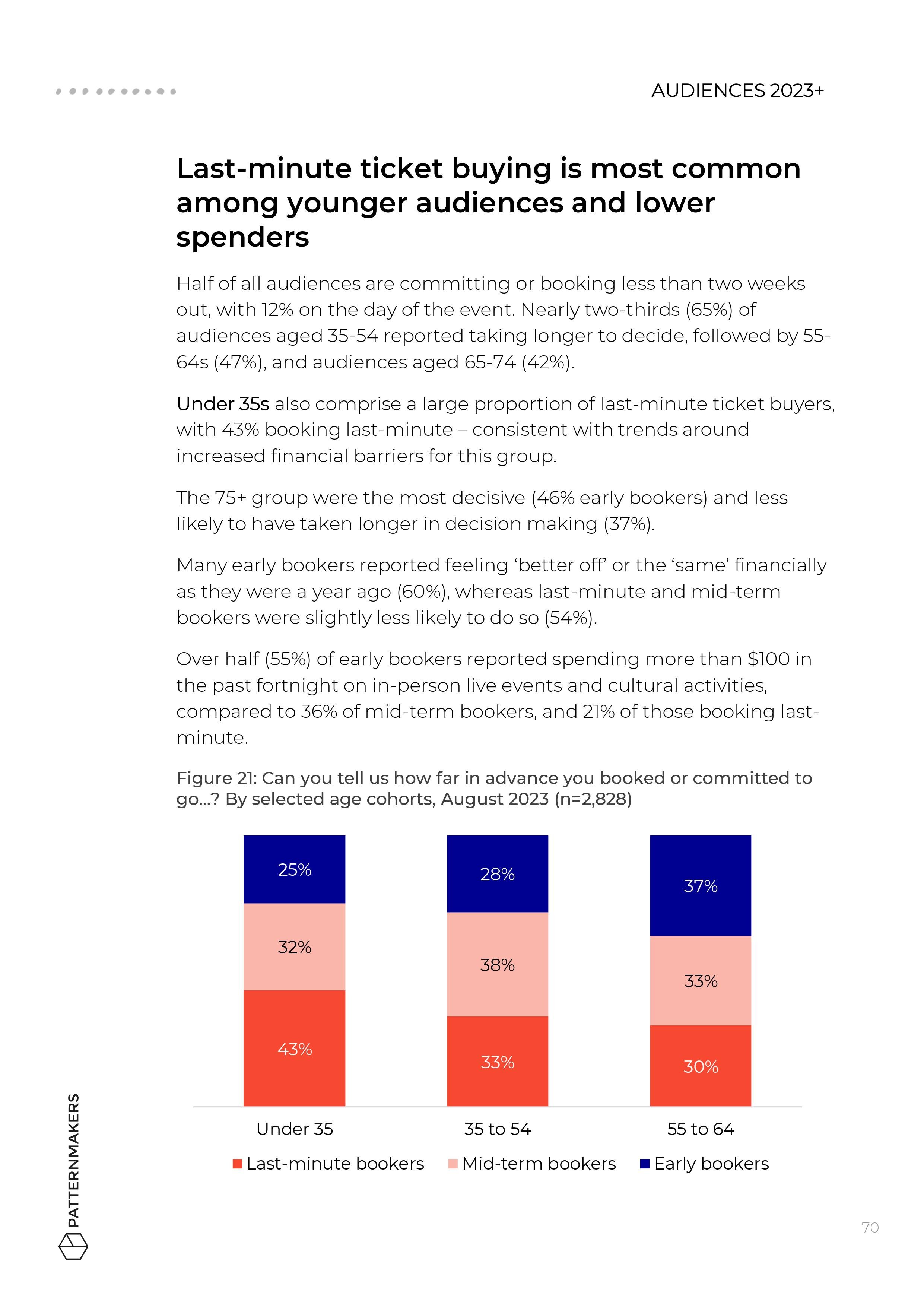

In 2023, last-minute decision making persists, with audiences facing more choices, and busier lives, as commuting, travel and social events pick up. Organisations need to prepare for new phases in campaigns, to reach people at the right time.

-

Half are booking less than two weeks out, with 12% on the day of the event

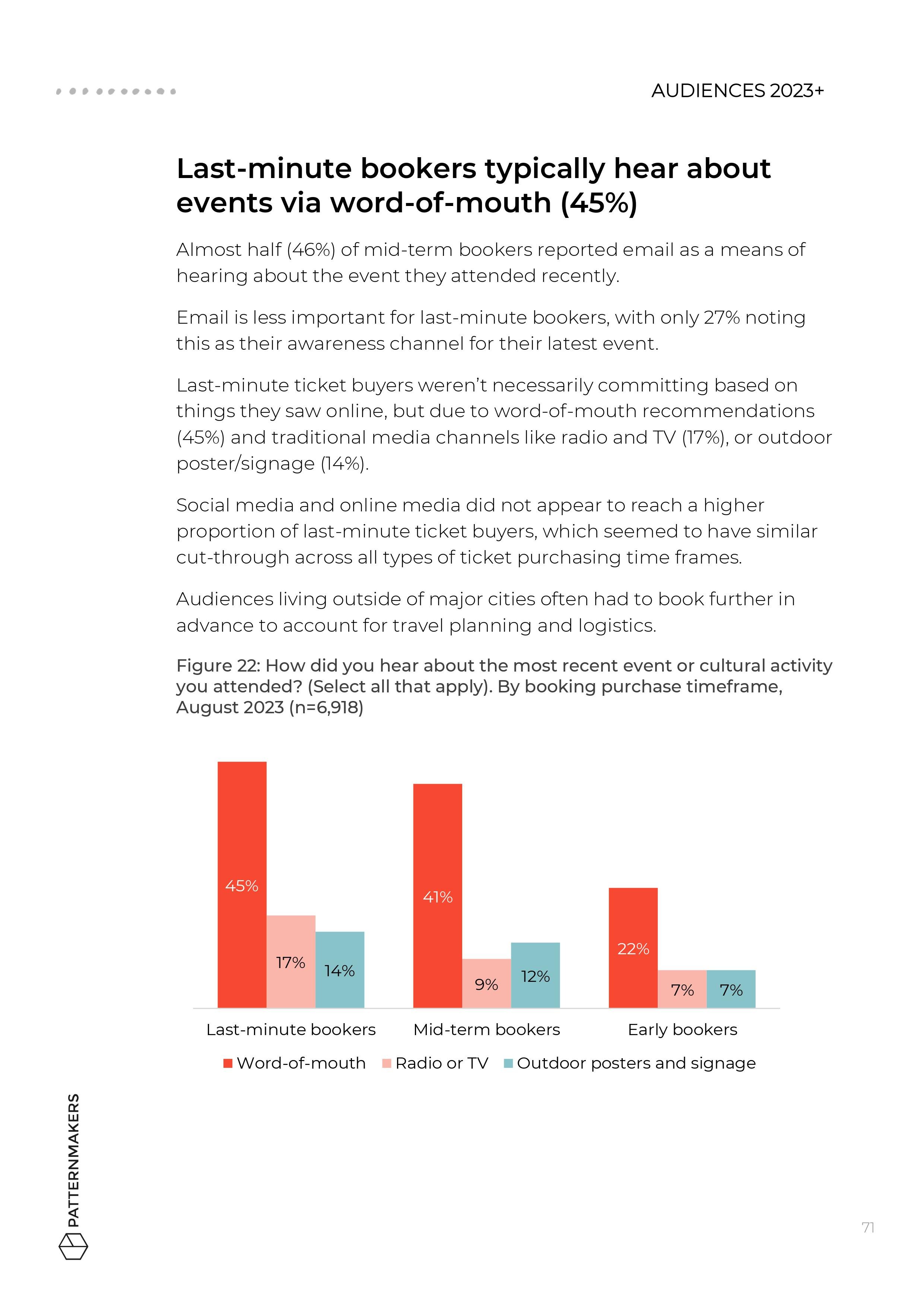

Analysis of ‘early bookers’, ‘mid-term bookers’ and ‘last-minute bookers’ shows that last-minute ticket buying is most common among younger audiences and lower spenders. Those booking later are also more likely to rely on word-of- mouth.

Ticketing initiatives to support more price sensitive audiences are important, but last- minute discounting may not be the answer.

7. Subscriptions and memberships

Subscribers and members are vital for many arts organisations, but their needs vary dramatically across age groups, and organisations are adjusting their packages to suit new needs.

-

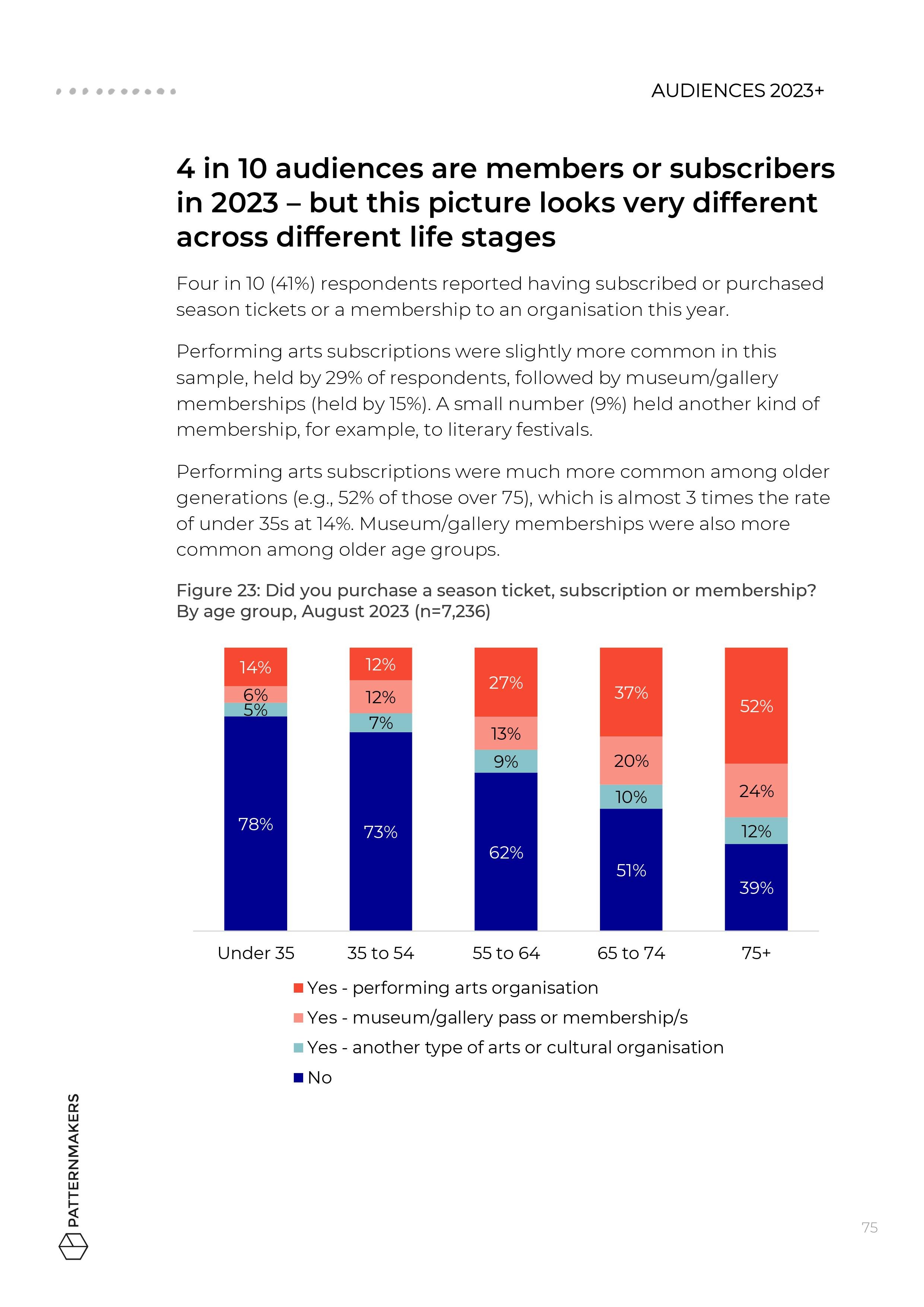

4 in 10 audiences are members or subscribers– with performing arts subscriptions more common than other types.

Subscriptions uptake and motivations are very different across audiences in different stages of life.

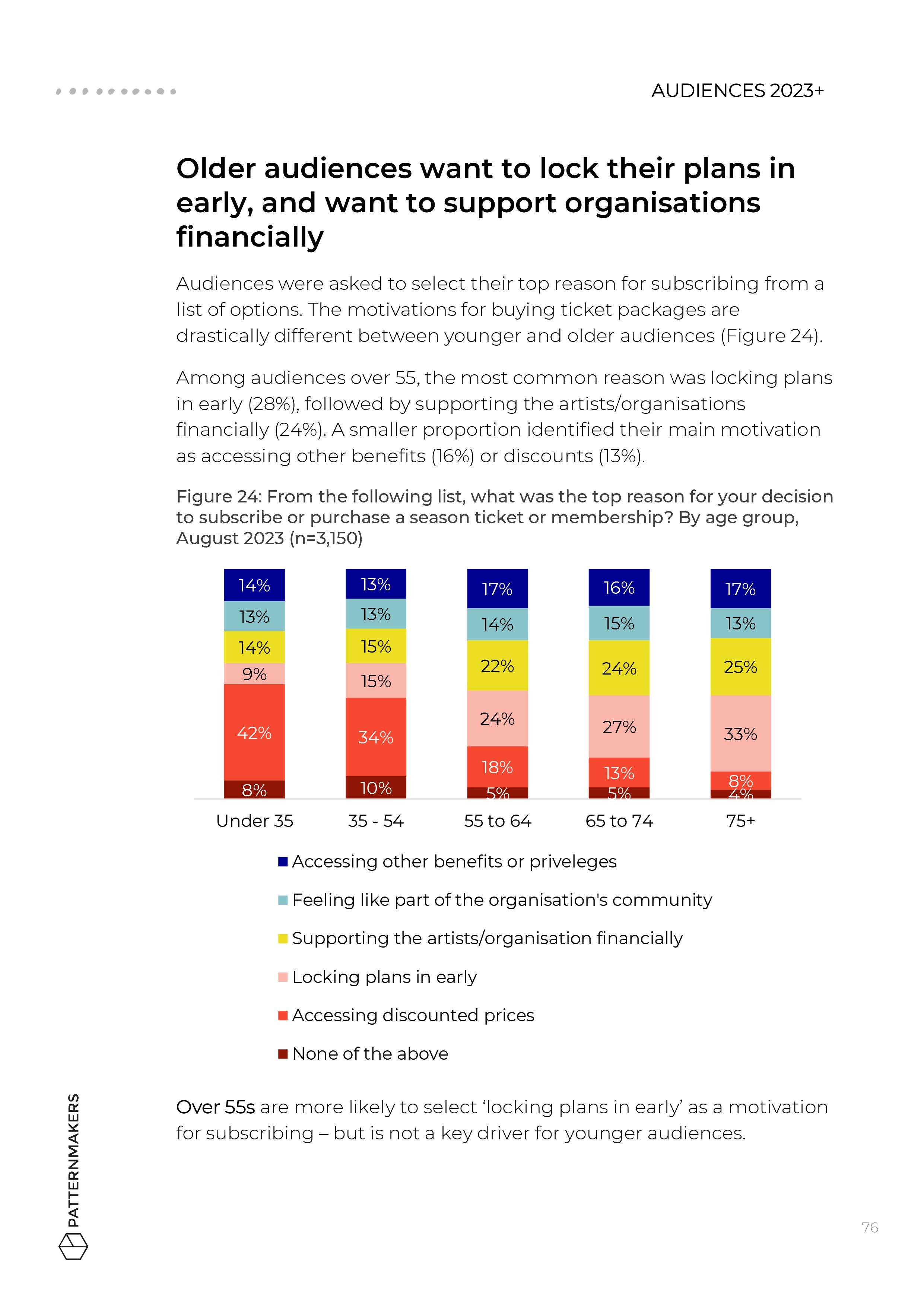

Older audiences want to lock their plans in early and show financial support, while younger audiences are more likely to want access to discounted tickets.

There is a case to test different offers and models, using messaging to target the unique needs of different audience segments.

Cover Image Credit: Jacquie Manning, courtesy of Sydney Writers Festival.

Watch us launch the findings at APAX 2023

Our Managing Director, Tandi Palmer Williams, and Research Analyst, Peta Petrakis, travelled to Cairns to present the data from Audiences 2023+ at APAX 2023, PAC Australia’s annual conference.

Click the image below to watch the recording of the livestream. Simply register to make a free account and press play!

Use the dashboard to get results for your artform and region

Survey data from over 8,800 respondents has been uploaded to the dashboard, which now contains insights from over 100,000 Australian participants.

You can use the dashboard to explore the findings by state/territory, artform and audience segment.

It’s freely available to access, just click the image below and use the login details provided on the dashboard page.

About the Audience Outlook Monitor

The Audience Outlook Monitor provides the results of a study that has tracked audience sentiment over the course of the COVID-19 pandemic.

Data was collected in six phases throughout 2020-2022 and is again being tracked in 2023.

Government agencies across Australia are collaborating with research agencies Patternmakers (Sydney) and WolfBrown (USA) to produce this resource. The dashboard is freely accessible and designed to help artists and cultural organisations of all kinds to make the best possible decisions.

How to find out more

To receive new releases directly into your inbox, as soon as they are available, you can opt in to receive Audience Outlook Monitor news below.

Subscribers to our regular Culture Insight & Innovation Updates will need to update their preferences to receive all updates about the Audience Outlook Monitor. Just enter your email below and follow the instructions provided.

If you have a question, or an idea for using this data, please contact Patternmakers at info@thepatternmakers.com.au

Delivery partners

Supporting partners

Past posts on this blog

Archive

- 2023 21

- Dance 3

- Research 99

- Audience development 79

- Arts 73

- COVID-19 70

- Culture 72

- Data culture 69

- Evaluation 75

- Innovation 78

- Thought leadership 16

- About Patternmakers 35

- Privacy 6

- Project updates 25

- Culture Panel 1

- Resources 6

- Toolkit 5

- Beyond the Bio 8

- 2022 23

- Career Advice 9

- Opportunities 4

- Tips & Tricks 13

- 2021 7

- 2024 1

- First Nations 3

- Indigenous 2

- Strategic Planning 5

- Trends 3

- Performing Arts 5

- Manifesto 1

- Education 2

- Capacity building 3

- Digital art 4

- Interviews 3

- Coronavirus 2

- 2020 3

- Tandi Palmer Williams 7

- Theory of Creativity Podcast 1

- 2019 11

- Top 5 2

- 2018 12

- Case Studies 2

- Our services 4

- Postcode Analysis 1

- Accessibility 4

- Touring 3

- Publications 1

- 2017 8

- Data art 2

- 2016 5