City lights to red dirt: Connecting with audiences across Australia

In this Audience Outlook Monitor report, ‘City Lights to Red Dirt’, we look at the geographic trends in data collected from past attendees to cultural events, comparing audiences in big cities, outer suburbs and the regions.

Our cities, suburbs and regions are different places today and audiences are responding in interesting ways.

Attendees of arts and cultural events are feeling the pressure of the housing crisis, changing work and commuting patterns, navigating weather events and approaching travel and leisure differently.

In this new report, ‘City Lights to Red Dirt’, we look at the geographic trends in data collected from past audiences of cultural events.

Click the buttons below to download the report, as a PDF or accessible Word version, or read on for more of the findings.

Three chapters, three geographic audience segments

The report compares audiences in three main geographic areas, providing insights for connecting people with culture where they live and the places they visit.

Download the chapters as separate fact sheets below.

Audiences in Big Cities

Arts audiences in big cities are experiencing the arts at high levels, but with market saturation and the shifting dynamics of Australia's CBDs post-pandemic, new challenges have emerged for organisations to cut through.

-

In Australia’s big cities, more people are attending arts events more often, but resident arts organisations are competing in a congested market. The data from past attendees shows that:

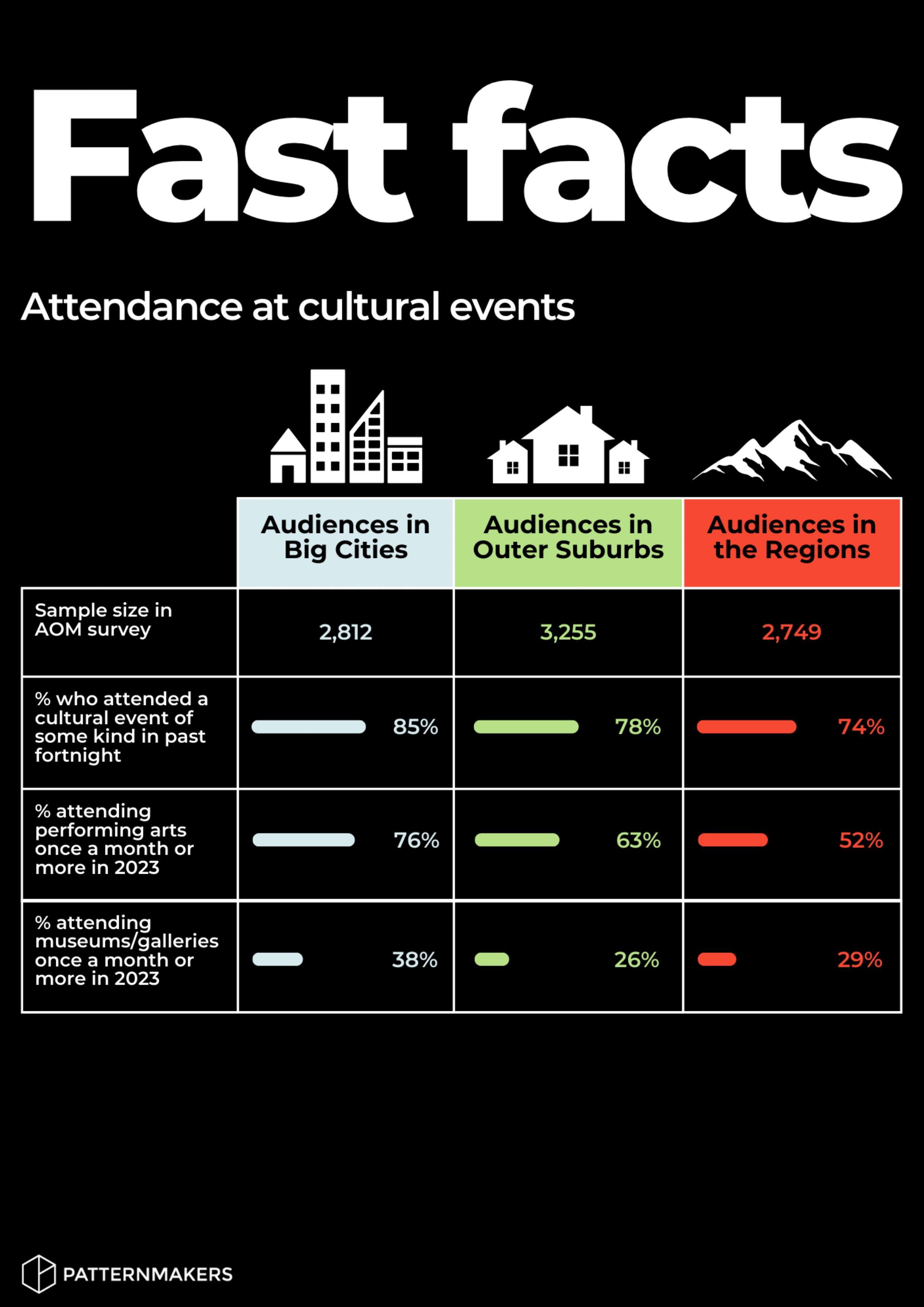

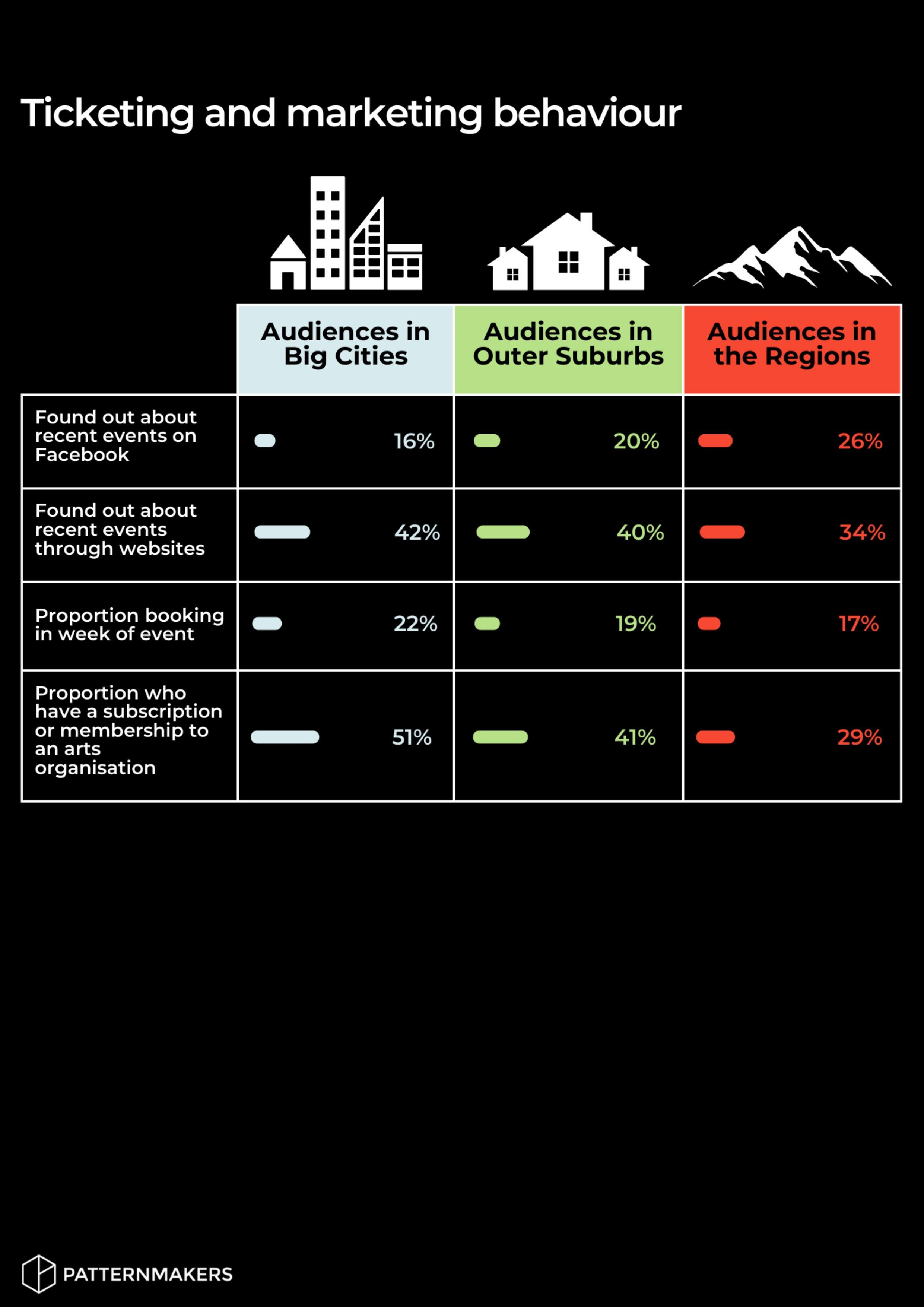

85% of big city audiences said they attended at least one kind of cultural event in the fortnight before data collection. Attendance is also more frequent amongst big city arts audiences: 38% attend a gallery or museum at least once a month, compared to outer suburbs (27%) and regional audiences (29%).

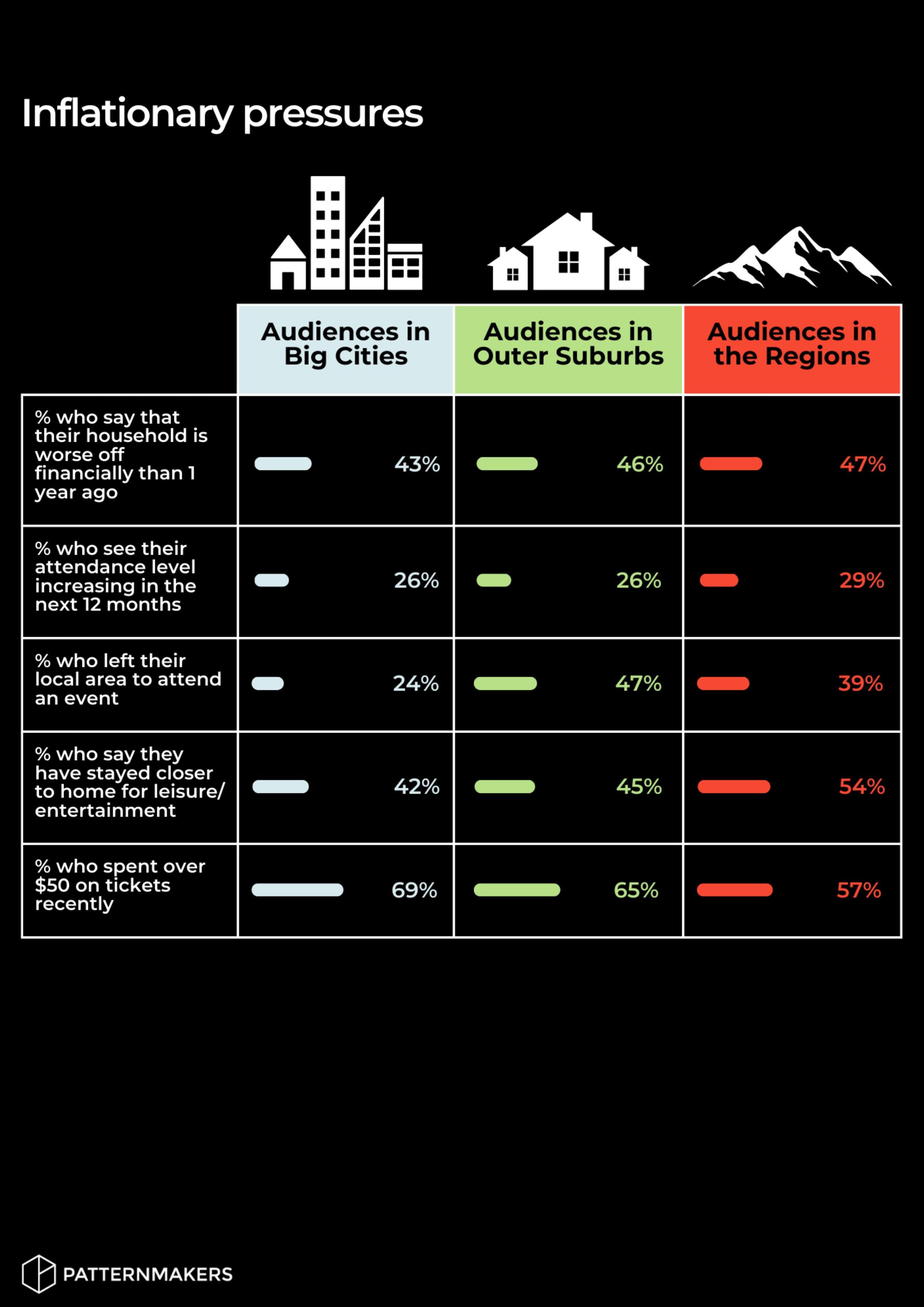

Arts audiences living in big cities are spending more on tickets to in-person live events and cultural activities: 7 in 10 spent more than $50 the fortnight before data collection (69%), compared to 65% of outer suburb audiences and 57% of regional audiences.

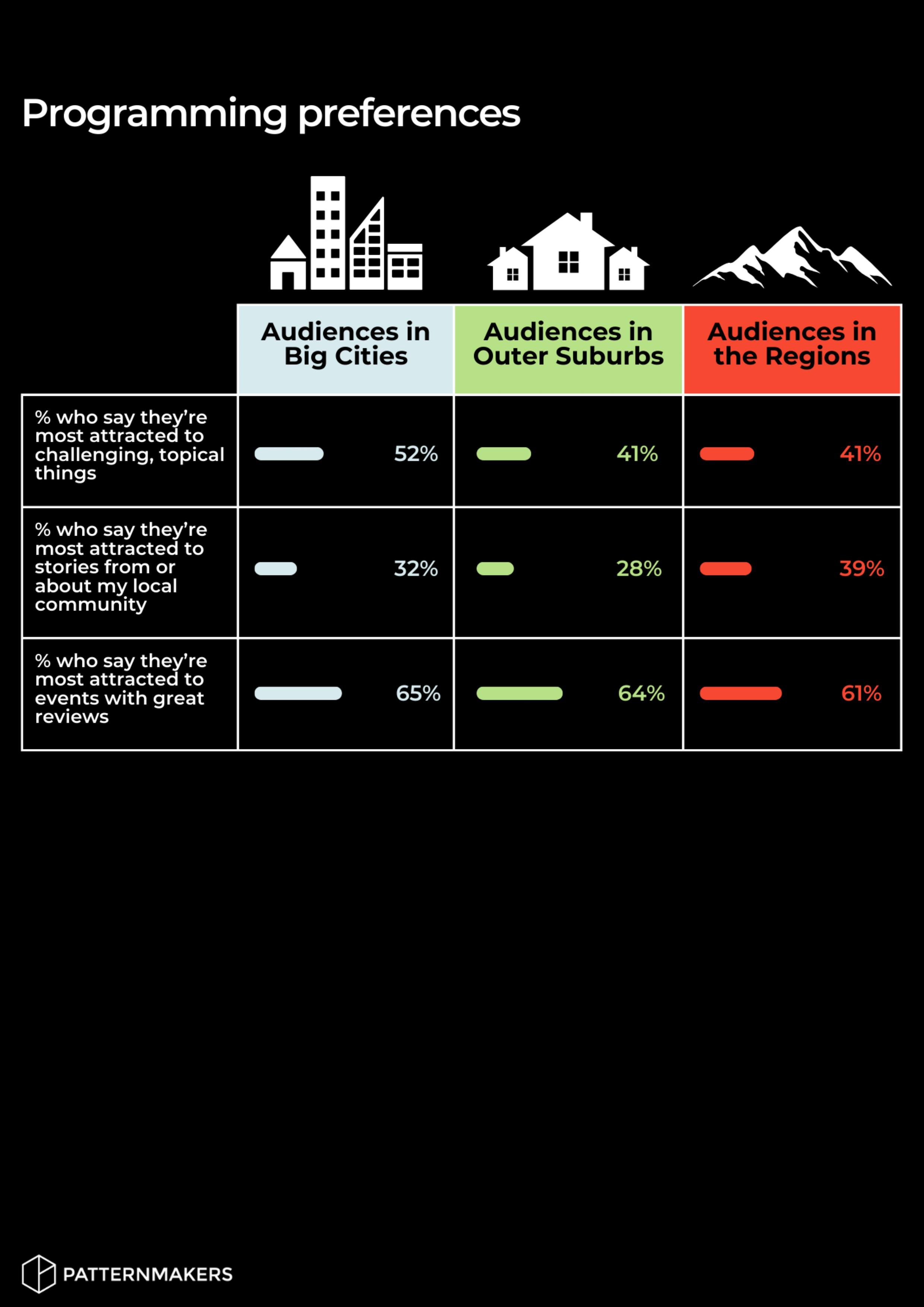

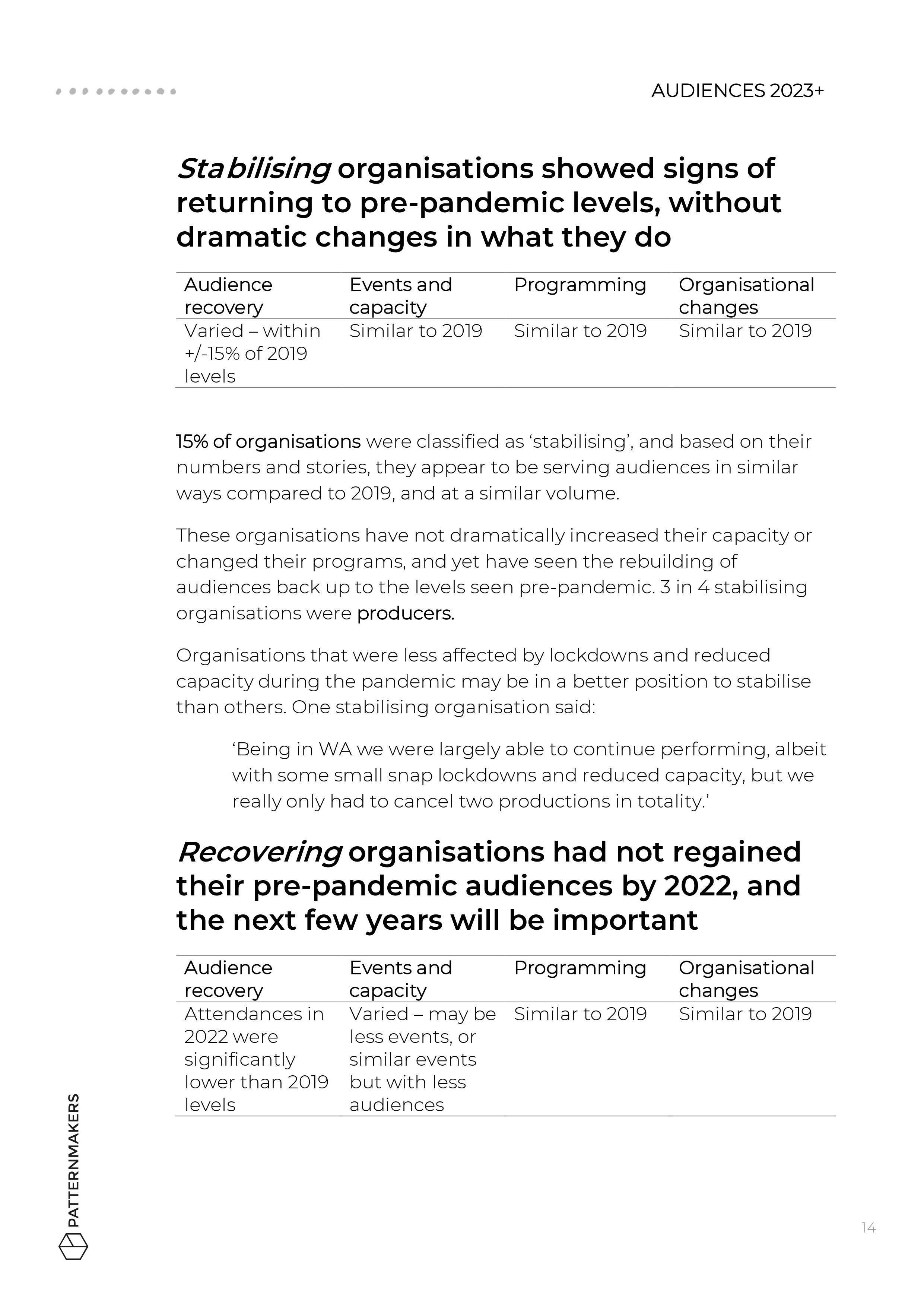

While most audiences are drawn to fun, uplifting and even escapist content right now, big city audiences are showing a greater appetite for challenging, topical content in the next 12 months (52%), compared to audiences living in outer suburbs and regional areas (both 41%). With more options on offer, they are also more likely to tune into reviews when considering what to attend.

Audiences in Outer Suburbs

Outer suburbs are the biggest growth areas in Australia right now, and have an expanding arts audience looking for more cultural experiences closer to home — but don't yet have enough venues nearby to accommodate.

-

In the outskirts and outer suburbs of big cities, the rate and frequency of attendance are slightly lower than big cities, but the market is growing, as more people move to more affordable areas where families can enjoy different lifestyles. The data from past attendees of events shows:

Audiences in outer suburbs are feeling slightly more pessimistic than optimistic about their financial situation, with almost half (46%) say they’re worse off than they were a year ago, and 25% expect to be financially worse off in the coming year.

Audiences in outer suburbs (combining both residents and visitors) were most likely to attend a cinema locally (59%), whereas big city audiences were comparatively more likely to attend a local live performance. Audiences in the regions were most likely to attend a fair/festival locally (40%) or visit a museum or gallery (51%).

Audiences in outer suburban areas are the least likely to be participating in online events right now. Half of outer suburbs residents say online arts events and experiences are playing a small (43%) or substantial role (8%) in their life, while another 49% say they play no role.

Audiences in the Regions

Across Australia's diverse regions, audiences are experiencing access to arts and culture differently. Factoring in extra time and travel costs means heightened barriers in 2023, but with a decentralising trend, more options could be on the cards.

-

Regional Australia is changing, with demographic shifts seeing some regional places grow dramatically in recent years – but rising costs of travel are leaving some isolated. There are different patterns for large towns, smaller villages and bush or outback areas, but on average, the data shows that:

Regional audiences indicated feeling less stable financially and more pessimistic about their future finances than those in outer suburbs and big cities, and many are being selective about what they attend right now. Almost half (47%) say they are ‘worse off’ financially than they were one year ago, and 26% expect to be ‘worse off’ in the coming year.

Regional audiences have lower levels of access to some types of events, like live performances, and therefore attend less often: 52% of audiences in the regions said they attend performing arts events at least once a month or more, lower than proportions in big cities (77%) and outer suburbs (63%).

Some art forms appear to reach audiences in regional areas better than others. For instance, in the past 12 months, 51% of regional audiences have attended contemporary music and 57% have attended libraries, which are similar to attendance rates in urban areas.

Four in ten regional audience members say that in the coming year, they’ll be most attracted to stories that are ‘about or from my local community’ (39%), slightly higher than the rate in big cities (32%) and outer suburbs (28%).

Get the data at a glance

Click the button below to download our Fast Facts for attendance, inflationary pressures, programming preferences and ticketing and marketing behaviour.

Read the ‘Audiences 2023+’ report

In case you missed it, click the button below for the key insights from the August 2023 National Snapshot.

Use the dashboard to get results for your artform and region

Survey data from Phase 9, which heard from over 8,800 respondents, has been uploaded to the dashboard, which now contains insights from over 100,000 Australian participants.

You can use the dashboard to explore the findings by state/territory, artform and audience segment.

It’s freely available to access, just click the image below and use the login details provided on the dashboard page.

About the Audience Outlook Monitor

The Audience Outlook Monitor provides the results of a study that has tracked audience sentiment over the course of the COVID-19 pandemic.

Data was collected in six phases throughout 2020-2022 and is again being tracked in 2023.

Government agencies across Australia are collaborating with research agencies Patternmakers (Sydney) and WolfBrown (USA) to produce this resource. The dashboard is freely accessible and designed to help artists and cultural organisations of all kinds to make the best possible decisions.

How to find out more

To receive new releases directly into your inbox, as soon as they are available, you can opt in to receive updates below.

If you have a question, or an idea for using this data, please contact Patternmakers at info@thepatternmakers.com.au

A state-specific breakdown of Australian audiences in 2023 and beyond

Download the August 2023 State Snapshot reports to discover the top trends in audience behaviour at a state-level.

Read our State Snapshots to discover the top trends in audience behaviour at a state-by-state level.

Based on data from the August 2023 Audience Outlook Monitor, the State Snapshots explore how audience behaviour is impacted across different parts of the country, especially as economic pressures persist.

Attendance levels have stabilised across the states since the pandemic began, with three states reaching their highest rate of attendance since 2020. However, as disposable income gets squeezed, audiences nationwide are grappling with tough decisions about what, how and when to attend.

There are some important distinctions. New South Wales audiences are attending the most and spending the highest on cultural events. Meanwhile, those in Victoria and Queensland are most likely to be acting more frugal and taking longer to make decisions, staying closer to home and looking for cheap/free things to do. In Western Australia and South Australia, the outlook appears most stable, with audiences the most likely to say their rate of attendance will stay the same in the next 12 months.

Download the NSW, VIC, QLD, SA, ACT and WA reports below for the latest look — including the story on last-minute booking, subscriptions/memberships and online participation — and to explore the opportunities for strategic thinking in 2023 and beyond.

Download the snapshots

Click the buttons below to access the snapshots for each state.

Thank you to the following state arts agencies for their support in delivering the State Snapshots: Creative Victoria, Create NSW, Arts Queensland, Department of the Premier and Cabinet (Arts SA), Department of Local Government, Sport and Cultural Industries (WA) and ArtsACT.

Cover Image Credit: Cecilia Martin, courtesy of Spaghetti Circus.

Read the ‘Audiences 2023+’ report

In case you missed it, click the button below for the key insights from the August 2023 National Snapshot.

Use the dashboard to get results for your artform and region

Survey data from over 8,800 respondents has been uploaded to the dashboard, which now contains insights from 100,000 Australian participants.

You can use the dashboard to explore the findings by state, artform and audience segment.

It’s freely available to access, just click the image below and use the login details provided on the dashboard page.

About the Audience Outlook Monitor

The Audience Outlook Monitor provides the results of a study that has tracked audience sentiment over the course of the COVID-19 pandemic.

Data was collected in six phases throughout 2020-2022 and is again being tracked in 2023.

Government agencies across Australia are collaborating with research agencies Patternmakers (Sydney) and WolfBrown (USA) to produce this resource. The dashboard is freely accessible and designed to help artists and cultural organisations of all kinds to make the best possible decisions.

How to find out more

To receive new releases directly into your inbox, as soon as they are available, you can opt in to receive Audience Outlook Monitor news below.

Subscribers to our regular Culture Insight & Innovation Updates will need to update their preferences to receive all updates about the Audience Outlook Monitor. Just enter your email below and follow the instructions provided.

If you have a question, or an idea for using this data, please contact Patternmakers at info@thepatternmakers.com.au

About the Author

Peta Petrakis

Research Analyst

Delivery partners:

Supporting partners:

Past posts on this blog

Archive

- 2023 21

- Dance 3

- Research 99

- Audience development 79

- Arts 73

- COVID-19 70

- Culture 72

- Data culture 69

- Evaluation 75

- Innovation 78

- Thought leadership 16

- About Patternmakers 35

- Privacy 6

- Project updates 25

- Culture Panel 1

- Resources 6

- Toolkit 5

- Beyond the Bio 8

- 2022 23

- Career Advice 9

- Opportunities 4

- Tips & Tricks 13

- 2021 7

- 2024 1

- First Nations 3

- Indigenous 2

- Strategic Planning 5

- Trends 3

- Performing Arts 5

- Manifesto 1

- Education 2

- Capacity building 3

- Digital art 4

- Interviews 3

- Coronavirus 2

- 2020 3

- Tandi Palmer Williams 7

- Theory of Creativity Podcast 1

- 2019 11

- Top 5 2

- 2018 12

- Case Studies 2

- Our services 4

- Postcode Analysis 1

- Accessibility 4

- Touring 3

- Publications 1

- 2017 8

- Data art 2

- 2016 5

The top trends shaping Australian audiences in 2023 and beyond

August 2023 results from the Audience Outlook Monitor are now available. Explore 7 topics around current audience behaviour, presenting the datapoints you need for strategic planning, forecasting attendances, remodelling subscriptions and targeted marketing in 2023 and beyond.

Read about the findings and download the National Snapshot report.

1. Attendance trajectories

Attendance rates across the country continue their slow recovery since the pandemic, and with a challenging year ahead, it’s wise to set sights on the right targets.

-

In 2023, attendance is reaching its highest point since 2020, and the frequency of attendance is increasing, but the recovery process continues.

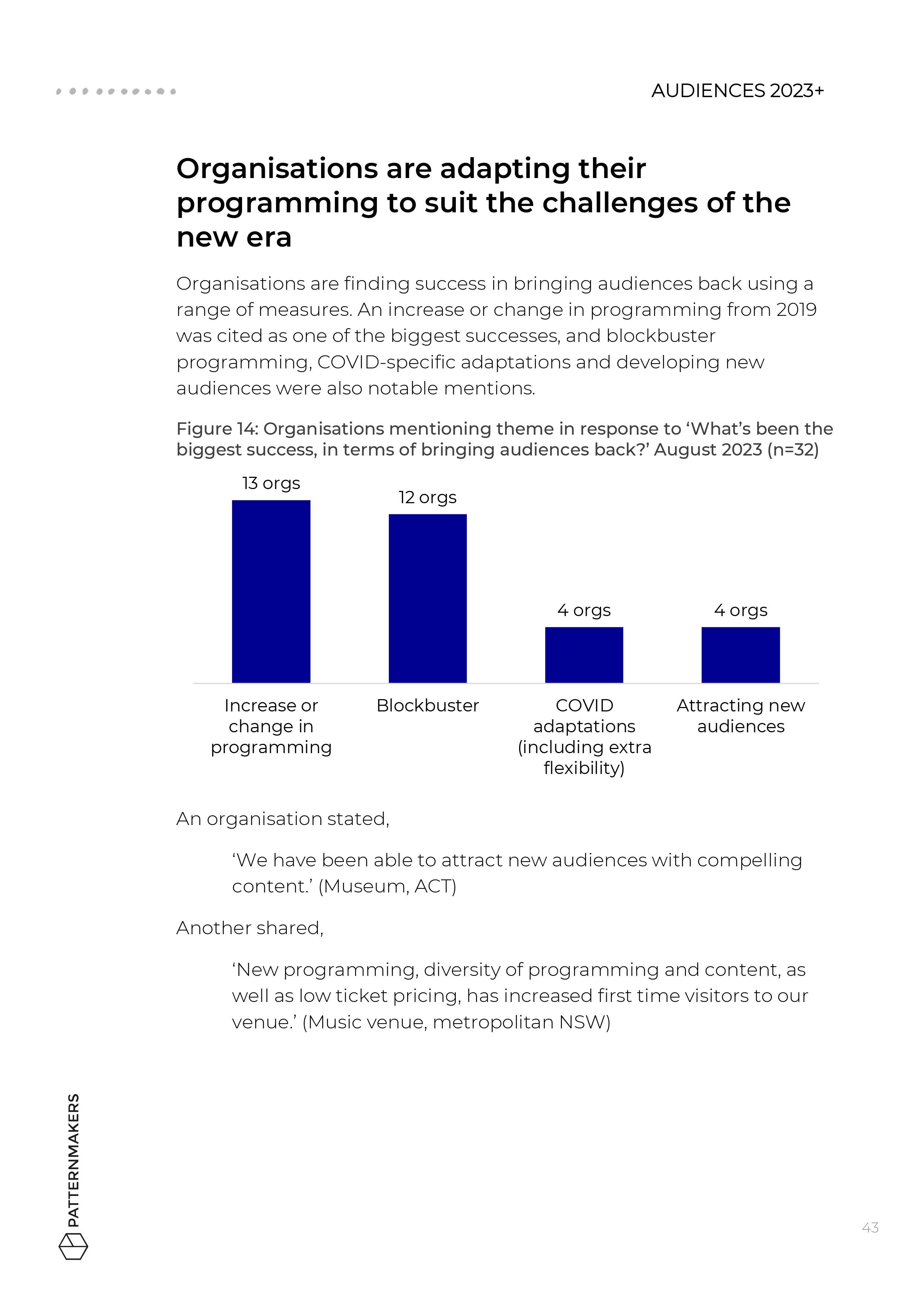

Strategic investment and programming shifts have helped many organisations sustain or increase their capacity in 2022 and 2023, but charting recovery is complex, with mixed attendance results across the market.

Big jumps in attendance appear unlikely in the next 12 months, with 2 in 3 audience members expecting their attendance levels will stay the same amid a challenging economic outlook.

Making space to review measures of success and share learnings – internally and externally – may help organisations focus on the right challenges over the coming year.

Click the buttons below to download the August 2023 Snapshot Report, as a PDF, accessible Word version or RTF, or read on for more of the findings.

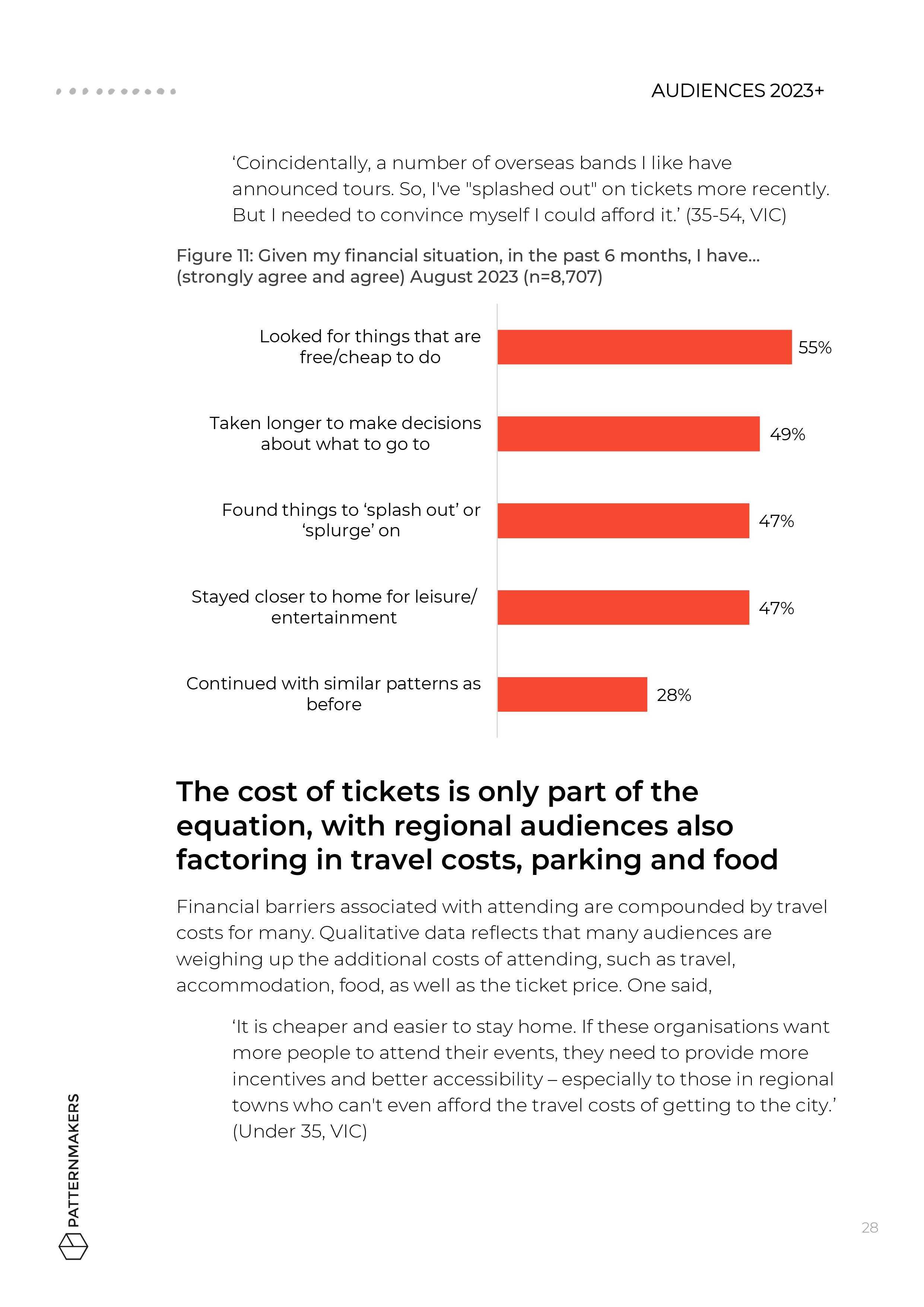

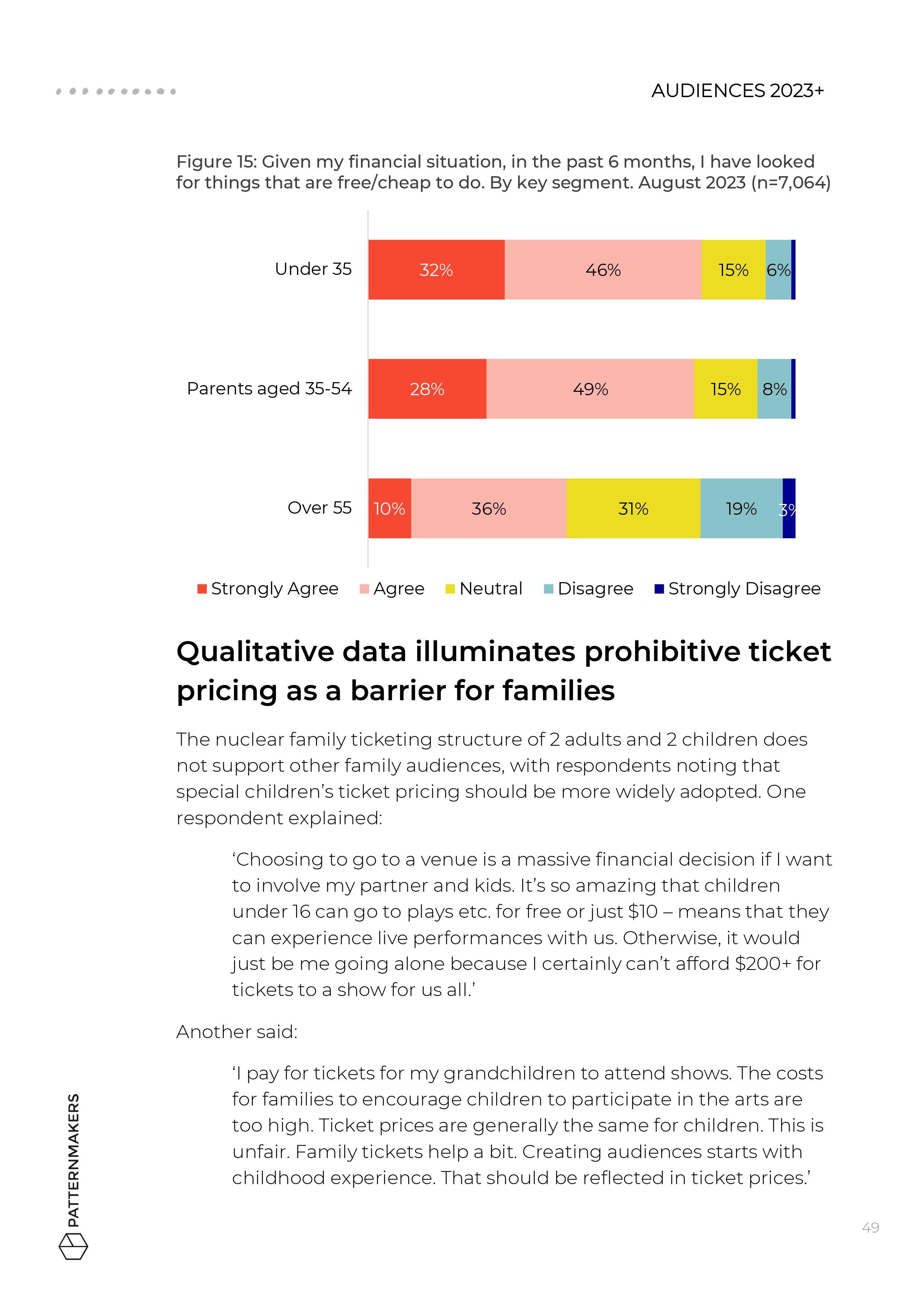

2. Inflationary pressures and pricing

Economic conditions are limiting what Australian audiences can spend on events, and some segments need targeted thinking to ensure access to arts and culture.

-

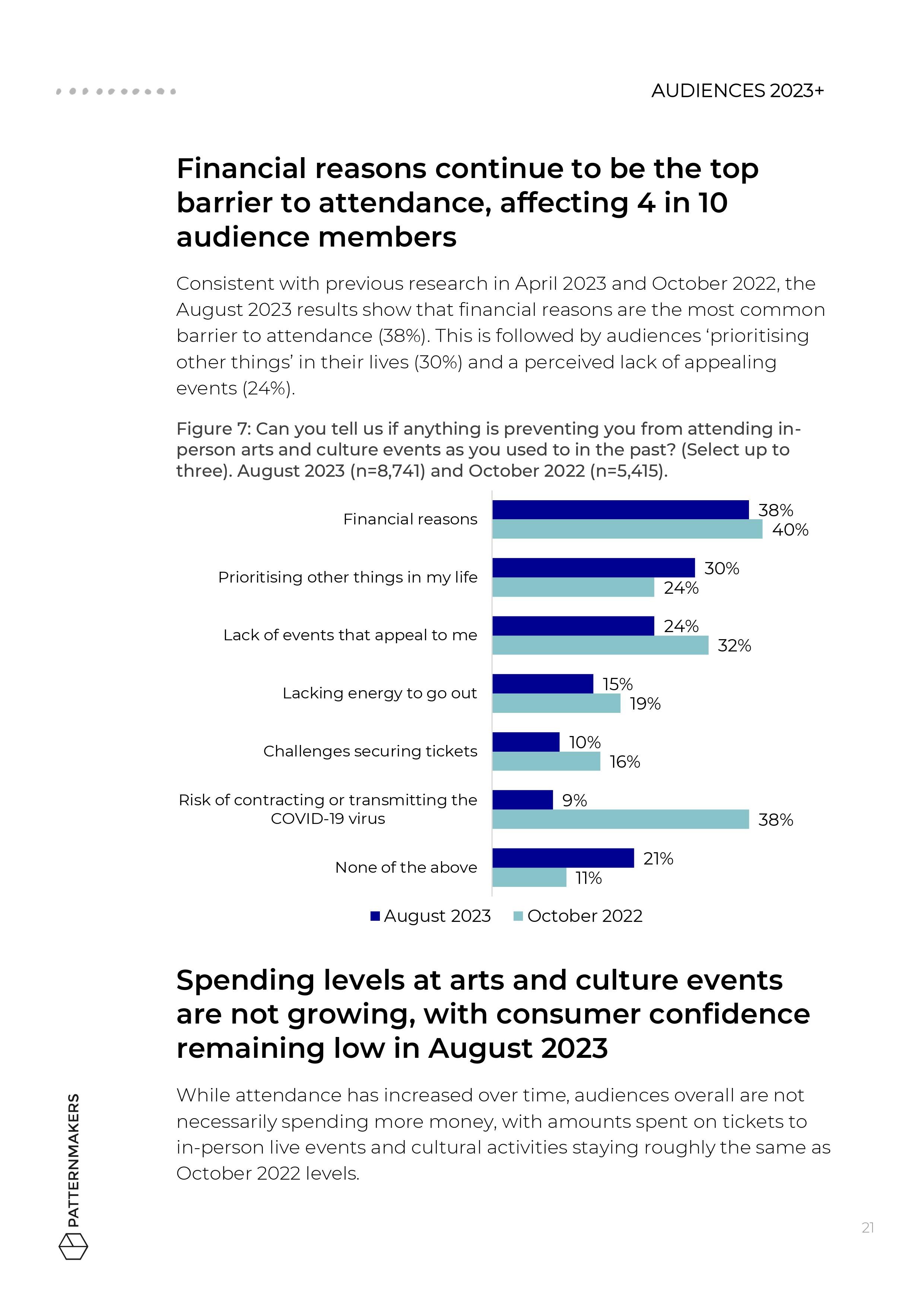

Financial reasons are the top barrier to attendance, and inflationary pressures are expected to continue in 2023 and 2024.

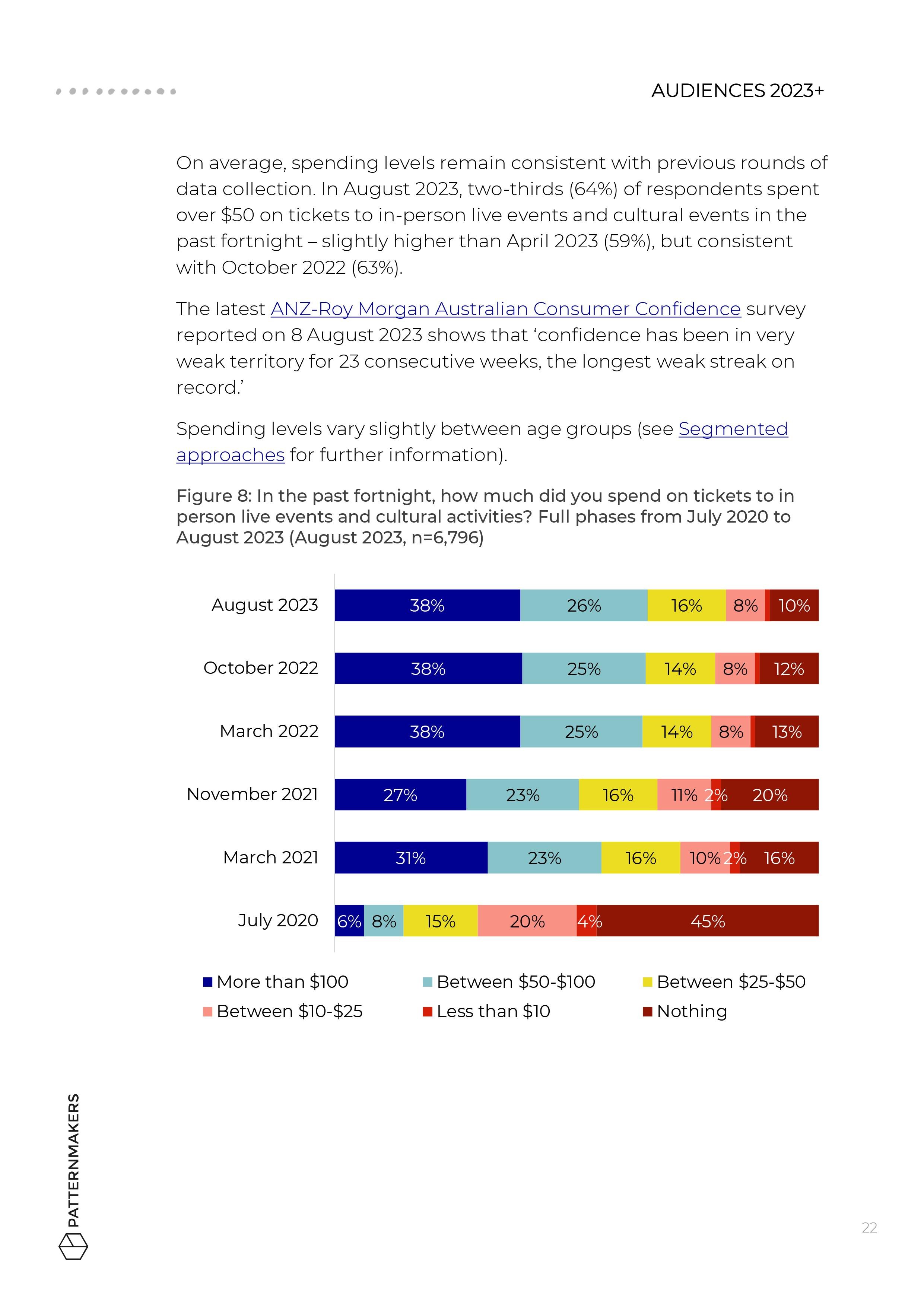

Spending levels at arts and culture events are not growing, as audiences weigh up value for money and take longer to make decisions.

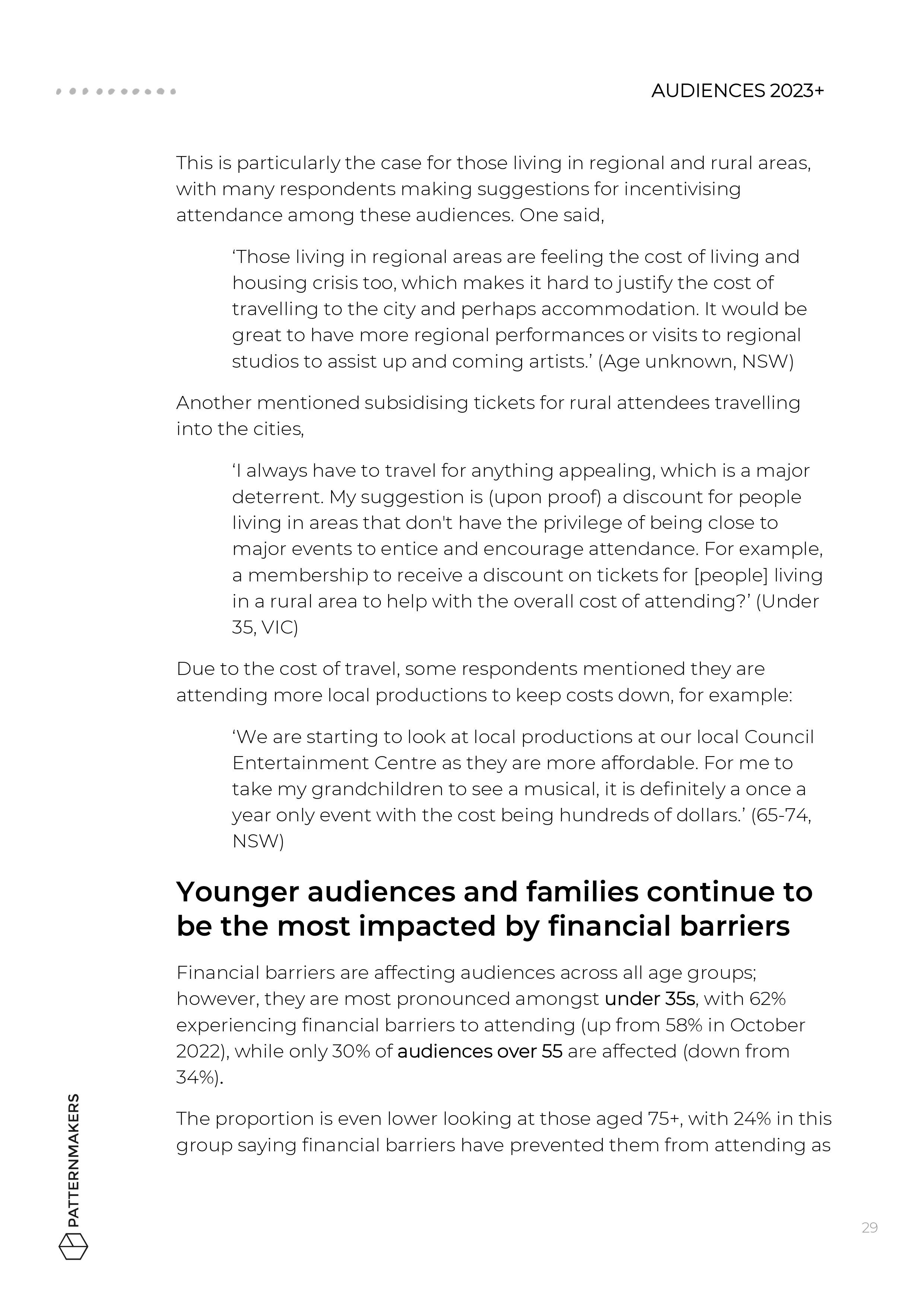

Younger audiences and families continue to be the most impacted.

A key opportunity is developing sustainable strategies for targeting disadvantaged segments.

3. The desire to inspire

In the wake of the pandemic, audiences are in the mood for uplifting experiences — requiring event organisers to think strategically about creating meaning and building trust in difficult times.

-

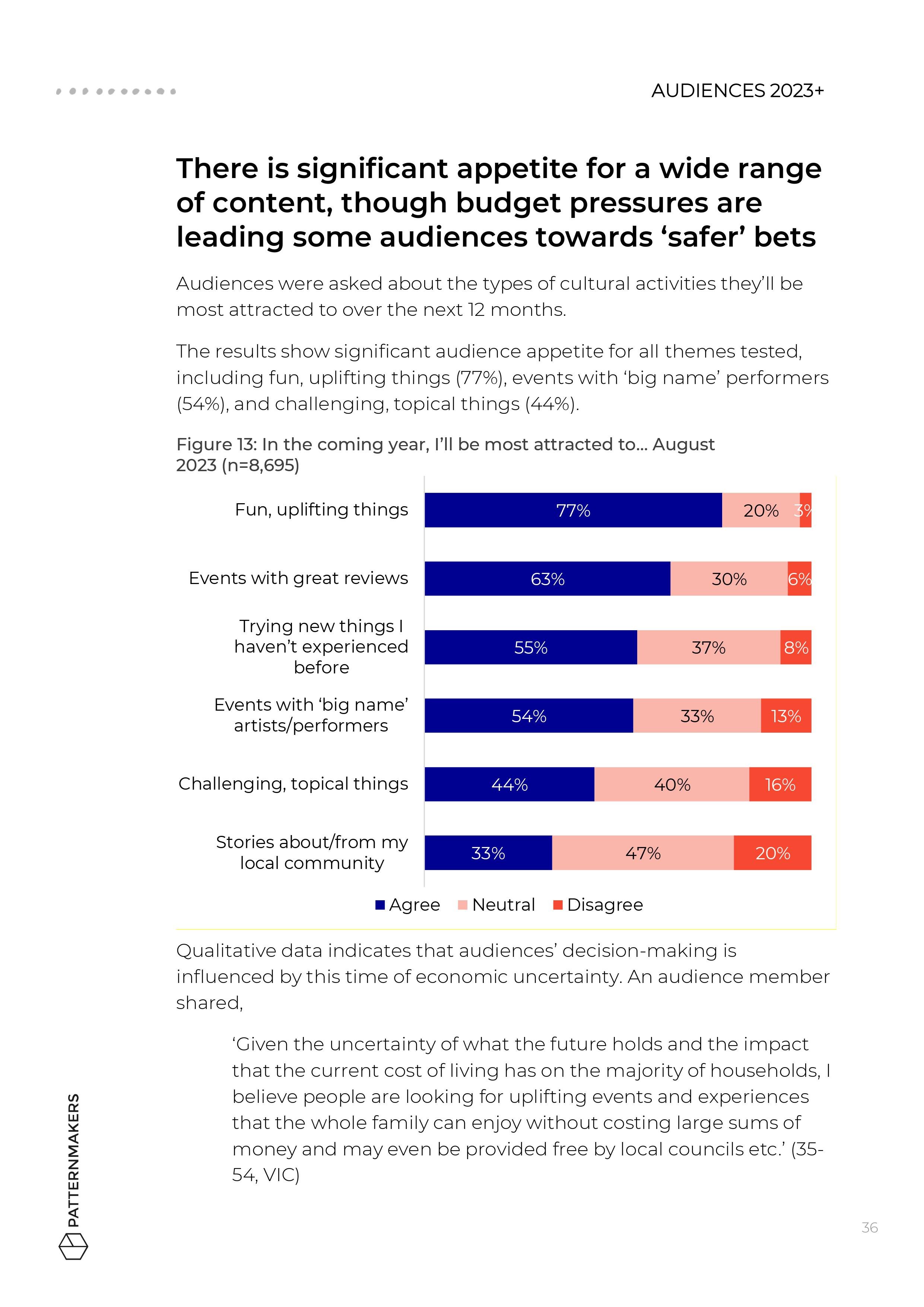

Australian audiences are showing significant appetite for a wide range of content, though budget pressures are leading some audiences towards ‘safer’ bets or ‘guaranteed fun’.

Social, uplifting experiences and events with great reviews will continue to reach the widest audience in the coming year.

Many audiences are hungry for meaning, but care and tact may be needed to when approaching challenging topics.

Organisations that understand the mood can please crowds today while building trust for tomorrow.

“The arts are so important to keeping my spirits up and my mental health well.

It’s really challenging when you can’t afford to go to an event every now and again that you know will keep you well.”

4. Three segments to know

Younger audiences, families and older audiences are thinking and behaving very differently in 2023, and organisations must build capacity for new ways of working.

-

Social and economic pressures impact different generations in different ways, and this is reflected in three key audience segments.

Young people, families and older audiences show stark differences in mood, entertainment priorities, spending patterns and media consumption.

Organisations must consider how to create and execute strategies for different segments and build in flexibility to adapt as conditions evolve.

For easy viewing, click below to download the summary of all three key segments.

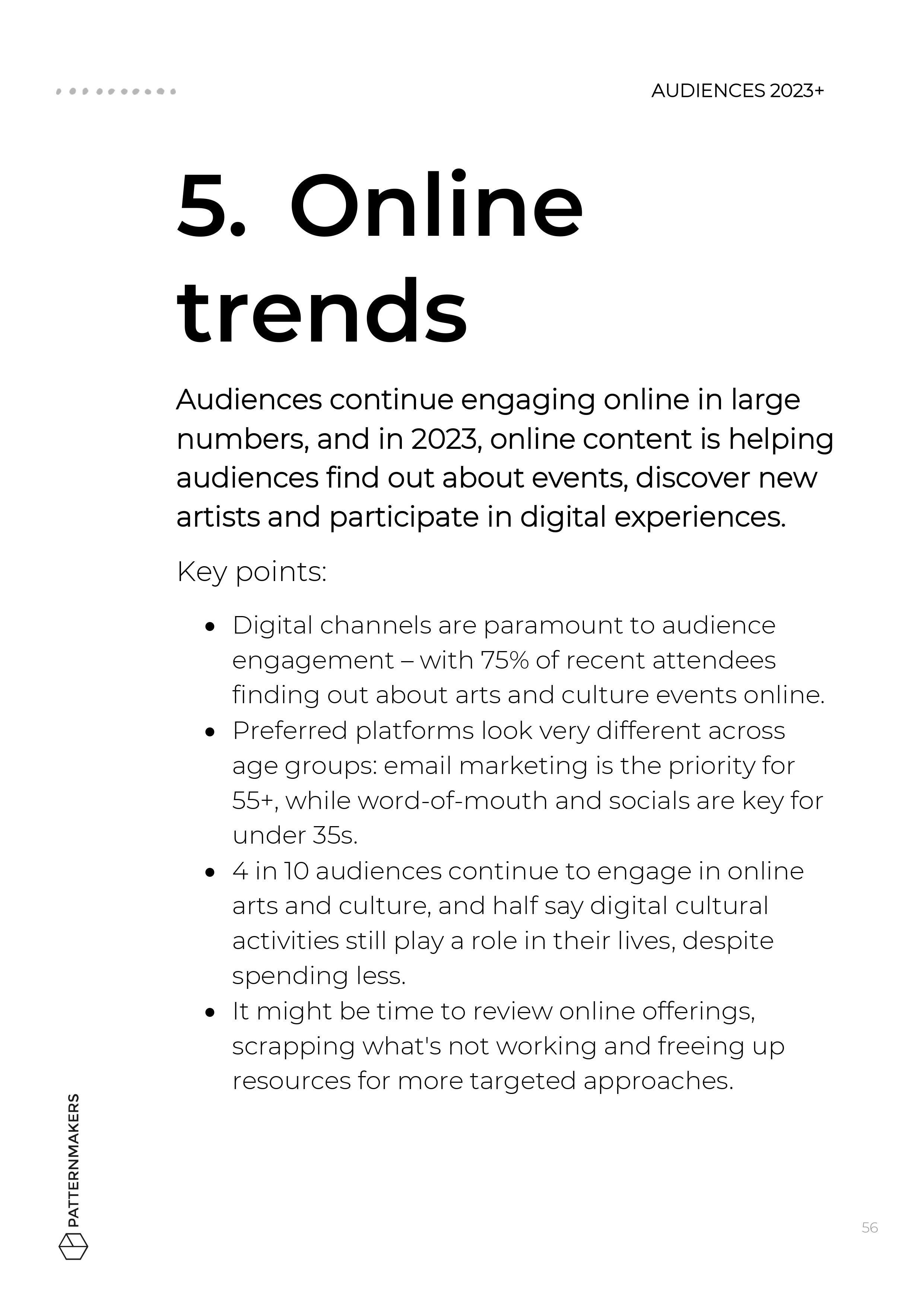

5. Online trends

Audiences continue engaging online in large numbers, and in 2023, online content is helping audiences find out about events, discover new artists and participate in digital experiences.

-

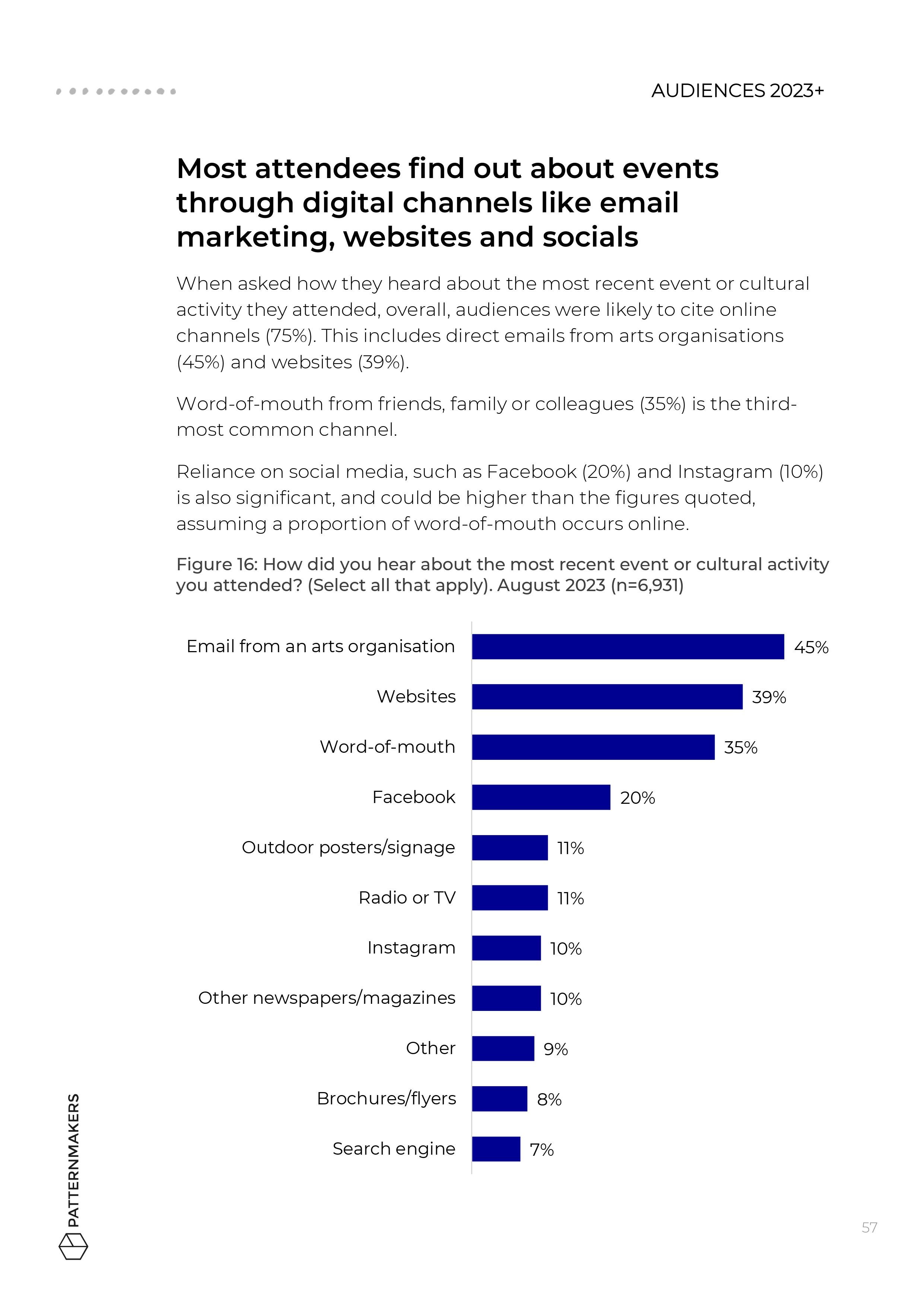

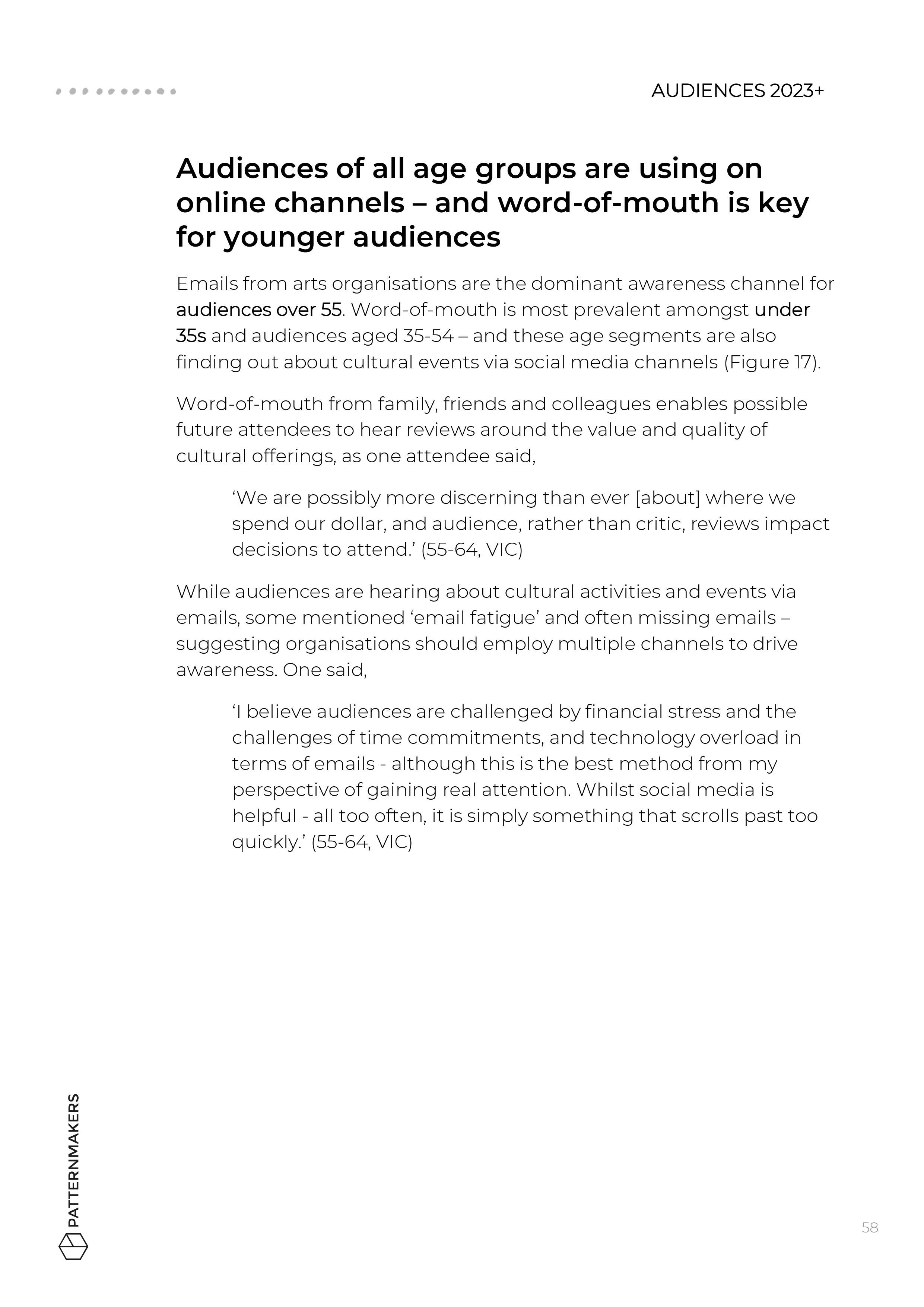

Digital channels are paramount to audience engagement – with 75% of recent attendees finding out about arts and culture events online.

Preferred platforms look very different across age groups: email marketing is the priority for 55+, while word-of-mouth and socials are key for under 35s.

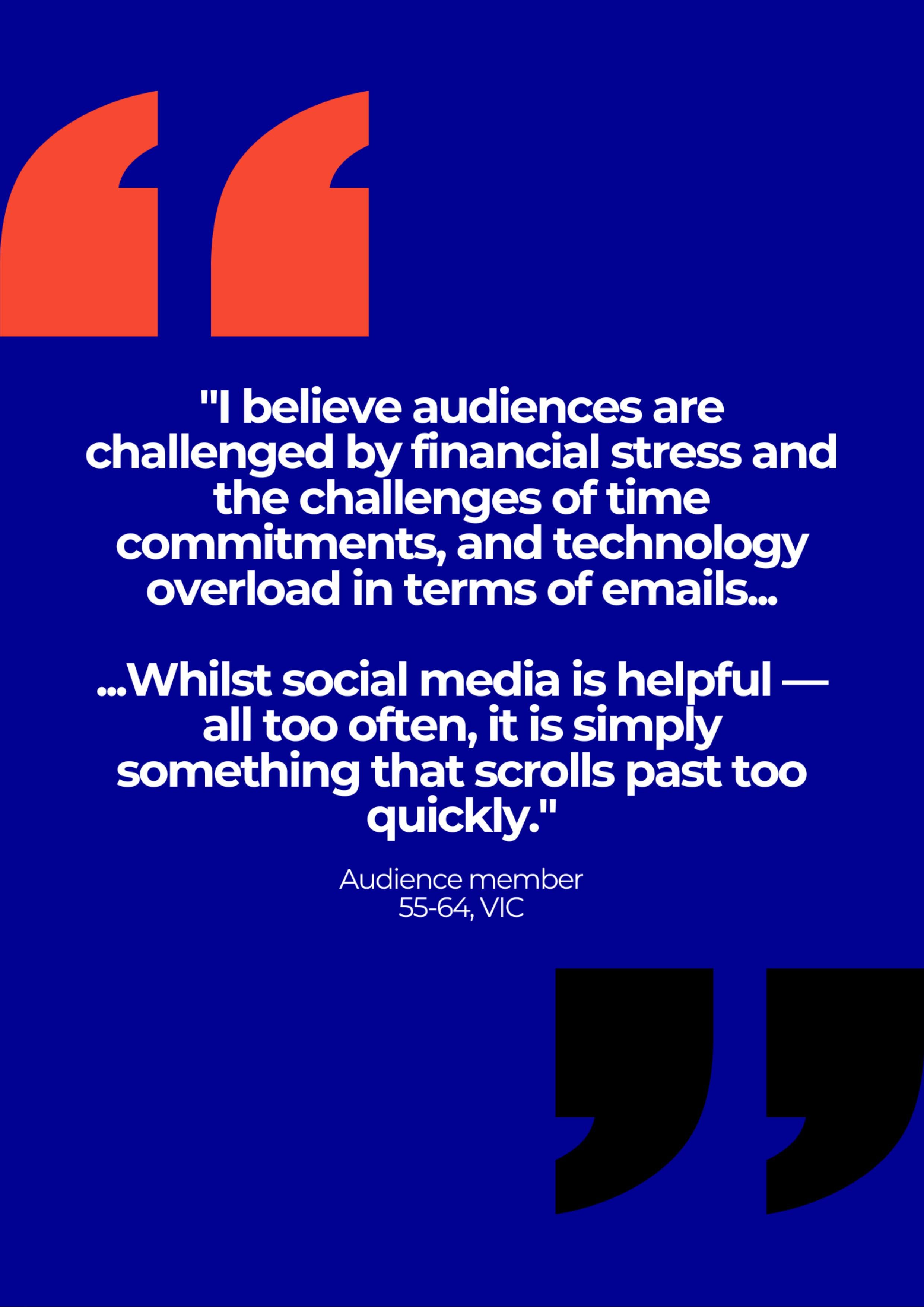

4 in 10 audiences continue to engage in online arts and culture, and half say digital cultural activities still play a role in their lives, despite spending less.

It might be time to review online offerings, scrapping what's not working and freeing up resources for more targeted approaches.

“Australian arts audiences are intelligent and open to be challenged...

...This is essential for the future health and development of arts in this country.”

6. Late decision-making

In 2023, last-minute decision making persists, with audiences facing more choices, and busier lives, as commuting, travel and social events pick up. Organisations need to prepare for new phases in campaigns, to reach people at the right time.

-

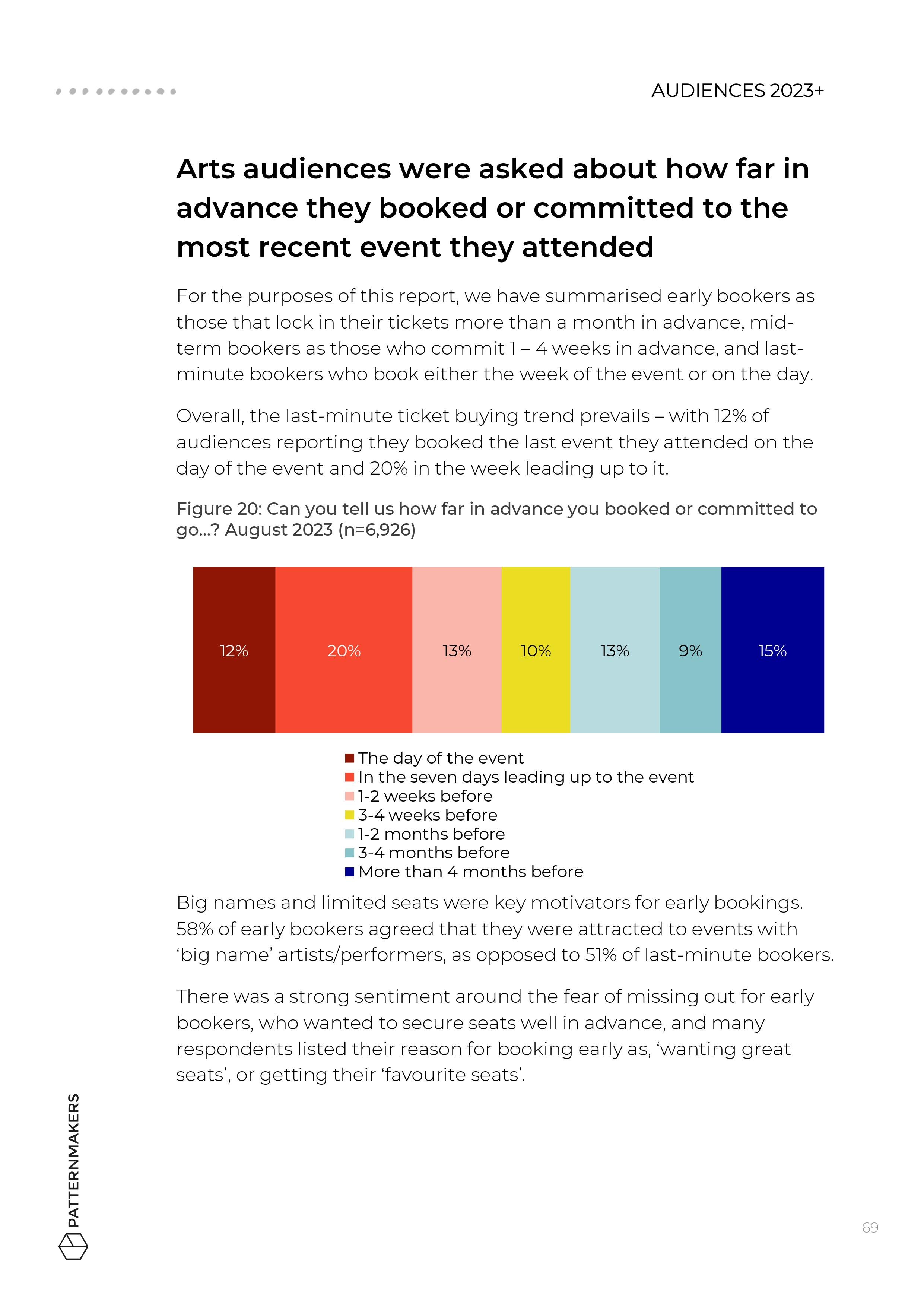

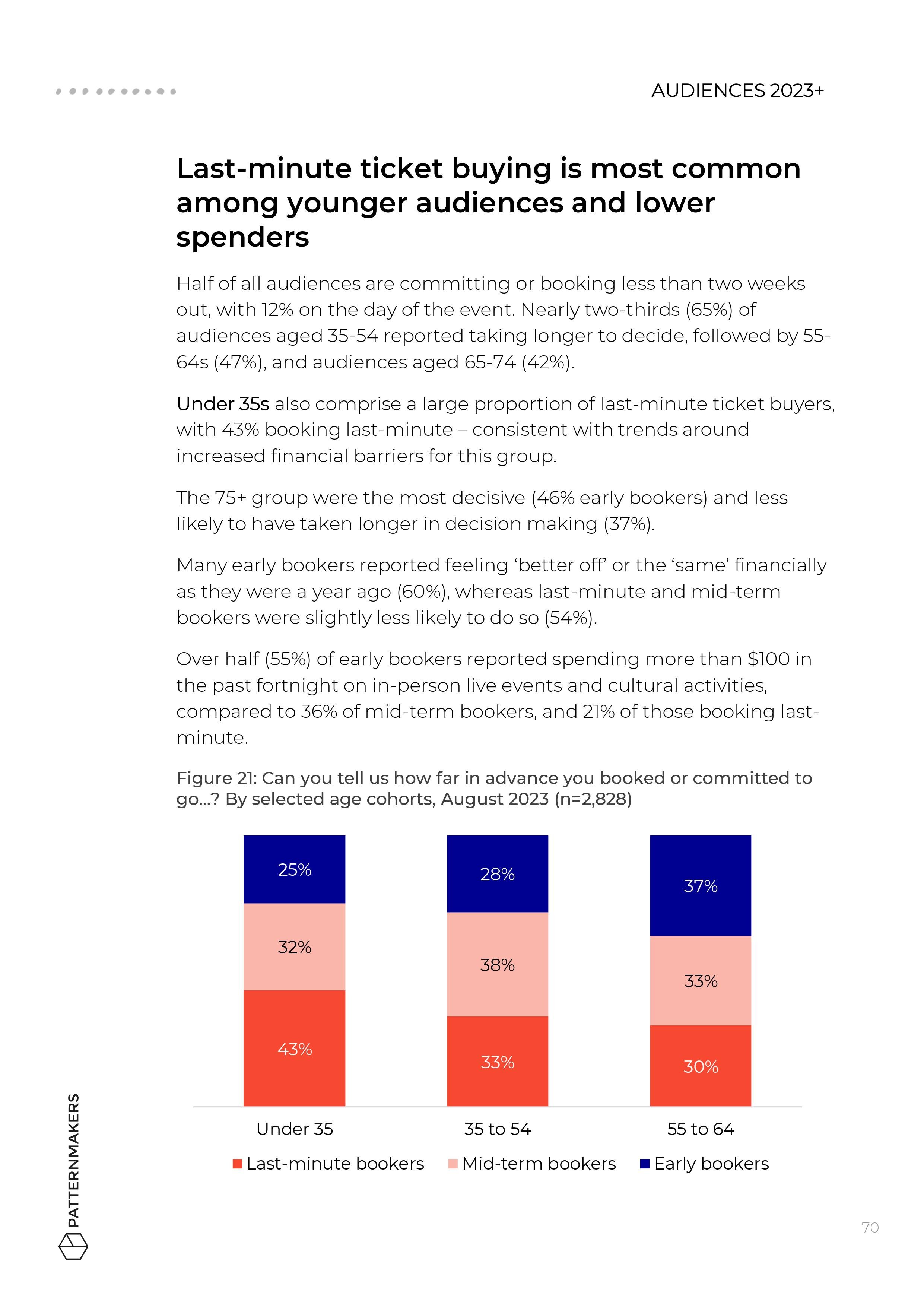

Half are booking less than two weeks out, with 12% on the day of the event

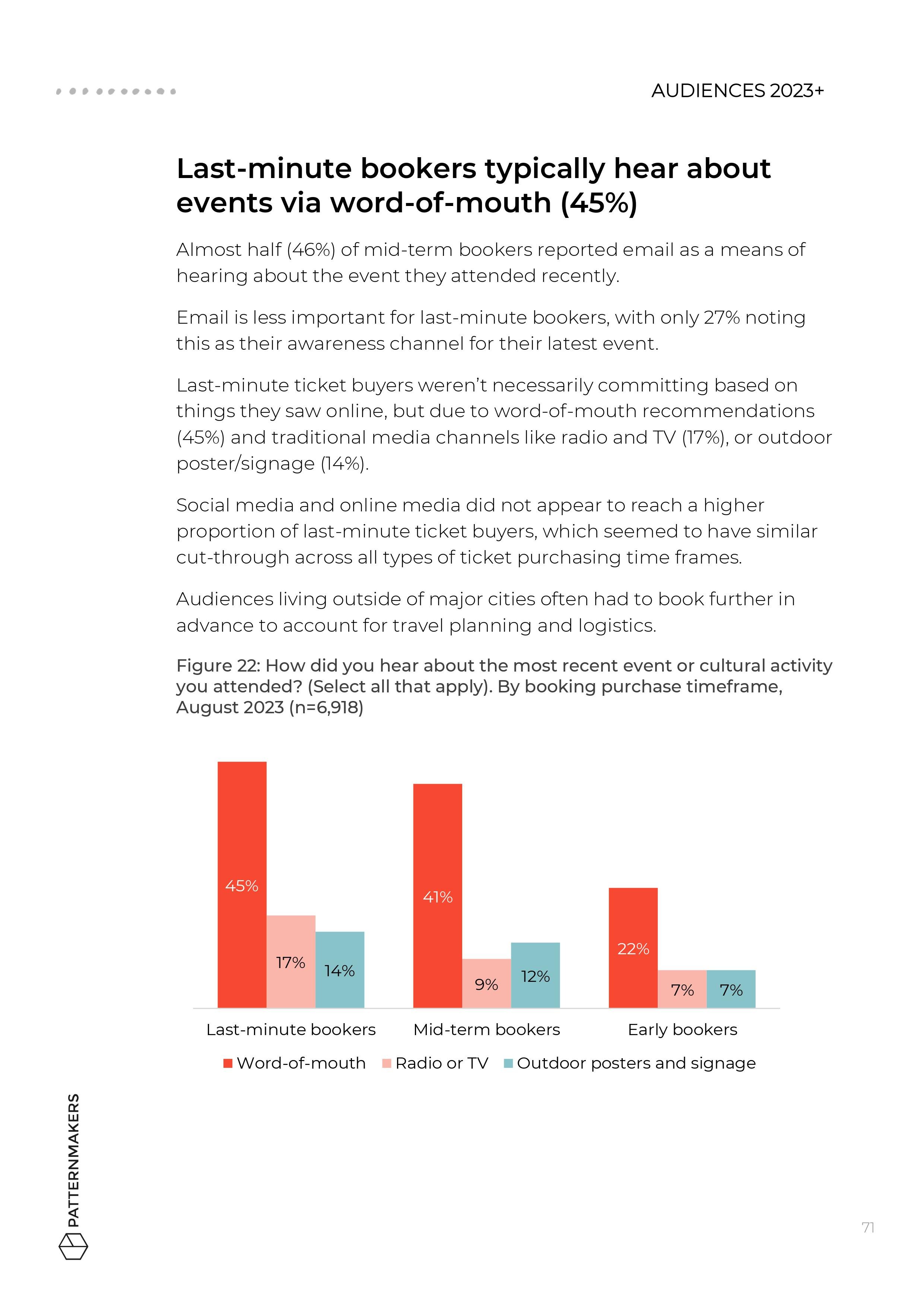

Analysis of ‘early bookers’, ‘mid-term bookers’ and ‘last-minute bookers’ shows that last-minute ticket buying is most common among younger audiences and lower spenders. Those booking later are also more likely to rely on word-of- mouth.

Ticketing initiatives to support more price sensitive audiences are important, but last- minute discounting may not be the answer.

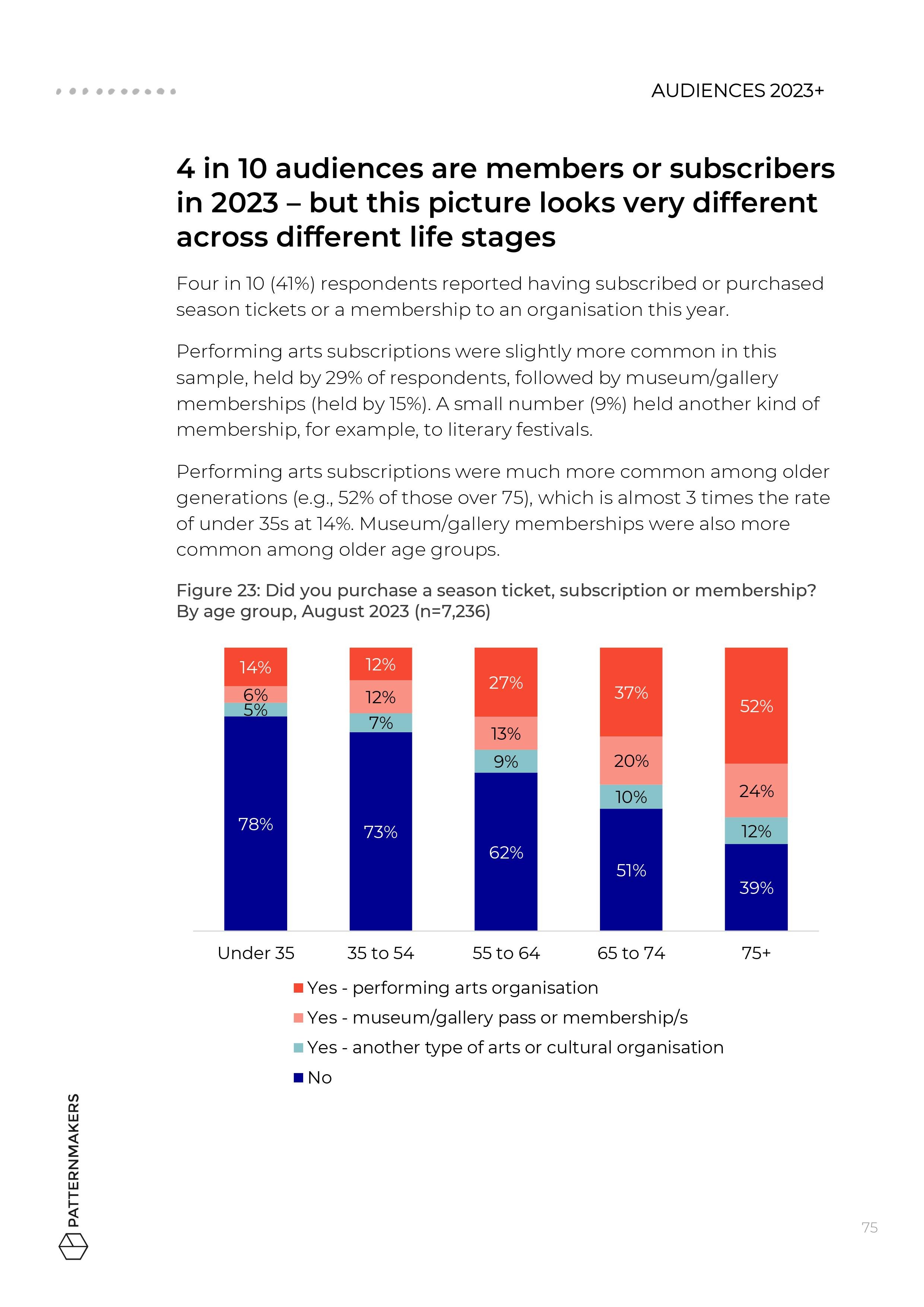

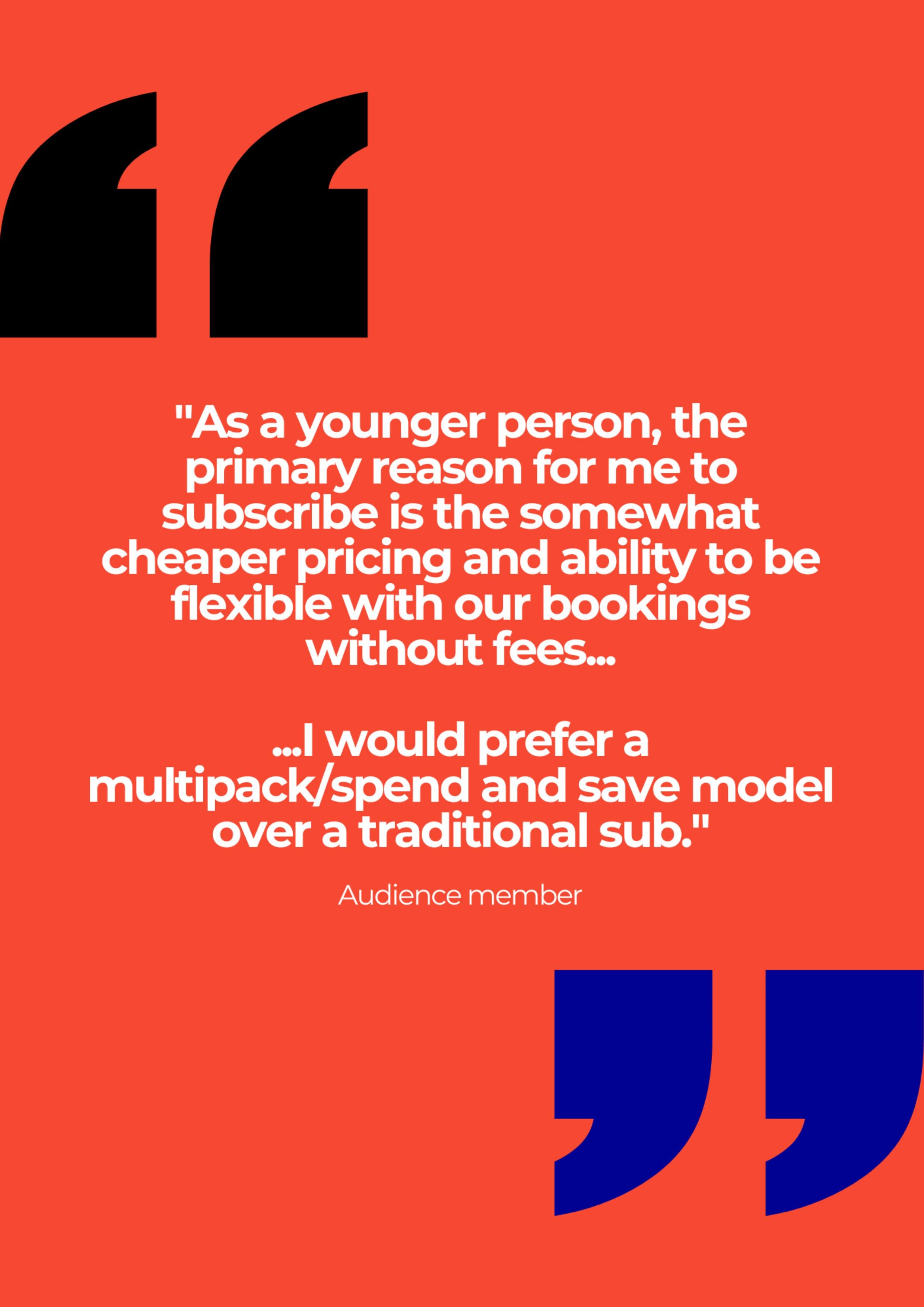

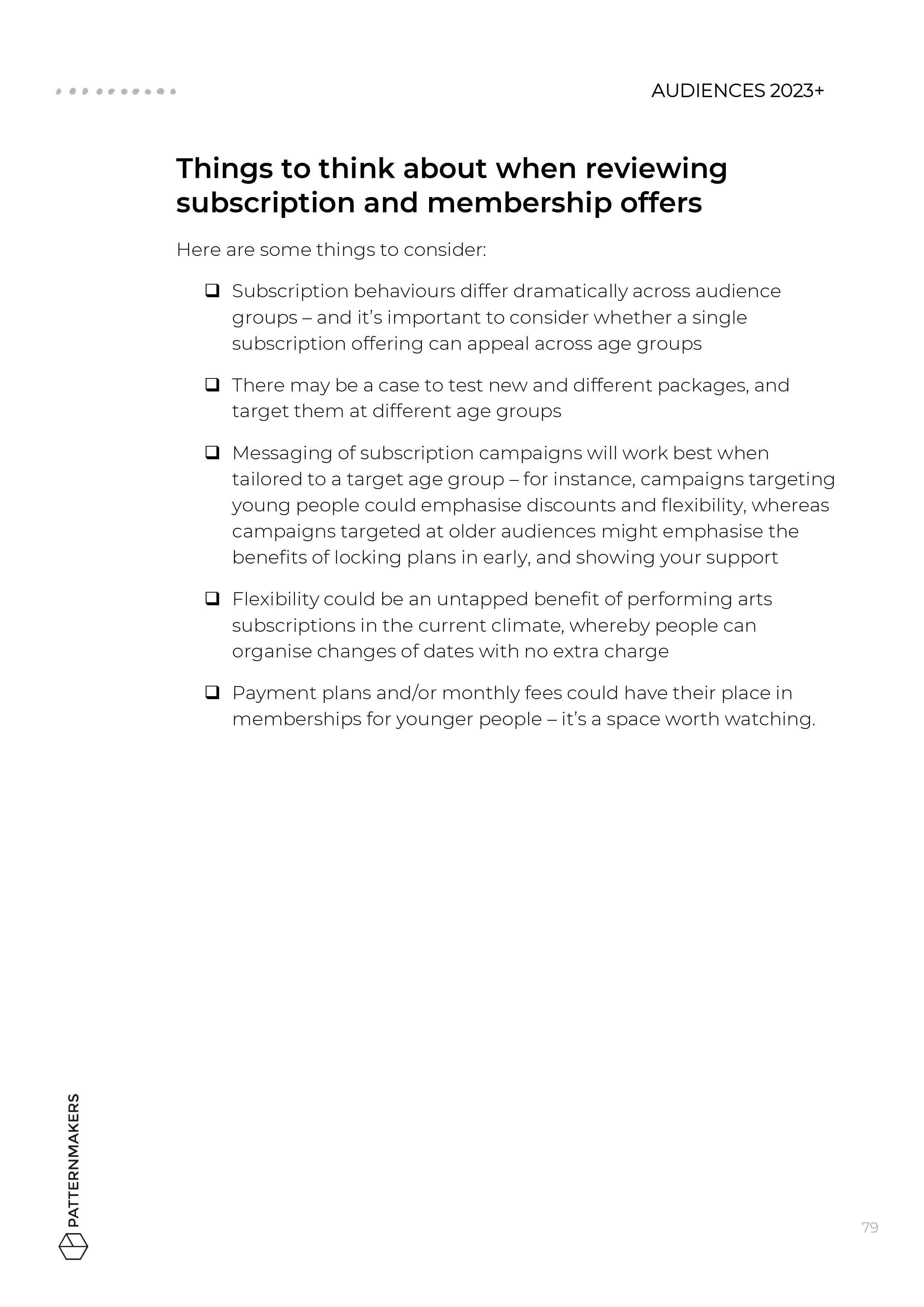

7. Subscriptions and memberships

Subscribers and members are vital for many arts organisations, but their needs vary dramatically across age groups, and organisations are adjusting their packages to suit new needs.

-

4 in 10 audiences are members or subscribers– with performing arts subscriptions more common than other types.

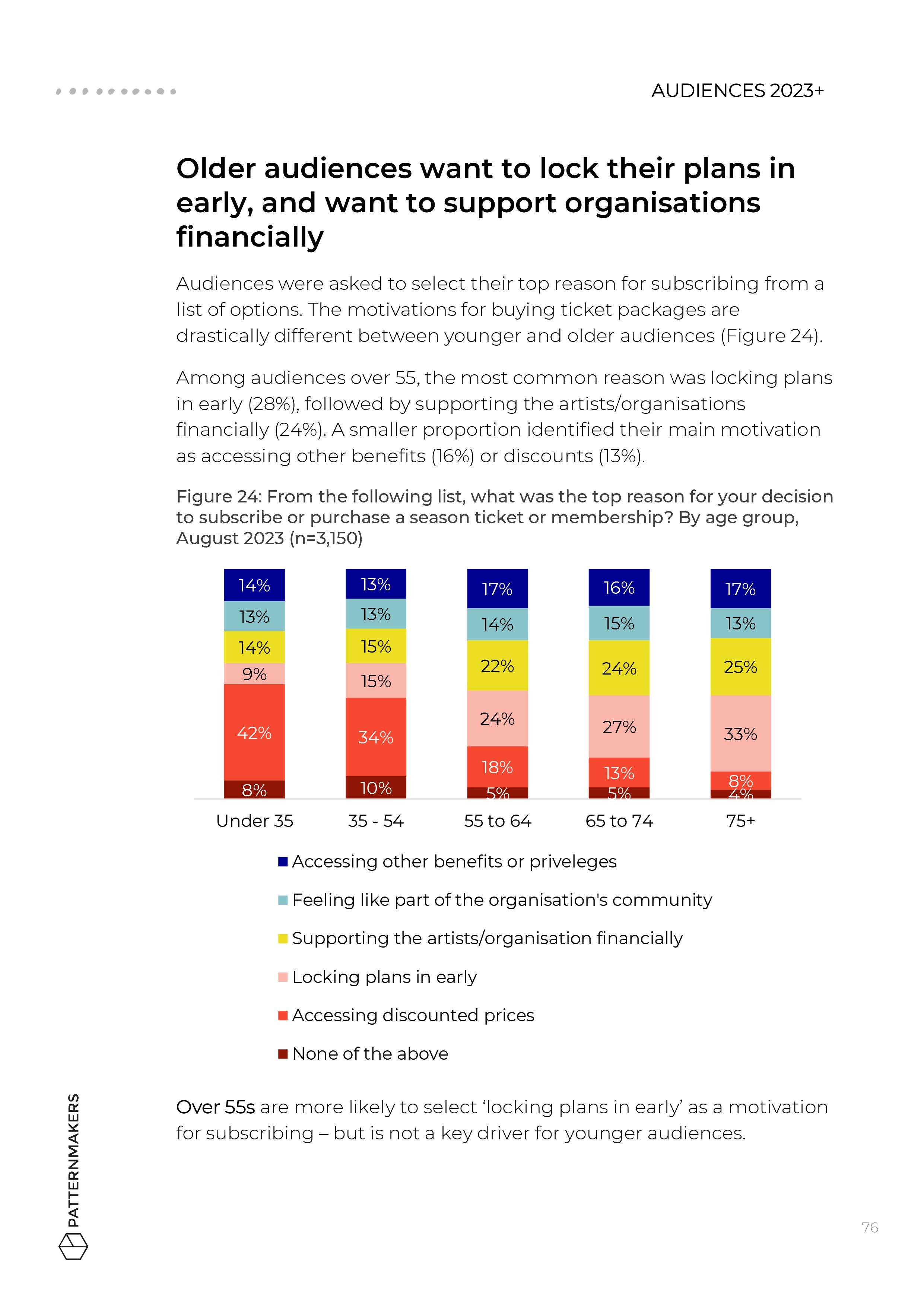

Subscriptions uptake and motivations are very different across audiences in different stages of life.

Older audiences want to lock their plans in early and show financial support, while younger audiences are more likely to want access to discounted tickets.

There is a case to test different offers and models, using messaging to target the unique needs of different audience segments.

Cover Image Credit: Jacquie Manning, courtesy of Sydney Writers Festival.

Watch us launch the findings at APAX 2023

Our Managing Director, Tandi Palmer Williams, and Research Analyst, Peta Petrakis, travelled to Cairns to present the data from Audiences 2023+ at APAX 2023, PAC Australia’s annual conference.

Click the image below to watch the recording of the livestream. Simply register to make a free account and press play!

Use the dashboard to get results for your artform and region

Survey data from over 8,800 respondents has been uploaded to the dashboard, which now contains insights from over 100,000 Australian participants.

You can use the dashboard to explore the findings by state/territory, artform and audience segment.

It’s freely available to access, just click the image below and use the login details provided on the dashboard page.

About the Audience Outlook Monitor

The Audience Outlook Monitor provides the results of a study that has tracked audience sentiment over the course of the COVID-19 pandemic.

Data was collected in six phases throughout 2020-2022 and is again being tracked in 2023.

Government agencies across Australia are collaborating with research agencies Patternmakers (Sydney) and WolfBrown (USA) to produce this resource. The dashboard is freely accessible and designed to help artists and cultural organisations of all kinds to make the best possible decisions.

How to find out more

To receive new releases directly into your inbox, as soon as they are available, you can opt in to receive Audience Outlook Monitor news below.

Subscribers to our regular Culture Insight & Innovation Updates will need to update their preferences to receive all updates about the Audience Outlook Monitor. Just enter your email below and follow the instructions provided.

If you have a question, or an idea for using this data, please contact Patternmakers at info@thepatternmakers.com.au

Delivery partners

Supporting partners

Past posts on this blog

Archive

- 2023 21

- Dance 3

- Research 99

- Audience development 79

- Arts 73

- COVID-19 70

- Culture 72

- Data culture 69

- Evaluation 75

- Innovation 78

- Thought leadership 16

- About Patternmakers 35

- Privacy 6

- Project updates 25

- Culture Panel 1

- Resources 6

- Toolkit 5

- Beyond the Bio 8

- 2022 23

- Career Advice 9

- Opportunities 4

- Tips & Tricks 13

- 2021 7

- 2024 1

- First Nations 3

- Indigenous 2

- Strategic Planning 5

- Trends 3

- Performing Arts 5

- Manifesto 1

- Education 2

- Capacity building 3

- Digital art 4

- Interviews 3

- Coronavirus 2

- 2020 3

- Tandi Palmer Williams 7

- Theory of Creativity Podcast 1

- 2019 11

- Top 5 2

- 2018 12

- Case Studies 2

- Our services 4

- Postcode Analysis 1

- Accessibility 4

- Touring 3

- Publications 1

- 2017 8

- Data art 2

- 2016 5

Use the dashboard

Data is available to explore in a dynamic dashboard, which can be filtered by artform and region.

The dashboard is publicly available, click more to find out how to login.

Use the dashboard to see how audiences feel about attending events in your artform and region

Survey data from over 100,000 Australian respondents has been aggregated in a freely available dashboard, to assist artists and cultural organisations of all kinds to understand how audiences feel about attending events again. You can access the dashboard at anytime - click the button below to get started in the dashboard.

Enter the following login details:

User: access@AOM.com.au

Password: Australia

Watch the tour

In the video below, you’ll hear about the data that’s available in the dashboard, how to navigate it and how to apply filters to see the results most relevant to you.

Download the guide

You can also download a short written guide for using the dashboard.

More about the data

Each Phase, data is collected in a cross-sector collaborative survey process involving 130 arts and culture organisations, including museums, galleries, performing arts organisations and festivals.

These organisations simultaneously send a survey to a random sample of audience members who had attended a cultural event since January 2018. Read more about the methodology and the types of events that are included.

By aggregating the data from over 120 participating organisations, this study provides a detailed resource with insights about all different artforms, types of events and demographic groups in all parts of Australia. No individual respondents or organisations are identified.

Join the conversation

Share your insights and reflections on social media using the hashtag #audienceoutlookmonitor

For questions, contact the researchers directly at info@thepatternmakers.com.au

Subscribe for updates

Periodically we publish new factsheets and snapshot reports. To hear of future announcements about the study, subscribe by entering your email address below.

About the Author

Tandi Palmer Williams

Managing Director

Tandi is Founder and Managing Director of Patternmakers. She’s an arts research specialist and leader of the agency’s research projects.

Delivery partners

Supporting partners

Past posts on this blog

Archive

- 2023 21

- Dance 3

- Research 99

- Audience development 79

- Arts 73

- COVID-19 70

- Culture 72

- Data culture 69

- Evaluation 75

- Innovation 78

- Thought leadership 16

- About Patternmakers 35

- Privacy 6

- Project updates 25

- Culture Panel 1

- Resources 6

- Toolkit 5

- Beyond the Bio 8

- 2022 23

- Career Advice 9

- Opportunities 4

- Tips & Tricks 13

- 2021 7

- 2024 1

- First Nations 3

- Indigenous 2

- Strategic Planning 5

- Trends 3

- Performing Arts 5

- Manifesto 1

- Education 2

- Capacity building 3

- Digital art 4

- Interviews 3

- Coronavirus 2

- 2020 3

- Tandi Palmer Williams 7

- Theory of Creativity Podcast 1

- 2019 11

- Top 5 2

- 2018 12

- Case Studies 2

- Our services 4

- Postcode Analysis 1

- Accessibility 4

- Touring 3

- Publications 1

- 2017 8

- Data art 2

- 2016 5

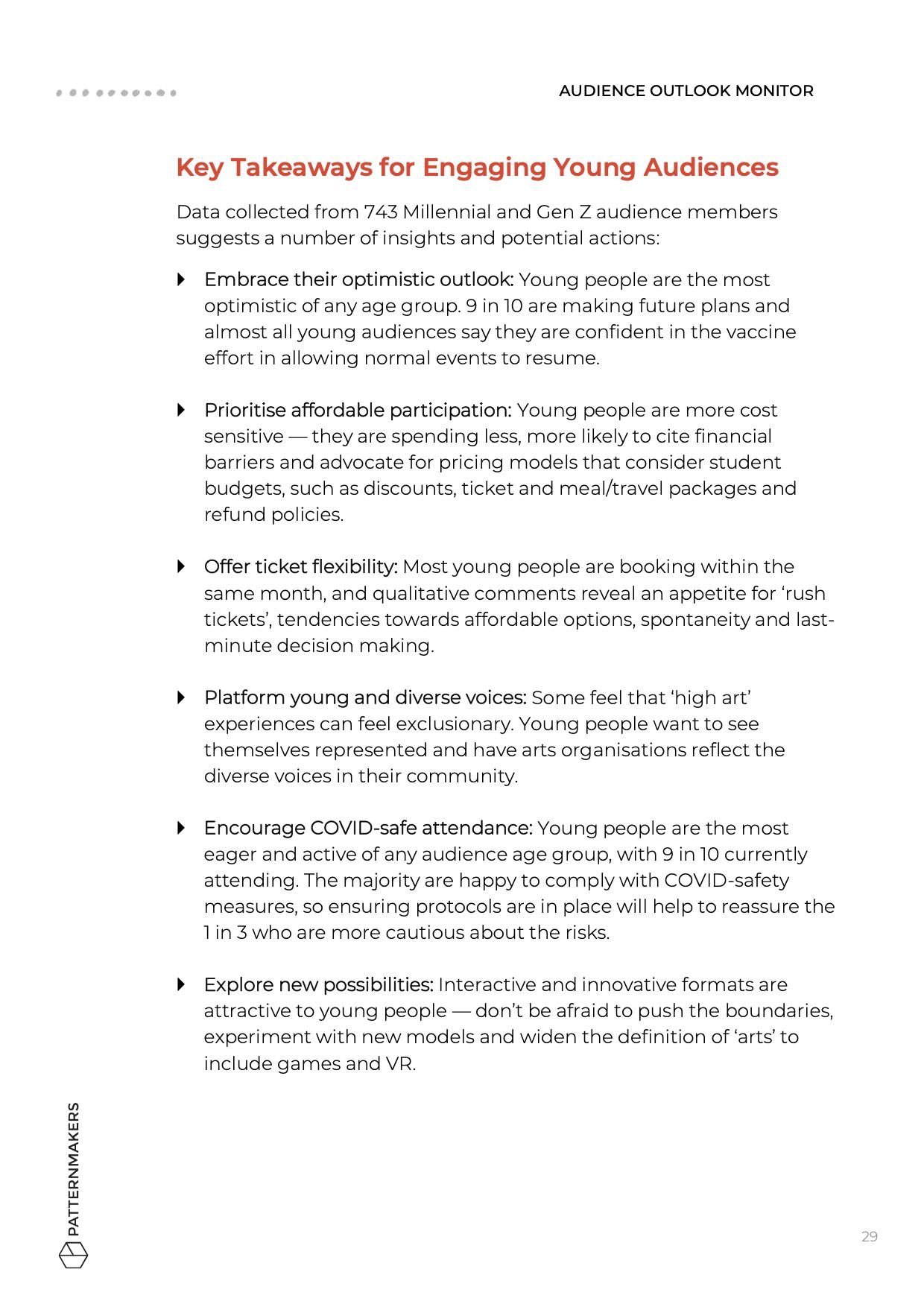

The 3 audience segments you need to know about in 2023 (and how to reach them!)

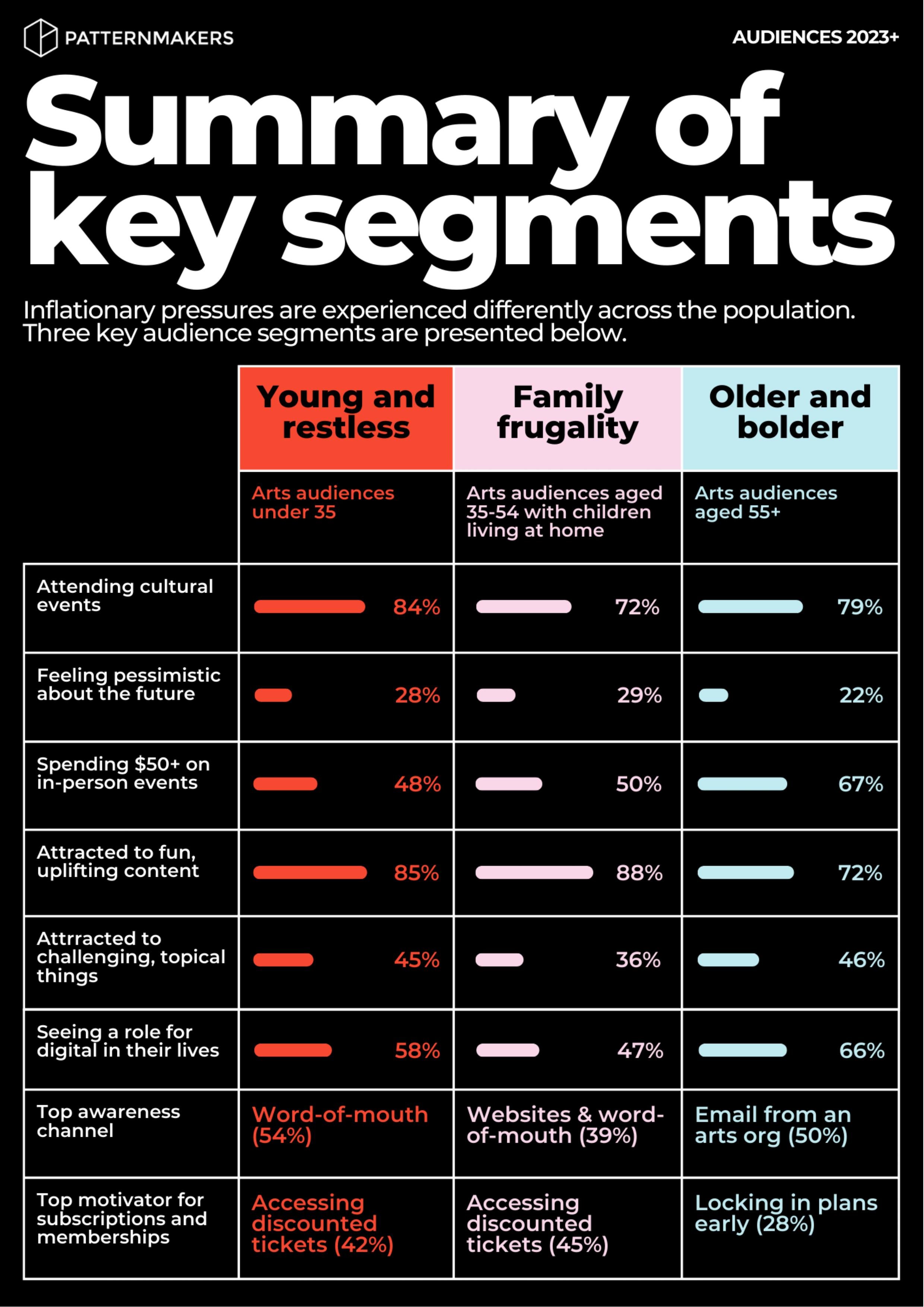

Inflationary pressures are impacting three key audience segments, Older and Bolder, Family Frugality, and Young and Restless, in different ways. Read for the insights on each, and suggestions on targeted marketing strategies to ensure no one gets left behind.

In 2023, inflationary pressures are impacting audiences in different ways, with some continuing to spend and attend and others making careful choices.

The data from our latest Pulse Check revealed that audiences are behaving differently right now in response to the current economic climate. More than ever before, this requires targeted strategies for programming, ticketing and marketing.

Read on for the key facts about three key audience segments: Older and Bolder, Family Frugality, and Young and Restless, and suggestions on what to do to ensure no one gets left behind.

Older and Bolder

Arts audiences aged 55+

After several years shaped by the virus and mask-wearing, older audiences are now enjoying higher attendance levels and spending.

As the most likely audiences to experience no barriers to attending right now, this group is open to a range of experiences and are the most likely to seek out challenging, topical works in the next 12 months.

They are spending at higher levels than they were 6 months ago. 40% spent more than $100, compared to 37% in August 2022.

8 in 10 attended a cultural event in the past fortnight, the highest rate seen in the study since it began in March 2020.

Although most see the country’s economic outlook as uncertain, they also generally believe their financial situation will be stable in the year ahead.

Email is the top way they find out about events, so consider ways to continually improve your databases and eDMs.

One such audience member told us what they’ve been attending and why, saying:

“Musicals - Mary Poppins, & Juliet and an art exhibition as well as an open-air rock concert; after COVID lockdown I think I’m more inclined to not miss out on anything.”

Family Frugality

Arts audiences aged 35-55 with children living at home

Rising housing costs are affecting families more than households without children, and audiences with kids at home have reduced their arts spending more than others.

Parents are more likely to cite financial barriers (56% vs 35%) and/or prioritising other things in their life (36% vs 22%) than other audiences.

High numbers are staying closer to home, looking for free/cheap things to do and taking longer to commit, as they weigh up costs for 3 or more people.

Families see the arts as important for their children – and many are prioritising it within their budget.

For Kids and Family shows, consider a pricing and promotion strategy tailored to this group (they’re the most likely group to find out about events on Facebook!).

One survey respondent commented on ticket pricing, saying:

“Over the last year we’ve been to a number of big concerts and shows but I’d seriously reconsider spending more than about $75 a ticket for anything at this point. We just saw Into the Woods at Belvoir St and adult tickets were $82 but they had a student rate of $47 which made it doable as a family.”

Young and Restless

Arts audiences under 35

Young people tend to have lower incomes, and are among the most affected by financial barriers right now.

Although they’re eager to get out and about, young people are attending at slightly lower levels than they did 12 months ago.

They’re facing financial barriers at twice the rate of their parents’ generations – and feel more down about their economic future.

They say other barriers are also inhibiting their attendance – such as ‘lacking energy to go out’ (36%) and ‘prioritising other things in my life’ (31%).

They’re eager to connect socially, attend fun/uplifting events and try new things they haven’t experienced before, but may need support to attend.

Some are looking with keen eyes for student or youth discounts – and ways to cover the costs of travel and eating out.

One audience member mentioned discounts and seeking more for their money, saying:

“I have been to several Melbourne International Comedy Festival acts in the last month as well as the cinema a few times. That was prioritised due to the availability of discount codes and cheaper tickets for certain nights, plus the fact that many variety shows are available where multiple acts can be seen.”

Summary of segments

For easy viewing, click below to download the summary of all three segments as an infographic.

Catch up on the data

In case you missed it, we have a suite of audience research and resources available from our April 2023 Pulse Check. Check it out below!

National Snapshot Report

Read the report for key national insights and the detailed breakdown of the three audience segments.

State Snapshots

Read the snapshot reports for NSW, VIC, QLD, SA and WA to discover the nuances in audience behaviour at a state-level.

Webinar

Watch Tandi Palmer Williams, Managing Director at Patternmakers, and Ella Huisman, Executive Director - Audience at Adelaide Fringe discuss the main findings and results from the Pulse Check.

Case Study: Adelaide Fringe

Read our article ‘How Adelaide Fringe sold 1 million tickets in the face of rising inflation’ for the key takeaways from one of the most successful campaigns of the year.

Cover Image Credit: Samuel Graves, The Garden of Unearthly Delights at Adelaide Fringe Festival 2023, courtesy of Adelaide Fringe.

Past posts on this blog:

Archive

- 2023 21

- Dance 3

- Research 99

- Audience development 79

- Arts 73

- COVID-19 70

- Culture 72

- Data culture 69

- Evaluation 75

- Innovation 78

- Thought leadership 16

- About Patternmakers 35

- Privacy 6

- Project updates 25

- Culture Panel 1

- Resources 6

- Toolkit 5

- Beyond the Bio 8

- 2022 23

- Career Advice 9

- Opportunities 4

- Tips & Tricks 13

- 2021 7

- 2024 1

- First Nations 3

- Indigenous 2

- Strategic Planning 5

- Trends 3

- Performing Arts 5

- Manifesto 1

- Education 2

- Capacity building 3

- Digital art 4

- Interviews 3

- Coronavirus 2

- 2020 3

- Tandi Palmer Williams 7

- Theory of Creativity Podcast 1

- 2019 11

- Top 5 2

- 2018 12

- Case Studies 2

- Our services 4

- Postcode Analysis 1

- Accessibility 4

- Touring 3

- Publications 1

- 2017 8

- Data art 2

- 2016 5

Be in the loop

State Snapshots on cost-of-living pressures

Download the April 2023 State Snapshot reports to see how inflationary pressures are being experienced differently across the country.

Read our snapshot reports to discover the nuances in audience behaviour at a state-level.

Based on data from the April 2023 Audience Outlook Monitor, find out how audiences across Australia’s states are responding to increasing interest rates and cost-of-living pressures.

While audiences in New South Wales are spoiled for choice right now – almost half are taking longer to make decisions about attending, and they’re taking into account 3 key factors more than usual.

Victorian and South Australian audiences are the most likely to be staying closer to home to keep costs down. There are certain offers marketers need to be aware of.

Things appear most stable in Queensland and Western Australia, with these audiences feeling the most optimistic about the country’s economic outlook. However, half are looking for cheap/free things to do currently, validating the need for certain ticketing initiatives.

Scroll down to access the snapshot reports for key states, VIC, QLD, NSW and SA. Keep an eye out for news about the WA snapshot in the coming weeks.

Download the snapshots

Click the buttons below to access the snapshots for each state.

The state snapshots are also available to download in an accessible version:

Thank you to the following state arts agencies for their support in delivering the State Snapshots: Creative Victoria, Create NSW, Arts Queensland, Department of the Premier and Cabinet (Arts SA) and Department of Local Government, Sport and Cultural Industries (WA).

Cover Image Credit: Concert for the Planet, courtesy of HOTA.

Read the National Snapshot Report

In case you missed it, click the button below for the key national insights from the April 2023 Pulse Check.

Use the dashboard to get results for your artform and region

Survey data from over 1,300 respondents has been uploaded to the dashboard, which now contains insights from 100,000 Australian participants.

You can use the dashboard to explore the findings by state, artform and audience segment.

It’s freely available to access, just click the image below and use the login details provided on the dashboard page.

About the Audience Outlook Monitor

The Audience Outlook Monitor provides the results of a study that has tracked audience sentiment over the course of the COVID-19 pandemic.

Data was collected in six phases throughout 2020-2022 and is again being tracked in 2023.

Government agencies across Australia are collaborating with research agencies Patternmakers (Sydney) and WolfBrown (USA) to produce this resource. The dashboard is freely accessible and designed to help artists and cultural organisations of all kinds to make the best possible decisions.

How to find out more

To receive new releases directly into your inbox, as soon as they are available, you can opt in to receive Audience Outlook Monitor news below.

Subscribers to our regular Culture Insight & Innovation Updates will need to update their preferences to receive all updates about the Audience Outlook Monitor. Just enter your email below and follow the instructions provided.

If you have a question, or an idea for using this data, please contact Patternmakers at info@thepatternmakers.com.au

Subscribe for updates

About the Author

Bianca Mulet

Senior Research Analyst

Delivery partners:

Supporting partners:

Past posts on this blog

Archive

- 2023 21

- Dance 3

- Research 99

- Audience development 79

- Arts 73

- COVID-19 70

- Culture 72

- Data culture 69

- Evaluation 75

- Innovation 78

- Thought leadership 16

- About Patternmakers 35

- Privacy 6

- Project updates 25

- Culture Panel 1

- Resources 6

- Toolkit 5

- Beyond the Bio 8

- 2022 23

- Career Advice 9

- Opportunities 4

- Tips & Tricks 13

- 2021 7

- 2024 1

- First Nations 3

- Indigenous 2

- Strategic Planning 5

- Trends 3

- Performing Arts 5

- Manifesto 1

- Education 2

- Capacity building 3

- Digital art 4

- Interviews 3

- Coronavirus 2

- 2020 3

- Tandi Palmer Williams 7

- Theory of Creativity Podcast 1

- 2019 11

- Top 5 2

- 2018 12

- Case Studies 2

- Our services 4

- Postcode Analysis 1

- Accessibility 4

- Touring 3

- Publications 1

- 2017 8

- Data art 2

- 2016 5

How rising inflation is impacting audiences

April 2023 results from the Audience Outlook Monitor are now available. Get the details on how the attendance outlook varies across three key audience segments and the programming, marketing, and ticketing opportunities that exist to improve consumer confidence.

Read about the findings and download the Live Attendance Update.

Rising inflation has put pressure on household budgets, with audiences attending slightly fewer events and spending less

-

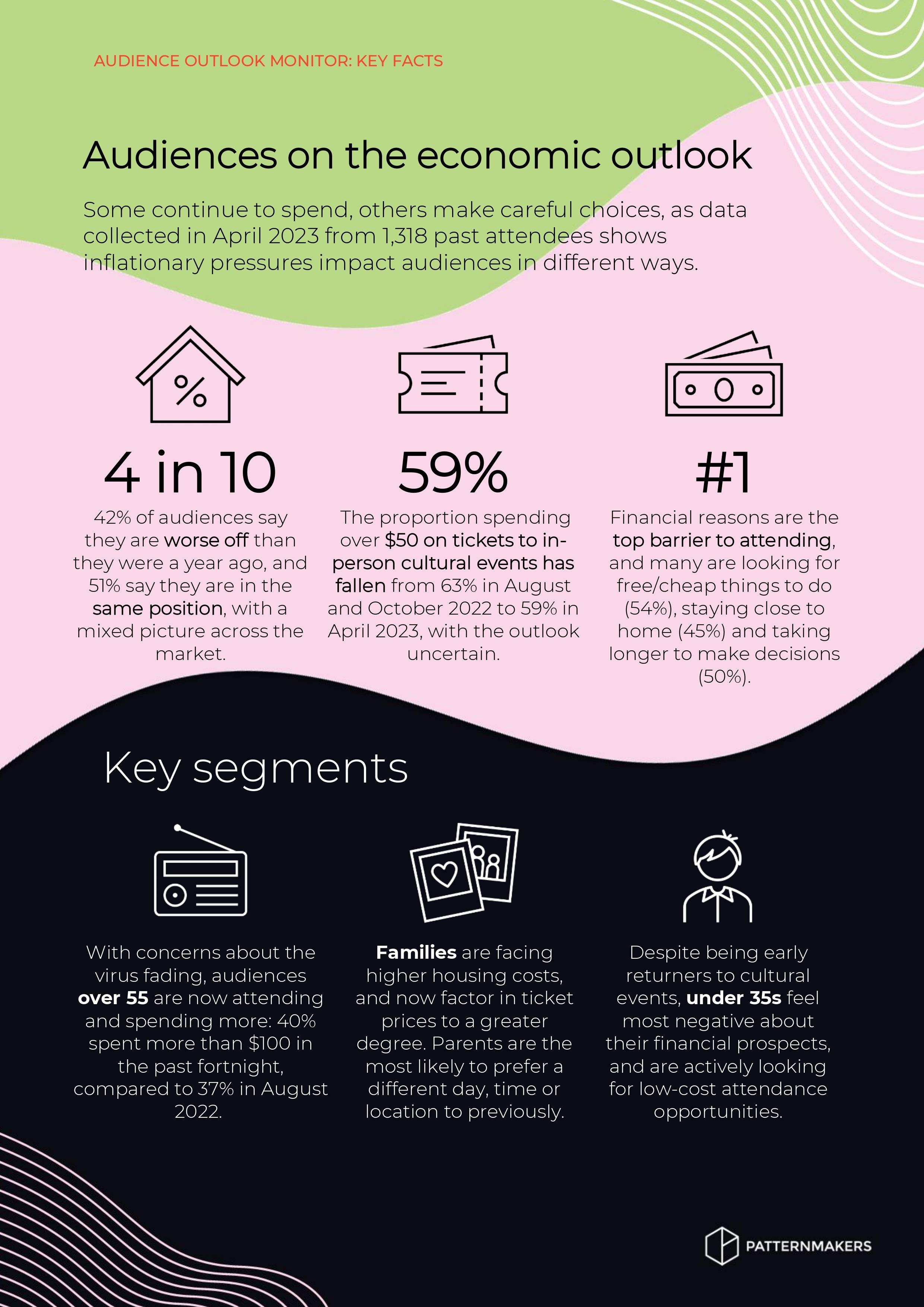

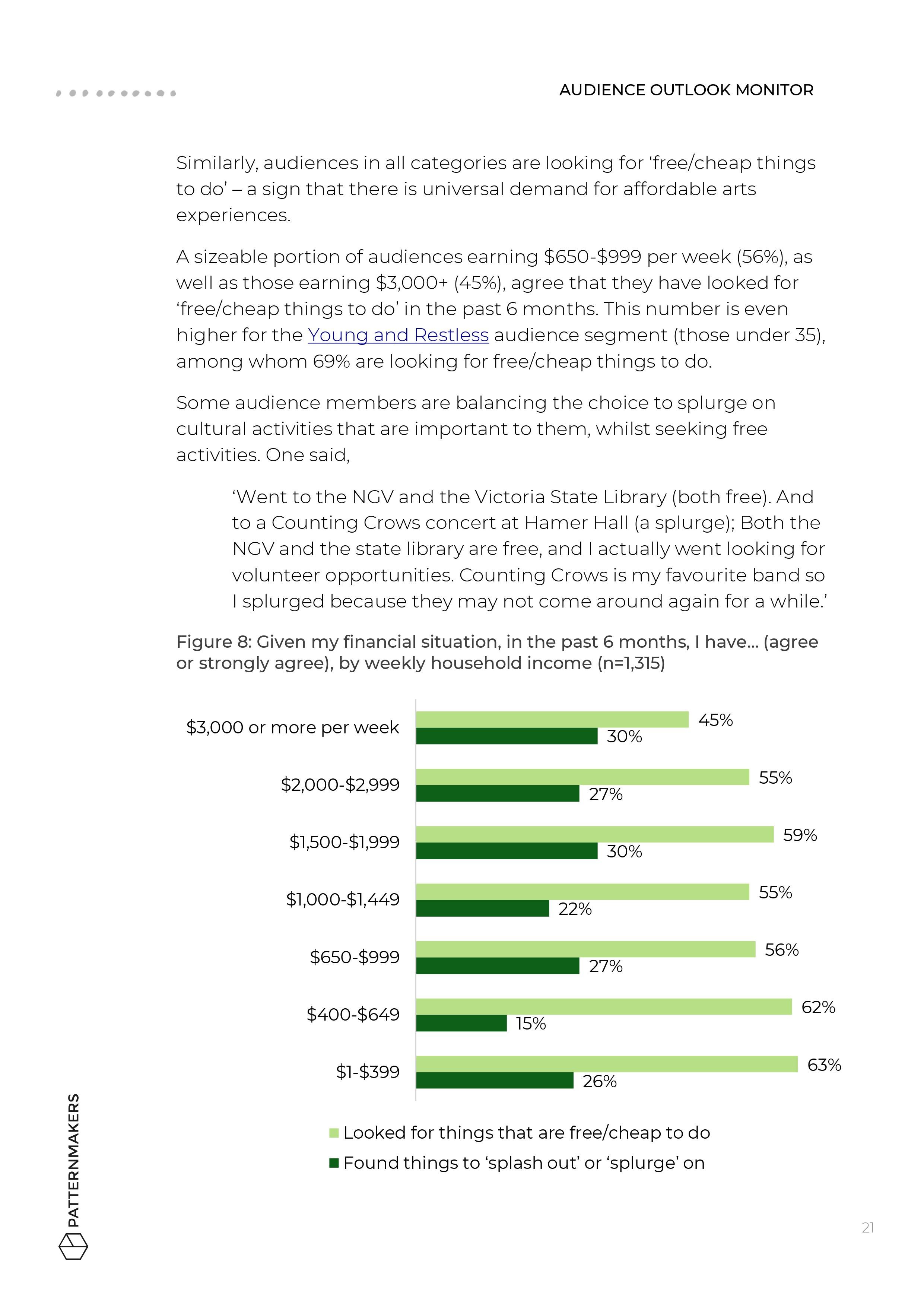

Increasing interest rates and cost-of-living pressures are impacting consumer confidence around the country. This ‘Pulse Check’ explores how Australian arts audiences are responding to changing economic conditions, based on data from 1,318 past attendees.

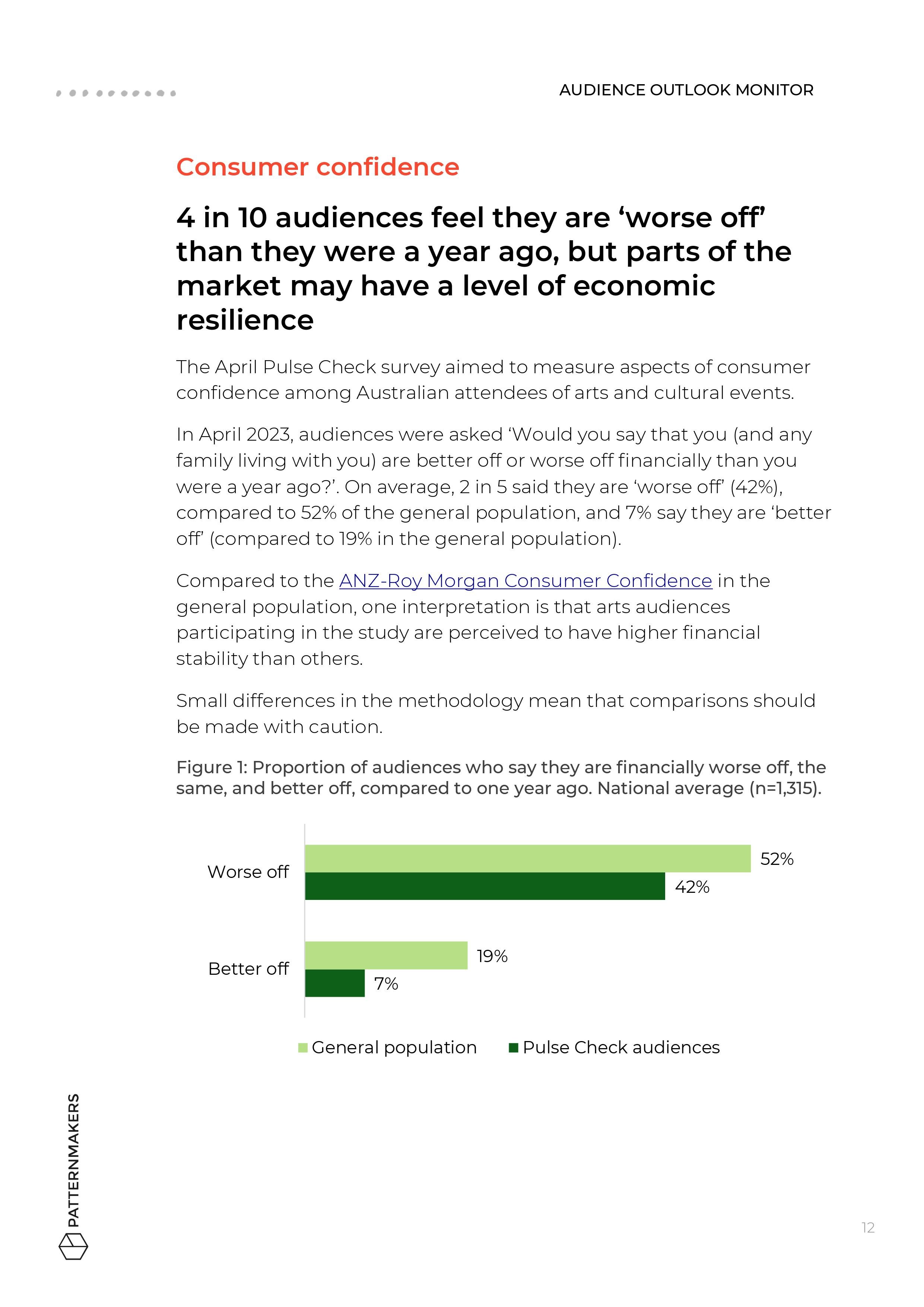

Around 4 in 10 (42%) audience members surveyed say they are ‘worse off’ financially compared to one year ago. 1 in 10 (7%) are ‘better off’ and 5 in 10 (51%) are ‘the same'.

Arts attendees appear to be faring slightly better than the general population, on average, but are more cautious about the country’s economic outlook, based on comparison of the results with the ANZ-Roy Morgan' Consumer Confidence index.

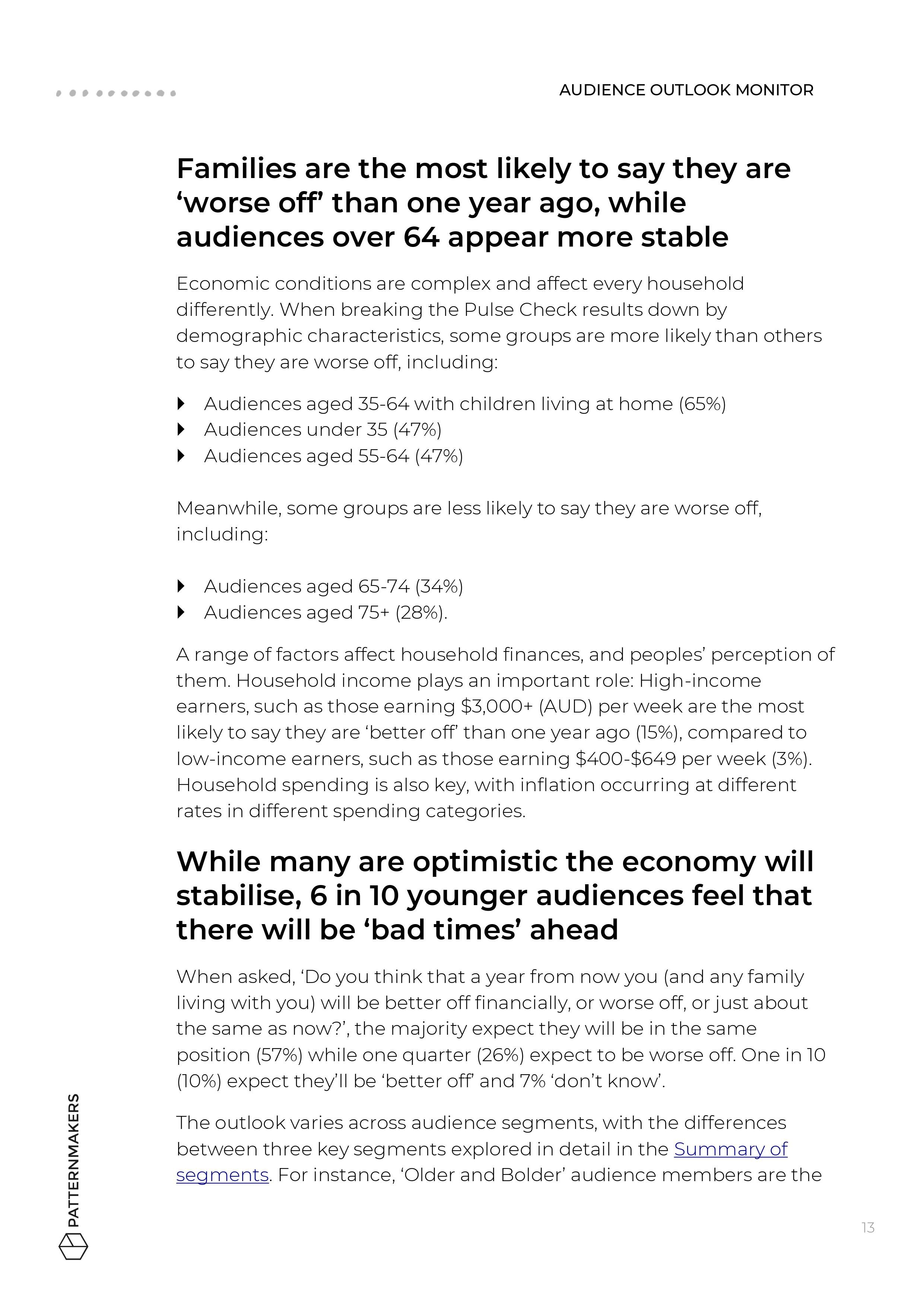

Trends vary across segments, confirming the need to tailor strategies for different audiences and events. Older audiences are the most likely to say their situation is the same (58%), while parents are the most likely to say they are ‘worse off’ (57%). Young audiences under 35 are most negative about the economic outlook.

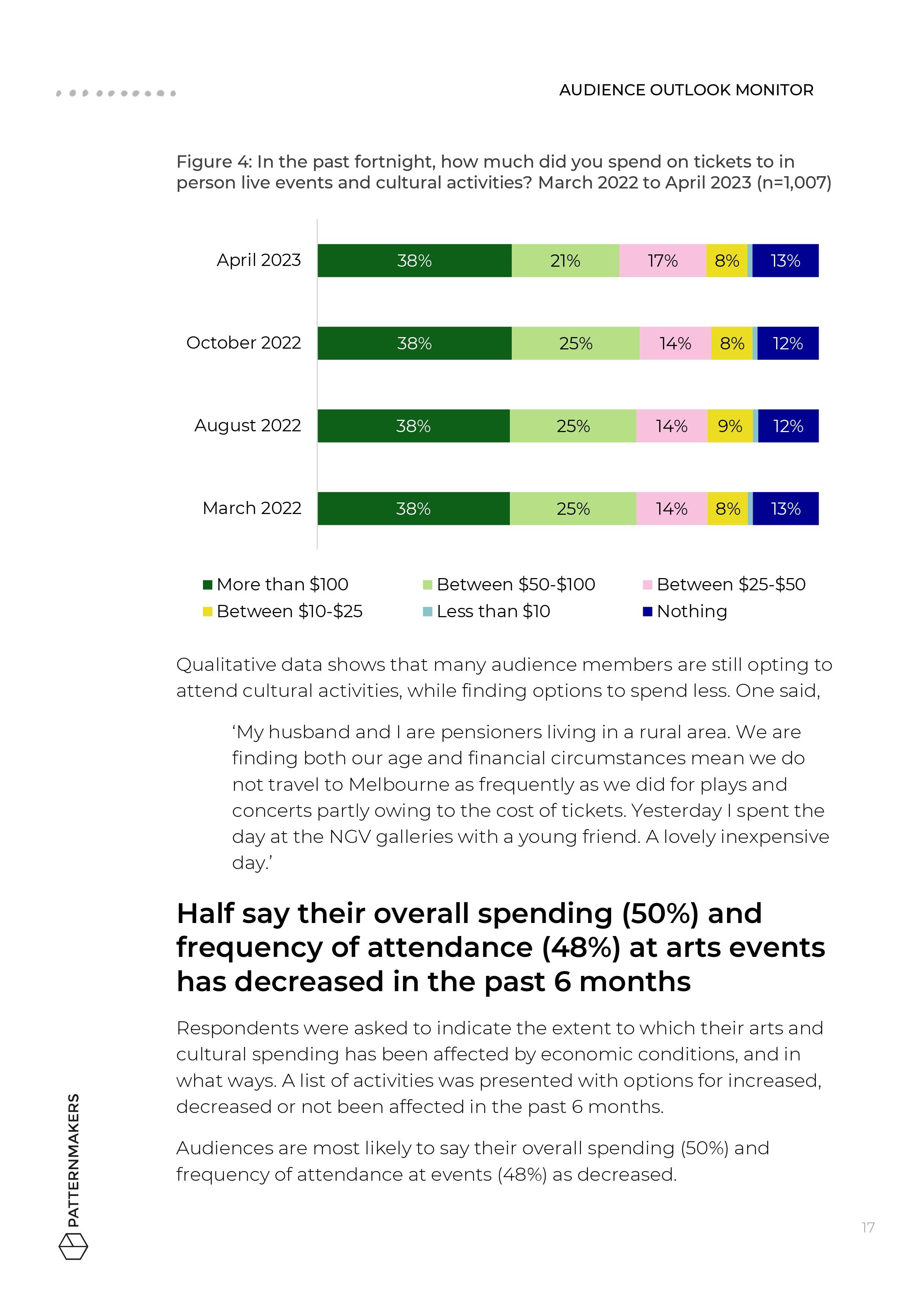

While three-quarters of past attendees (76%) attended a cultural event in the fortnight before data collection (19-23 April), consistent with October (75%) and August 2022 (76%), the profile of those attending, and their attendance preferences are changing.

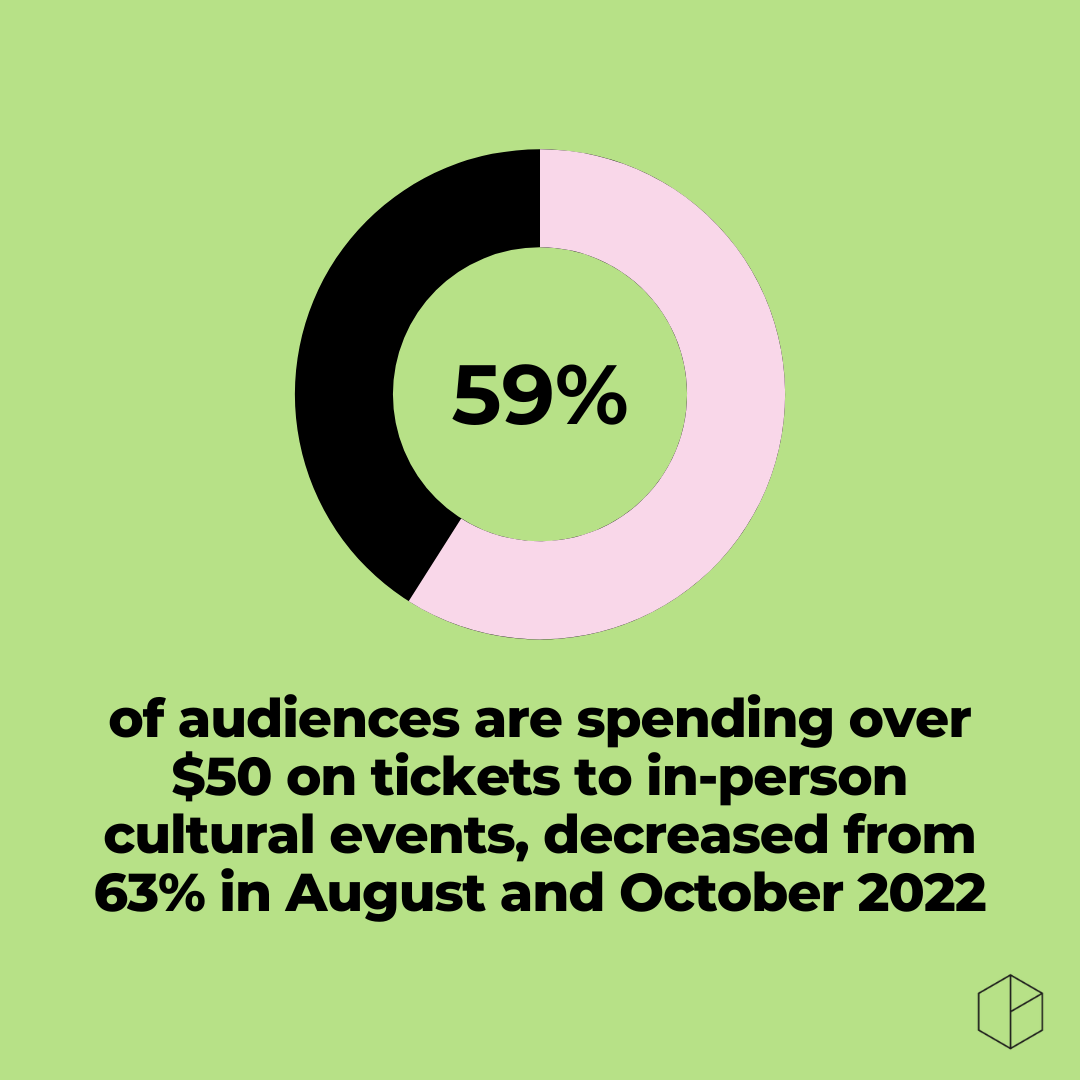

Average spending levels are decreasing, with 6 in 10 (59%) of those attending in the past fortnight spending over $50 or more, down slightly from August (63%) and October 2022 (63%). However, averages should be interpreted with caution, as some segments are actually spending more, and others less.

Read on or download the report for details on how different segments are behaving.

Click the buttons below to download the April 2023 Snapshot Report, as a PDF or the accessible Word version, or read on for more of the findings.

With financial limitations top of mind, many audiences are deliberating longer on factors such as price, location and overall value

-

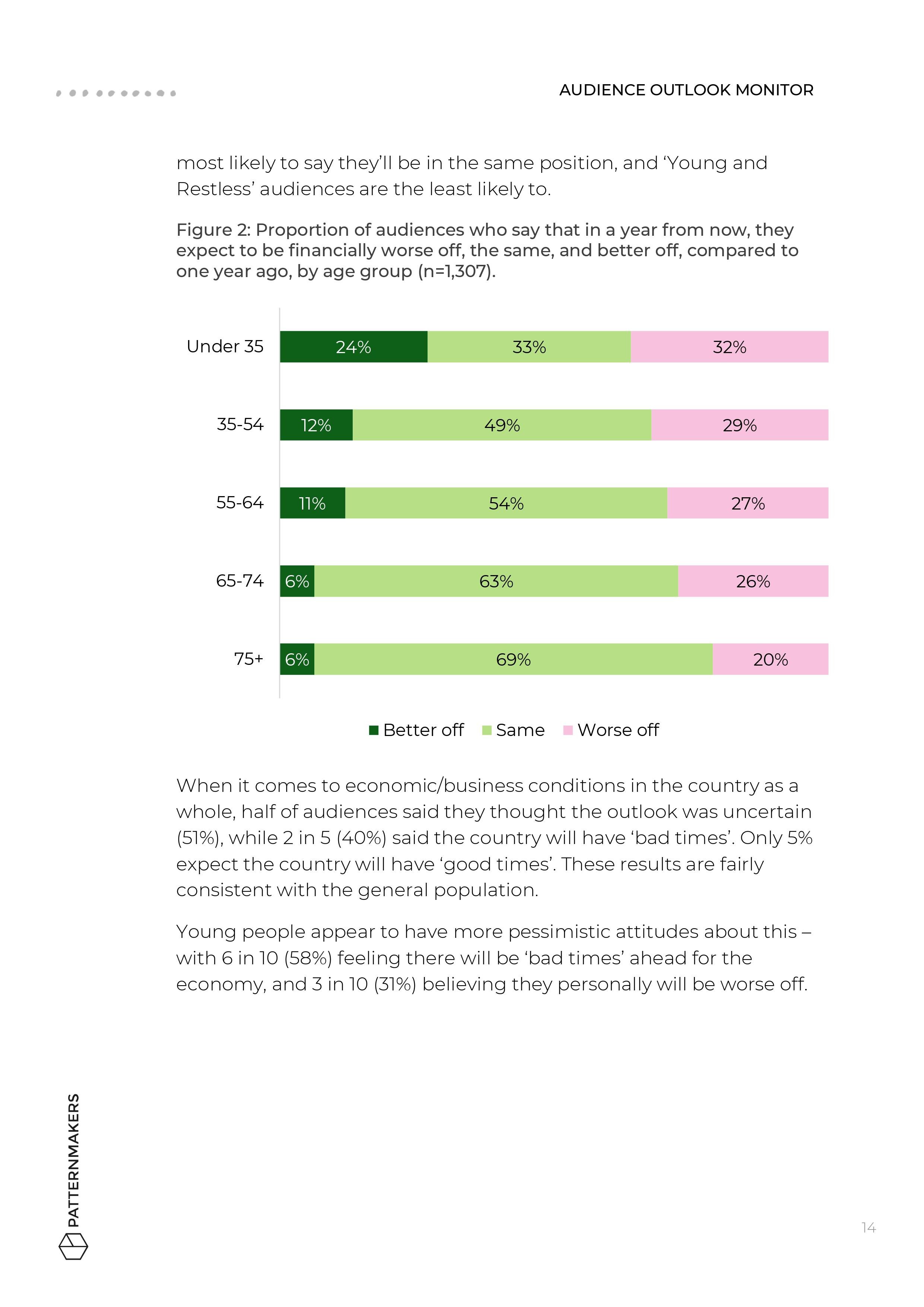

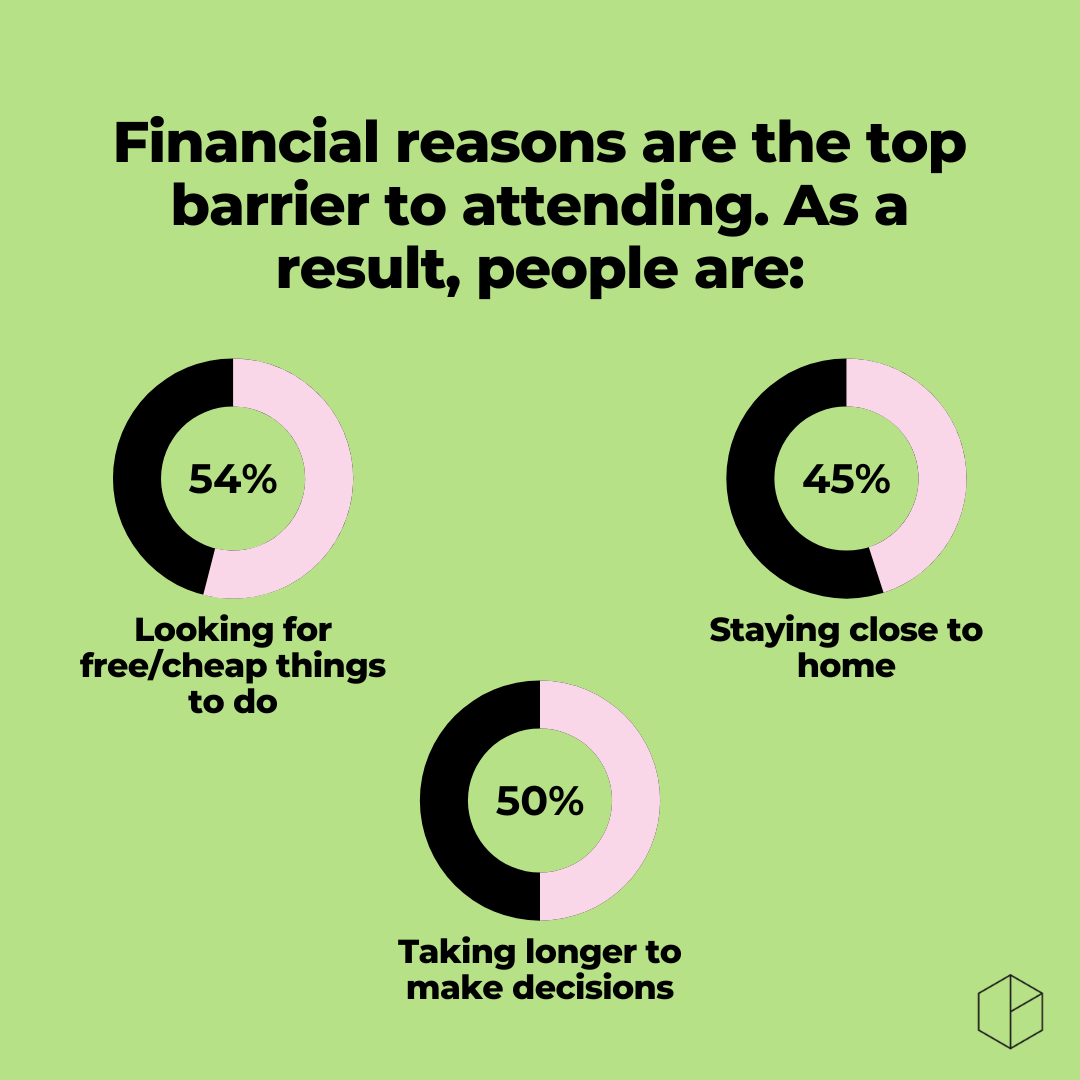

As COVID-related concerns continue to fade, financial reasons are the top barrier to attendance, affecting 4 in 10 audience members.

A lack of money is not the only consideration – the data also suggests a perceived lack of time and a lack of energy, as lifestyles continue to evolve after the pandemic. Many report feeling busier with the return of office working, commuting, travel and social events – and 24% say they are inhibited by ‘prioritising other things’.

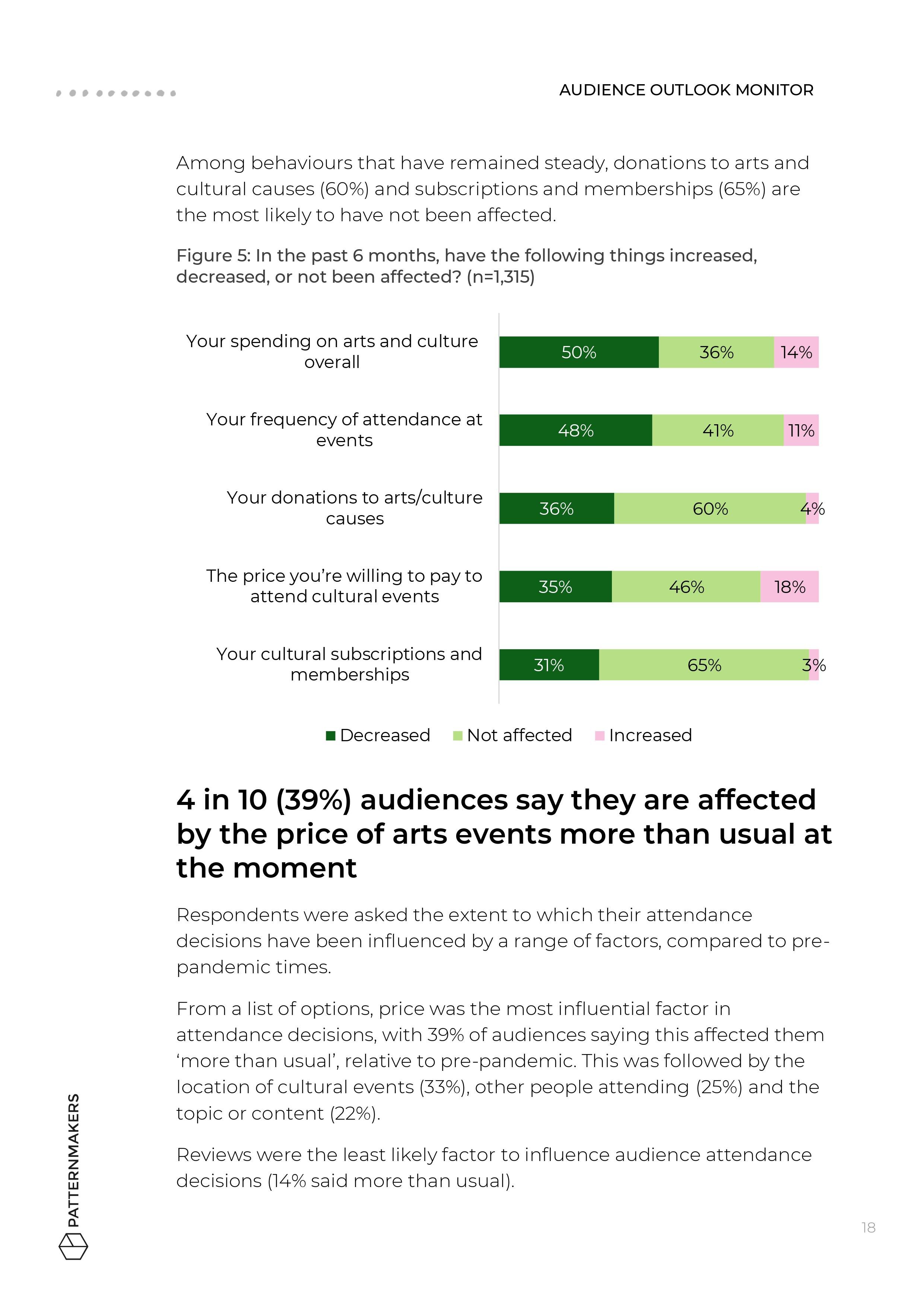

When asked about their cultural spending over the past 6 months, sizeable numbers say the price they are willing to pay to attend (35%) and/or their frequency of attendance (48%) have decreased.

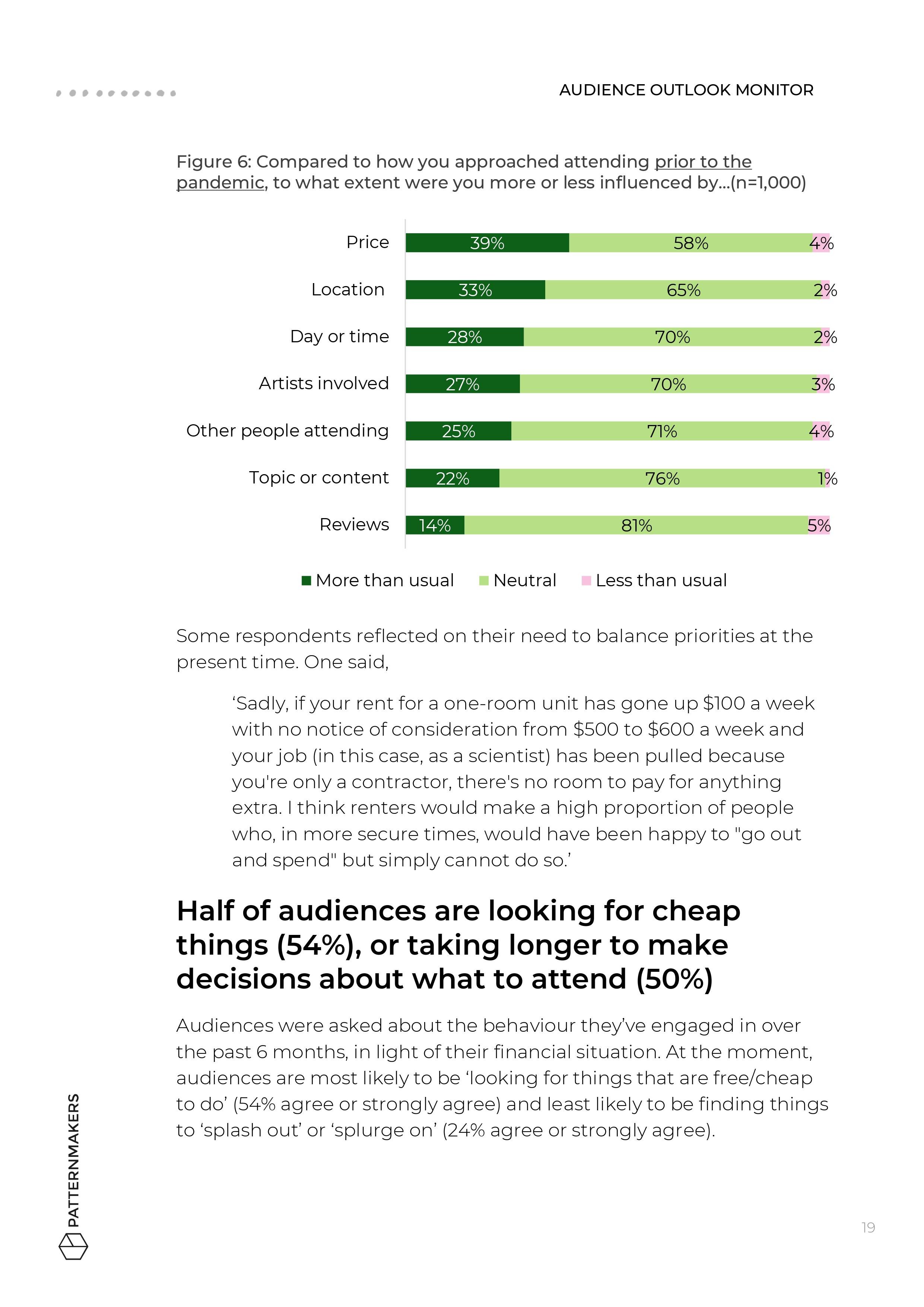

When reflecting on the most recent event they attended, 4 in 10 audiences said that price influenced them ‘more than usual’ (39%).

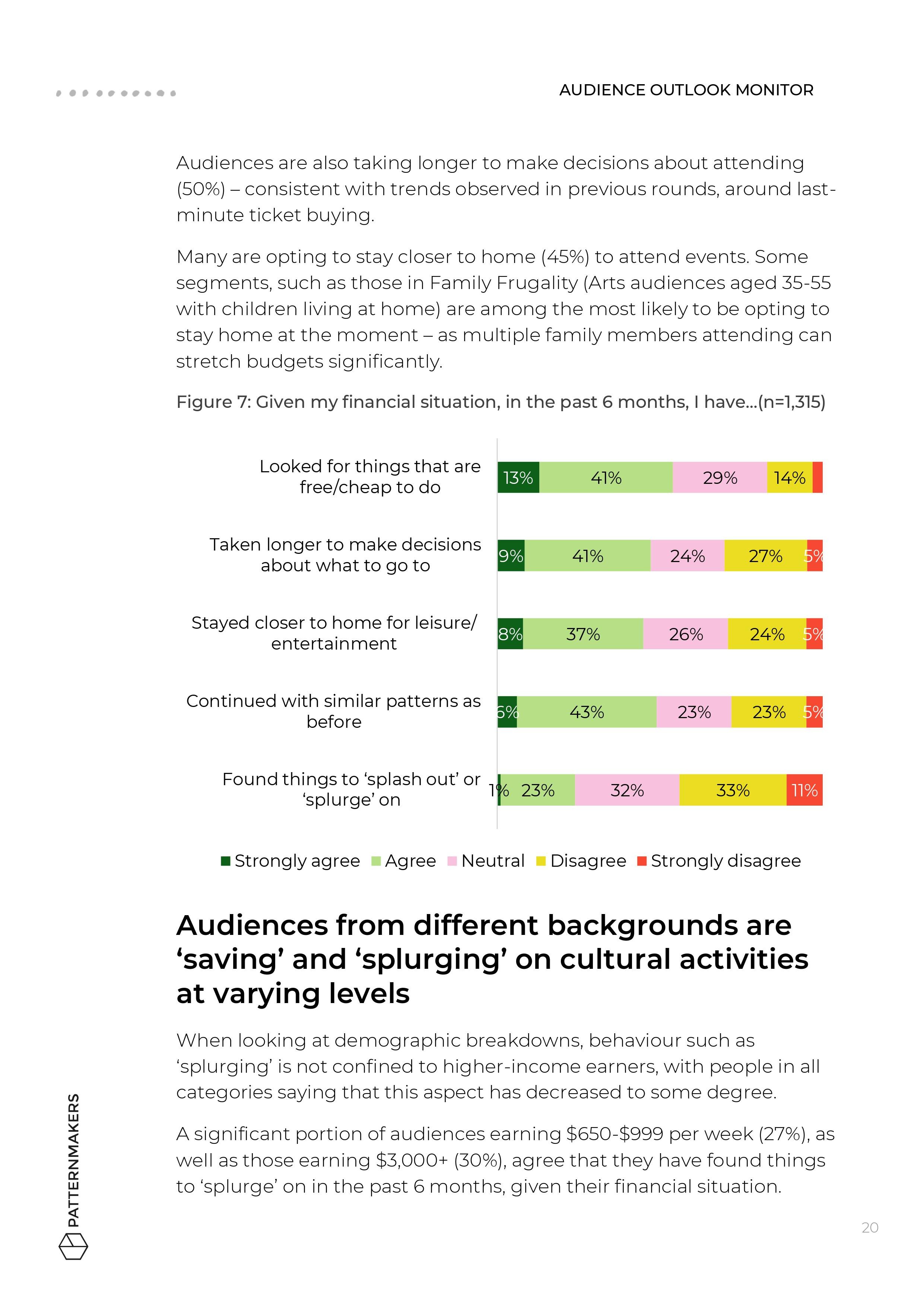

Around half are looking for free and cheap things to attend (54%) and qualitative data shows that discounts and pricing offers are factoring into a high number of decisions, particulary among families and young people.

People from different socio-economic backgrounds are ‘splurging’ and ‘saving’ to different degrees – and some are doing both, opting to splash out on events that are important to them, while making savings elsewhere by looking for free or low-cost alternatives.

Audiences say they have decreased spending on events (50%), donations (36%) and subscriptions/memberships (31%) – though many who engage in these forms of support say they plan to continue, acknowledging tough conditions for artists and a desire to show their support in tough times.

The uncertain economic outlook requires tailored strategies for different segments and scenarios

-

Many are taking longer to make decisions (50%), and last-minute ticket-buying appears here to stay for the time being.

The location of events is also impacting 33% of audiences more than usual and 45% say they are staying closer to home. Qualitative data suggests that proximity to events plays an important role – with costs of parking, fuel, air tickets and hospitality all increasing.

Some segments are more disadvantaged by travel costs than others, and logistical considerations in scheduling events will be important for catering to a range of audiences.

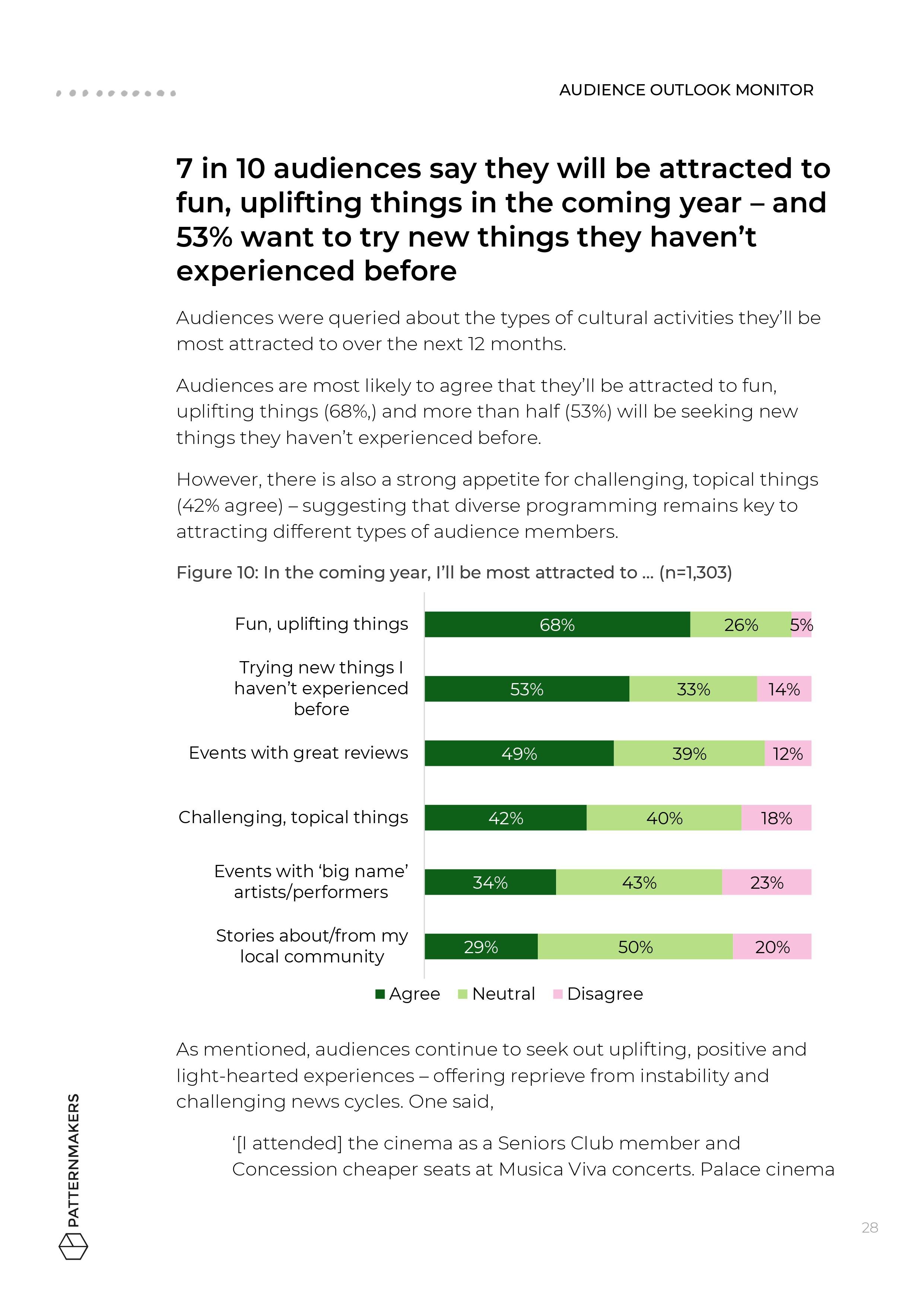

When asked about the next 12 months, audience responses confirm enduring appetites for new (53%), uplifting (68%) and challenging arts experiences (42%). Balanced programs are as important as ever.

When asked to share what they’ve attended recently, and why they prioritised those things, some common themes include a desire to support artists and organisations they value and wanting to return to the works they know and love. Some appear to want a ‘safe bet’ that they will have an enjoyable experience with friends/family.

Economic conditions are complex, and affect every household differently. However, looking at the trends in three key segments can assist with understanding some of the differences and identifying practical implications (overleaf).

With an uncertain outlook, and the possibility of a recession, it’s wise to stay flexible and consider how strategies and tactics can be adjusted as conditions change.

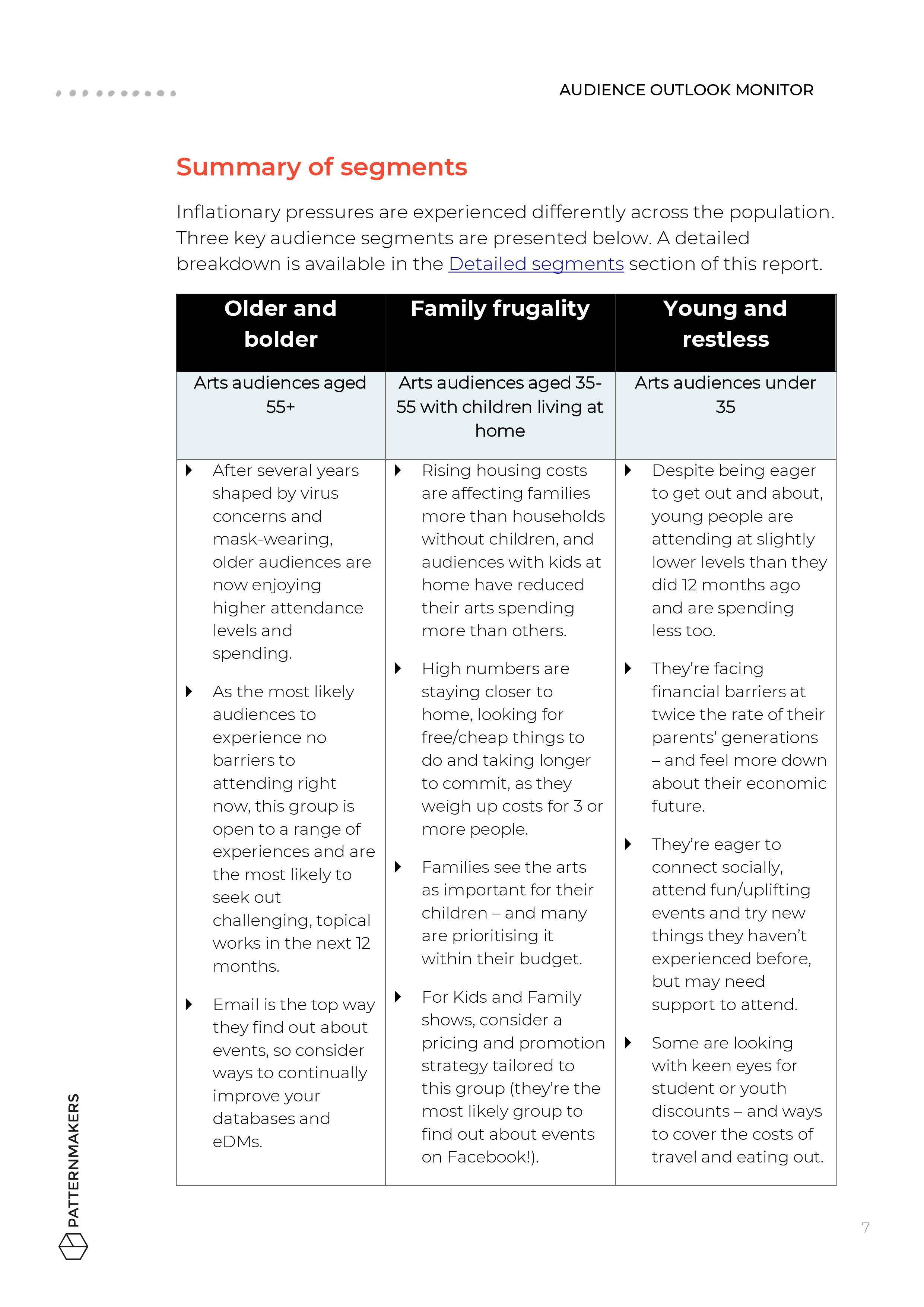

Summary of segments

Inflationary pressures are experienced differently across the population. Three key audience segments are presented below.

-

Arts audiences aged 55+

After several years shaped by virus concerns and mask-wearing, older audiences are now enjoying higher attendance levels and spending.

As the most likely audiences to experience no barriers to attending right now, this group is open to a range of experiences and are the most likely to seek out challenging, topical works in the next 12 months.

Email is the top way they find out about events, so consider ways to continually improve your databases and eDMs.

-

Arts audiences aged 35-55 with children living at home

Rising housing costs are affecting families more than households without children, and audiences with children at home have reduced their cultural spending more than other adults.

High numbers are staying closer to home, looking for free/cheap things to do and taking longer to commit, as they weigh up costs for 3 or more people.

Families see the arts as important for their children – and many are prioritising it within their budget.

For Kids and Family shows, consider a pricing and promotion strategy tailored to this group (they’re the most likely group to find out about events on Facebook!).

-

Arts audiences under 35

Despite being eager to get out and about, young people are attending at slightly lower levels than they did 12 months ago and are spending less too.

They’re facing financial barriers at twice the rate of their parents’ generations – and feel more down about their economic future.

They’re eager to connect socially, attend fun/uplifting events and try new things they haven’t experienced before, but may need support to attend.

Some are looking with keen eyes for student or youth discounts – and ways to cover the costs of travel and eating out.

Opportunities

As conditions continue to change, opportunities exist in terms of programming, marketing and ticketing. However, the right solutions will look different for every organisation. The ideas outlined below are put forward to get you thinking, and any action should be considered in terms of what’s right for you and your audience.

Programs featuring diverse topics and different price points are likely to reach the broadest audiences.

-

Keep in mind audiences’ desire for fun, uplifting events in the post-pandemic era, but don’t forget there are sizeable numbers wanting new, topical and/or challenging things – some audiences have expressed wariness of commercialisation or softening of the cultural activities they love at the expense of creative innovation

Review the price points of your offerings and consider how audiences in different segments will assess value for money

Research the demographic shifts affecting your area and explore as a team how behaviours like working from home, commuting and travel are changing

Keep on top of transport options to your area, such as public transport schedules and initiatives, and consider these when scheduling events

Consider programming earlier event options/matinees to encourage attendance among cost-conscious parents or outer metro/regional audiences who might catch public transport or drive but want to avoid travel rush or late-night travel

Looking ahead, consider the right frequency and volume of events for the economic conditions. It might be helpful to plan for different scenarios such as a fast rebound or prolonged recession.

Clear and helpful marketing campaigns can help get indecisive audiences over the line.

-

Look at ways to take pressure off audiences by spelling out instructions on how to get to and from events, on your websites, newsletters or pre-event emails

Consider researching and promoting any money saving transport or parking initiatives, to encourage regional or outer metro attendance at inner city events, or metropolitan attendance at regional or outer metro events

Consider creating and promoting itineraries for a ‘night out’ based on different budgets e.g., suggested transport, pre-show drink destination and post-show dinner destination

Take time to get digital marketing right and wherever possible tailor the words, imagery and channel, based on things like prior attendance, post code, age, family status or income (sometimes reaching a smaller group with the right campaign will deliver better engagement than a broad campaign to a bigger group)

Where one event ticks various boxes, consider A/B marketing tactics to communicate the same event to different segments in different ways – for example, highlight the ‘challenging, topical’ content of a show in an email to over 55s, while featuring any ‘big name artists’ in an email to under 55s.

Ticketing initiatives to support more price sensitive audiences are important, but last-minute discounting may not be the answer. Also, with some arts audiences doing well financially and others struggling, it might be time to introduce alternative payment models.

-

Look at ways of rewarding early bookers with earlybird discounts or newsletter subscriber pre-sales, rather than resorting to last minute ‘panic’ discounting

Consider offering cheaper ticket prices for young audiences and reviewing age limits – i.e. under 35 may be more appropriate than under 30 or under 25 given current conditions, and some artforms may have a case to extend this to under 40

Consider offering group discounts or family ticket offers (e.g., 2 adults, 2 kids or 1 adult, 3 kids) to relieve cost pressures from price sensitive parents and caregivers, and encourage group bookings

Review the approach to booking fees and consider a per ticket fee or a scaled offer e.g. percentage of total purchase instead of a set per transaction fee, which has a higher impact on single ticket purchasers

Clearly communicate where booking fee money is going, and consider investigating a payments solution like ArtsPay, – some audiences are put off by high booking fees but many are keen to support the arts and artists

Investigate ways to facilitate ‘pay it forward’ tickets, where people in more comfortable financial positions can purchase or subsidise tickets for people more affected by cost of living pressure

If feasible, options to pay in instalments could take the pressure off audiences splashing out big purchases, and encourage more to book in advance

For lower cost events, consider a ‘pay what you want’ model with a small pre-purchase deposit to encourage more risktaking from audiences to see something new, topical or challenging, but avoiding risks around no-shows

Cover Image Credit: Audience at Future History Runway. Melbourne Fringe Festival 2022. Photo by Duncan Jacob, courtesy of Melbourne Fringe.

Want to hear more about the findings? Join us for a webinar with the Australia Council on 17 May, 12:00 PM AEST.

Click the button below to register your attendance.

Use the dashboard to get results for your artform and region

Survey data from over 1,300 respondents has been uploaded to the dashboard, which now contains insights from 100,000 Australian participants.

You can use the dashboard to explore the findings by state/territory, artform and audience segment.

It’s freely available to access, just click the image below and use the login details provided on the dashboard page.

About the Audience Outlook Monitor

The Audience Outlook Monitor provides the results of a study that has tracked audience sentiment over the course of the COVID-19 pandemic.

Data was collected in six phases throughout 2020-2022 and is again being tracked in 2023.

Government agencies across Australia are collaborating with research agencies Patternmakers (Sydney) and WolfBrown (USA) to produce this resource. The dashboard is freely accessible and designed to help artists and cultural organisations of all kinds to make the best possible decisions.

How to find out more

To receive new releases directly into your inbox, as soon as they are available, you can opt in to receive Audience Outlook Monitor news below.

Subscribers to our regular Culture Insight & Innovation Updates will need to update their preferences to receive all updates about the Audience Outlook Monitor. Just enter your email below and follow the instructions provided.

If you have a question, or an idea for using this data, please contact Patternmakers at info@thepatternmakers.com.au

Subscribe for updates

About the Author

Bianca Mulet

Senior Research Analyst

Delivery partners

Supporting partners

Past posts on this blog

Archive

- 2023 21

- Dance 3

- Research 99

- Audience development 79

- Arts 73

- COVID-19 70

- Culture 72

- Data culture 69

- Evaluation 75

- Innovation 78

- Thought leadership 16

- About Patternmakers 35

- Privacy 6

- Project updates 25

- Culture Panel 1

- Resources 6

- Toolkit 5

- Beyond the Bio 8

- 2022 23

- Career Advice 9

- Opportunities 4

- Tips & Tricks 13

- 2021 7

- 2024 1

- First Nations 3

- Indigenous 2

- Strategic Planning 5

- Trends 3

- Performing Arts 5

- Manifesto 1

- Education 2

- Capacity building 3

- Digital art 4

- Interviews 3

- Coronavirus 2

- 2020 3

- Tandi Palmer Williams 7

- Theory of Creativity Podcast 1

- 2019 11

- Top 5 2

- 2018 12

- Case Studies 2

- Our services 4

- Postcode Analysis 1

- Accessibility 4

- Touring 3

- Publications 1

- 2017 8

- Data art 2

- 2016 5

Webinar: How rising inflation is impacting audiences

Join Tandi Palmer Williams from Patternmakers and a special guest as they discuss the latest insights related to arts audiences and the economic outlook in 2023.

Economic uncertainty, being the current top barrier to attending, is impacting audiences in different ways.

This webinar explored how various audience segments are responding to rising cost-of-living pressures and dive into suggestions for how arts organisations can augment their marketing, programming and ticketing initiatives to best engage audiences at this time.

Watch Tandi Palmer Williams, Managing Director at Patternmakers, and Ella Huisman, Executive Director - Audience at Adelaide Fringe, as they discuss the main findings and results from the April 2023 phase of data collection.

This round of data collection was conducted between 19 - 23 April 2023.

The webinar is live captioned and Auslan interpreted.

About the Audience Outlook Monitor

The Audience Outlook Monitor provides the results of a study that has tracked audience sentiment over the course of the COVID-19 pandemic.

Data was collected in six phases throughout 2020-2022 and is again being tracked in 2023.

Government agencies across Australia are collaborating with research agencies Patternmakers (Sydney) and WolfBrown (USA) to produce this resource. The dashboard is freely accessible and designed to help artists and cultural organisations of all kinds to make the best possible decisions.

How to find out more

To receive news and updates directly into your inbox, as soon as they are available, you can opt in to receive Audience Outlook Monitor news below.

If you have a question, or an idea for using this data, please contact Patternmakers at info@thepatternmakers.com.au

Subscribe for updates

About the Author

Tandi Palmer Williams

Managing Director

Tandi is Founder and Managing Director of Patternmakers. She’s an arts research specialist and leader of the agency’s research projects.

Delivery partners

Supporting partners

Past posts on this blog

Archive

- 2023 21

- Dance 3

- Research 99

- Audience development 79

- Arts 73

- COVID-19 70

- Culture 72

- Data culture 69

- Evaluation 75

- Innovation 78

- Thought leadership 16

- About Patternmakers 35

- Privacy 6

- Project updates 25

- Culture Panel 1

- Resources 6

- Toolkit 5

- Beyond the Bio 8

- 2022 23

- Career Advice 9

- Opportunities 4

- Tips & Tricks 13

- 2021 7

- 2024 1

- First Nations 3

- Indigenous 2

- Strategic Planning 5

- Trends 3

- Performing Arts 5

- Manifesto 1

- Education 2

- Capacity building 3

- Digital art 4

- Interviews 3

- Coronavirus 2

- 2020 3

- Tandi Palmer Williams 7

- Theory of Creativity Podcast 1

- 2019 11

- Top 5 2

- 2018 12

- Case Studies 2

- Our services 4

- Postcode Analysis 1

- Accessibility 4

- Touring 3

- Publications 1

- 2017 8

- Data art 2

- 2016 5

Evolving the Audience Outlook Monitor in 2023

The wild ride of the lockdown era is now behind us, so it’s time for a clear-eyed look at where we’ve landed. In this article, we share the topics that we’ll be researching this year, to ensure you can plan for the challenges and opportunities of the post-pandemic years.

The wild ride of the lockdown era is now behind us, so it’s time for a clear-eyed look at where we’ve landed.

In this article, I share the topics that we’ll be researching this year, to ensure you can plan for the challenges and opportunities of the post-pandemic years.

Over the past few months, our team has been out and about at performances, museums and festivals.

In Sydney alone, it’s been sensational to see the city come alive with World Pride and the excitement of a new flagship gallery Sydney Modern.

Around the country, we’ve seen record sales in the Adelaide festival season, new projects funded and of course Revive, the National Cultural Policy.

So, things have vastly improved over the past 3 years.

But not all parts of the sector are recovering at the same pace. Some concert halls remain stubbornly hard to fill, and some tours are still being cut short after cancelled shows.

In the US, forecasting by IMPACTS Experience projects that while the museum sector may reach almost back to pre-pandemic levels by the end of 2023, performing arts attendances will only reach 78% of 2019 levels.

Our own research shows that some segments in our community are behaving very differently right now. For instance:

Disabled and immunocompromised audiences are the most likely to be participating in online cultural activities (47%, compared to 39% of audiences without access needs)

Young people under 25 are participating in most types of cultural activities more than older audiences — particularly live performance (85%, compared to 75% of older audiences)

Families are more likely to be facing financial barriers at the moment (49%, compared to 38% of other audiences) – and this trend is likely to continue into 2023.

While there’s lots to celebrate, the picture is complex, and I believe it’s vital we look at where we are with clear eyes. Simply waiting for attendances to build further is not a sound strategy.

This year we will be undertaking three projects as part of the Audience Outlook Monitor. We’re delighted to be working with US agency WolfBrown for the fourth year, with support from the Australia Council for the Arts and state arts agencies around Australia.

1. Pulse Check on audiences amid cost-of-living pressures

Right now, our primary interest is the economic outlook, and how Australian audiences are responding amid cost of living pressures.

Before the autumn is out, we’ll be conducting a ‘Pulse Check’ survey of past participants to get an updated picture of their spending, and explore how arts and culture events are faring in a range of household budgets.

It will be interesting to see the segments that are continuing to spend, who is feeling pained but patient, and who is out of the market altogether.

Our sector has been through recessions before, but this situation is unique in that it comes following three years of a pandemic.

As reported in HBR, ‘The deeper and more prolonged a recession is, the greater the possibility that there will be profound transformations in consumers’ attitudes and values.’

The smartest organisations will stay flexible, strategising on the assumption of a worsening slump, but being ready to respond when the upturn comes. Past downturns suggest audiences may be likely to branch out and try a variety of new experiences once the economy improves.

Make sure you’re subscribed to our Culture Insight & Innovation Updates to hear when the insights are available.

2. Full round of the AOM, tracking audience sentiment on a wide range of topics

Alongside the Pulse Check, we’ll also begin working towards a full round of the AOM in July. Full rounds are where we execute a survey in partnership with around 100 Participating organisations nationally. In contrast with our more targeted Pulse checks, our full rounds explore a broad range of topics, from digital attendance to cultural tourism and subscriptions and memberships.

Organisations that have participated in the past will be invited to continue - and we’ll be reaching out to some new organisations to join the cohort.

This year, participating organisations will also be invited to share their situation in an optional benchmarking exercise. By anonymously sharing their attendance results, top challenges and strategies, we’re aiming to provide a stronger picture of recovery across the arts.

We’re excited to see what emerges when we combine audience data with organisation statistics - and hope it will deliver a useful resource for everyone working on audience development.

3. Pulse Check on diverse audiences

For us at Patternmakers, it’s vital that we continue reaching out to different parts of our audience and community, and we’re excited to see what we can learn this year.

Later in the year, we’ll be exploring audience sentiment in a new segment of our audience - stay tuned for that announcement soon.

Research with diverse audiences requires extra time and care, and it’s important not to shy away from challenging topics. We seek advice and input from those with lived experience to ensure our process is appropriate, accessible and ethically sound.

In 2023, I feel like it’s time to tabulate our gains and losses, take stock of everything that we have learned, and strategise for the next chapter. We have left our ‘panic stations’, and are charting a new course in calmer waters.

A lot of organisations will be forming new strategic plans, or updating old ones. It’s a good time for leaders to be recharging their batteries, thinking deeply and marshalling their resources for the next charge.

It feels like there is A LOT going on, a lot of volume returning to our plates and we are wise to pace ourselves.

I hope the research we provide will be helpful to you.

If you have any suggestions or questions for us, please don’t hesitate to get in touch with us at info@thepatternmakers.com.au

Image Credit: Nicole Reed and Michael Oulton, courtesy of ACMI.

How the pandemic has changed audience accessibility

Download the Access Report to find out more about how the state of access in our sector has changed, case studies to demonstrate the data through lived experience, and resources and tips to prioritise the access needs of audiences.

Attendance by audiences with access needs is recovering – but at a slower rate than average

In our latest Audience Outlook Monitor publication, we take a look at the attendance insights and barriers for audiences affected by access issues, including the return of crowds, the cost of living crisis and the success and sustainability of digital events.

Click the images below to download a PDF of the full report and an infographic of the key facts:

The findings are also available in the following accessible versions:

Read on for the key insights:

Attendance levels among audiences with access needs have fluctuated during the pandemic. Data from October 2022 shows that 7 in 10 (69%) disabled audience members attended a cultural event recently – more than three times the level seen in July 2020 (19%). However, these attendance levels are increasing at a slower rate than average.

The fact that arts spaces, including museums, have been less busy has offered some disabled and immunocompromised audiences improved access to cultural activities at certain points in the pandemic.

The availability of digital events dramatically improved access for some segments. In October, 47% said they participated online recently, compared to 39% of those without access needs, though some note a dramatic reduction in the availability of online events.

Attendance has yet to return to pre-pandemic levels – and may take longer than audiences without access needs. 6 in 10 (58%) audiences with access needs are attending performing arts less than they used to, pre-pandemic, compared to 41% of audiences without access needs.

This report highlights insights from the Audience Outlook Monitor surveys, along with four case studies of audiences with access needs. They show that access needs continue to vary widely – and that more work is needed to address continuing and new barriers.

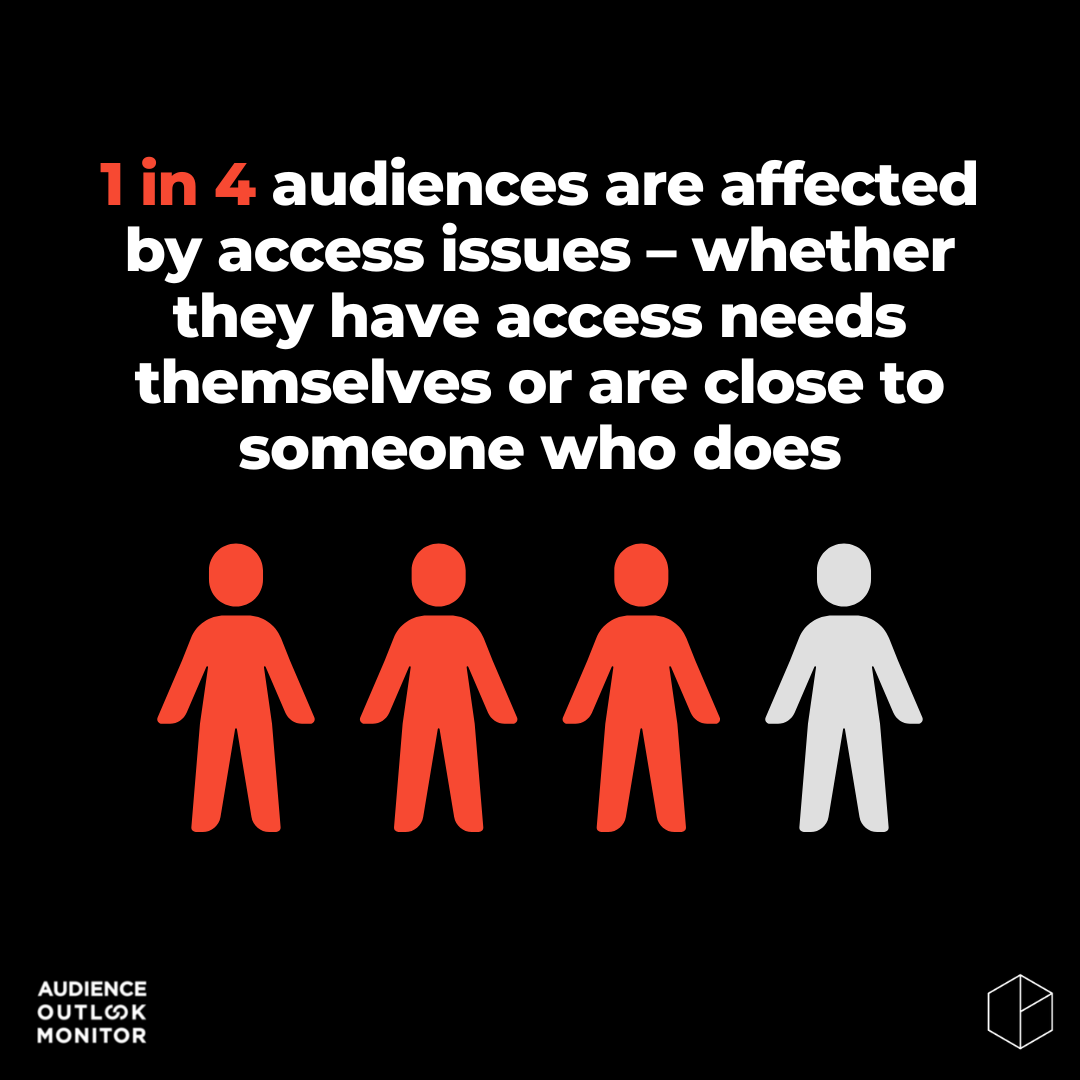

Audiences with access needs are changing their behaviour and require updated strategies

While in general disabled audiences are more likely to face barriers to attending cultural events, the pandemic has led to new and heightened access needs. 26% of audiences surveyed identify as being disabled (10%) or immuno-compromised themselves (10%), or close to someone who is (9%), showing the impact of these issues.

There are signs that more people may be experiencing access challenges due to factors such as long COVID, reduced energy levels and re-entry anxiety.

Audiences with access needs are twice as likely to say their scheduling preferences have changed in light of the pandemic . 1 in 3 (32%) say there has been a change in the time, day or location of events, compared to 17% of audiences without access needs.

Some audiences say that they’re now more likely to attend during the daytime and/or weekdays to avoid crowded times or places, minimise fatigue, and consider the availability of public transport when planning their attendance.

Financial pressures disproportionally affect audiences with access needs. The proportion citing financial reasons as a barrier to attendance is larger among audiences with access needs (49%), compared to those without (39%).

Although digital events can help to overcome barriers to live attendance, their availability is changing, and they are not for everyone. 75% of audiences with access needs see a role for digital events in their lives, but many are eager for opportunities to reconnect with the arts in-person, especially after times of isolation.

The pandemic has shown it’s possible to challenge the status quo to make the arts more accessible

In some senses, the pandemic made the needs and experiences of people with disability more visible. Collective harm minimisation strategies, like lockdowns, encouraged the public to consider the needs of immunocompromised individuals and those at risk of serious health outcomes from COVID-19.

There are signs that work by d/Deaf and disabled artists and disability activists is contributing to a greater cultural awareness of disability and organisational capacity for access. Deaf artist Sue Jo Wright suggests even the presence of Auslan Interpreters at daily press conferences during lockdowns helped bring more exposure to the d/Deaf community.

After being advocated for by people with disability for many years, the livestreaming of arts events became a central part of cultural life during lockdowns – although there’s still work to be done to find sustainable models for digital events.

Some people with disability will be limited in their ability to participate in public life while the virus continues to circulate, and the arts has an essential role to play in maintaining social connection and reflecting these experiences.

The pandemic showed us that it’s possible to reorganise existing social practices for the collective good, especially where accessibility is concerned. Vital conversations, led by people with disability, have taken place – and the lessons learned mean the sector is better-equipped to take action to ensure the arts are accessible and inclusive.

There is an opportunity to review and update Disability Action Plans to capitalise on what has been learned and explore new strategies.

This report also includes four case studies to augment data with lived experience

A series of structured qualitative interviews were undertaken with audience members who identify as d/Deaf or disabled. Hearing from people with lived experience of inaccessibility highlights some of the challenges and opportunities for the arts and culture sector.

Opportunities exist for improving access on-site, online and organisationally

Together, the Audience Outlook Monitor and case study research reveal some practical suggestions that are relevant at this time:

On-site

Provide as much information as possible, ahead of events, whether it’s about venue accessibility, COVID-safety measures or ticketing policies, or the performance or venue itself. Providing information up-front about what to expect will help individuals with access needs plan their attendance on-site.

Check whether all Front of House staff have received Disability Awareness Training, and/or appoint a dedicated roving staff member before, during and after live events to proactively offer support. As we return to in-person events, it’s important to recognise that encountering untrained staff can have an emotional toll for audiences with disability.

With the use of QR codes becoming commonplace during the pandemic, venues might think about using this technology to offer alternative options for ordering food and drink, audio descriptions or Auslan interpretation.

Restore and increase sensory-friendly options such as relaxed performances, noise-cancelling headphones and quiet spaces to ensure audiences with sensory needs are able to fully participate. Tactile experiences weren’t possible during some stages, but most audiences say it’s now time to offer these again.

Review seating options as attendance numbers increase. Find ways to make seating available in most spaces of the event or venue – such as foyers and queuing areas – as well as performance and exhibition spaces. In addition to audiences with mobility needs, 30% of audiences say they need seating to enjoy attending.

Online

Websites:

When welcoming disabled audiences back, look into having a dedicated accessibility page on your website, so that audiences with access needs can simply and easily find the information they need. This avoids placing the ‘burden of asking’ on audiences with access needs and demonstrates a commitment to inclusivity.

Digital productions:

Now that in-person events have returned to a regular schedule, continue investing in digital work that is sustainable for your organisation. The pandemic taught us that digital events play a vital role in accessibility and overcoming barriers to participating in cultural experiences – and many want them to continue.

Hybrid events are one option, but sometimes digital attendees can feel sidelined compared to in-person attendees. Consider digital-only events, or appointing a digital facilitator to ensure people tuning in from home are given the opportunity to engage with performers/speakers and ask questions during Q&A’s.

Marketing/communications:

Use inclusive language and accessible formats in digital advertising, communications and booking systems to let potential attendees know that an event or venue is accessible to all. This includes Plain English resources or Auslan interpretation, audio descriptions, image descriptions and alternative text.

Organisationally

As we look to the next chapter, the conversation about accessibility is evolving. Consider reviewing and updating your Disability Inclusion Action Plan to address the heightened needs of audiences with access requirements.

Incorporate accessibility early, for example when planning and decision-making. Add an accessibility line to your budget templates and develop a checklist for accessibility considerations when conducting important tasks like selecting venues, programming and commissioning works, advertising opportunities, launching major marketing campaigns and ticketing major events.

Involve disabled and immunocompromised people in the planning process of your major programs and projects. This can assist in fostering allyship and creating opportunities for people without access needs to collaborate with disabled and immunocompromised people on access strategies.

With cost of living pressures disproportionately affecting disabled audiences, explore revenue models that address financial barriers such as subsidised ticketing policies, accessibility funds supported through grants, donations or fundraising, or partnering with advocacy groups and support networks.

Further resources

Below is a list of additional resources, with guidance on improving accessibility for audiences.

Accessible Arts resources: https://aarts.net.au/arts-resources/

Arts Hub Artists Essentials Toolkit #9: Accessibility for your arts project: https://www.artshub.com.au/news/career-advice/accessibility-for-your-arts-project-artists-essentials-toolkit-9-2501288/

Melbourne Fringe, Producer’s Guide to Access: https://melbournefringe.com.au/wp-content/uploads/2022/08/Producers-Guide-to-Access-1.pdf

Morwenna Collett Consulting resources: https://www.morwennacollett.com/resources

National Endowment for the Arts, Design for Accessibility: A Cultural Administrator’s Handbook: https://www.arts.gov/about/publications/design-accessibility-cultural-administrators-handbook

Smithsonian Guide for Accessible Exhibition Design: https://www.sifacilities.si.edu/sites/default/files/Files/Accessibility/accessible-exhibition-design1.pdf

Use the dashboard to get results for your artform and region

Survey data from over 5,400 respondents has been uploaded to the dashboard, which now contains insights from 100,000 Australian participants.

You can use the dashboard to explore the findings by state/territory, artform and audience segment.

It’s freely available to access, just click the image below and use the login details provided on the dashboard page.

About the Audience Outlook Monitor

The Audience Outlook Monitor provides the results of a study that has tracked audience sentiment over the course of the COVID-19 pandemic.

Data was collected in six phases throughout 2020-2022. A new approach will be taken in 2023.

Government agencies across Australia are collaborating with research agencies Patternmakers (Sydney) and WolfBrown (USA) to produce this resource. The dashboard is freely accessible and designed to help artists and cultural organisations of all kinds to make the best possible decisions.

How to find out more

To receive new releases directly into your inbox, as soon as they are available, you can opt in to receive Audience Outlook Monitor news below.

Subscribers to our regular Culture Insight & Innovation Updates will need to update their preferences to receive all updates about the Audience Outlook Monitor. Just enter your email below and follow the instructions provided.

If you have a question, or an idea for using this data, please contact Patternmakers at info@thepatternmakers.com.au

Subscribe for updates

About the Author

Bianca Mulet

Senior Research Analyst

Delivery partners

Supporting partners

Past posts on this blog

- 2016 5

- 2017 8

- 2018 12

- 2019 11

- 2020 3

- 2021 7

- 2022 23

- 2023 21

- 2024 1

- About Patternmakers 35

- Accessibility 4

- Arts 73

- Audience development 79

- Beyond the Bio 8

- COVID-19 70

- Capacity building 3

- Career Advice 9

- Case Studies 2

- Coronavirus 2

- Culture 72

- Culture Panel 1

- Dance 3

- Data art 2

- Data culture 69

- Digital art 4

- Education 2

- Evaluation 75

- First Nations 3

- Indigenous 2

- Innovation 78

- Interviews 3

- Manifesto 1

- Opportunities 4

- Our services 4

- Performing Arts 5

- Postcode Analysis 1

- Privacy 6

- Project updates 25

- Publications 1

- Research 99

- Resources 6

- Strategic Planning 5

- Tandi Palmer Williams 7

- Theory of Creativity Podcast 1

- Thought leadership 16

- Tips & Tricks 13

- Toolkit 5

- Top 5 2

- Touring 3

- Trends 3

The outlook for recovery across Australia

Download the October 2022 snapshot reports for key states/territories for tailored insights into how Australian audiences are settling into the post-COVID landscape.

Snapshot reports for key states/territories

Based on data from the October 2022 Audience Outlook Monitor, find out how audiences across Australia’s states and territories are settling into the post-COVID landscape, balancing confidence and the desire for innovative experiences with barriers such as financial pressures, re-entry anxiety and lifestyle changes.

Scroll down to access the Snapshot reports for key states and territories, thanks to support from state/territory arts agencies: Creative Victoria, Create NSW, Arts Queensland, Department of the Premier and Cabinet (Arts SA) and Department of Local Government, Sport and Cultural Industries (WA) and artsACT.

Download the snapshots

Navigate and click the images below to access the snapshots for each state.

Download the following state/territory snapshots in an accessible format:

Use the dashboard to get results for your artform and region

Survey data from over 5,400 respondents has been uploaded to the dashboard, which now contains insights from 100,000 Australian participants.

You can use the dashboard to explore the findings by state/territory, artform and audience segment.

It’s freely available to access, just click the image below and use the login details provided on the dashboard page.

About the Audience Outlook Monitor

The Audience Outlook Monitor provides the results of a study that has tracked audience sentiment over the course of the COVID-19 pandemic.

Data was collected in six phases throughout 2020-2021 and is again being tracked in 2022.

Government agencies across Australia are collaborating with research agencies Patternmakers (Sydney) and WolfBrown (USA) to produce this resource. The dashboard is freely accessible and designed to help artists and cultural organisations of all kinds to make the best possible decisions.

How to find out more

To receive new releases directly into your inbox, as soon as they are available, you can opt in to receive Audience Outlook Monitor news below.

Subscribers to our regular Culture Insight & Innovation Updates will need to update their preferences to receive all updates about the Audience Outlook Monitor. Just enter your email below and follow the instructions provided.

If you have a question, or an idea for using this data, please contact Patternmakers at info@thepatternmakers.com.au

Subscribe for updates

About the Author

Tandi Palmer Williams

Managing Director

Tandi is Founder and Managing Director of Patternmakers. She’s an arts research specialist and leader of the agency’s research projects.

Delivery partners

Supporting partners

Past posts on this blog

- 2016 5

- 2017 8

- 2018 12

- 2019 11

- 2020 3

- 2021 7

- 2022 23

- 2023 21

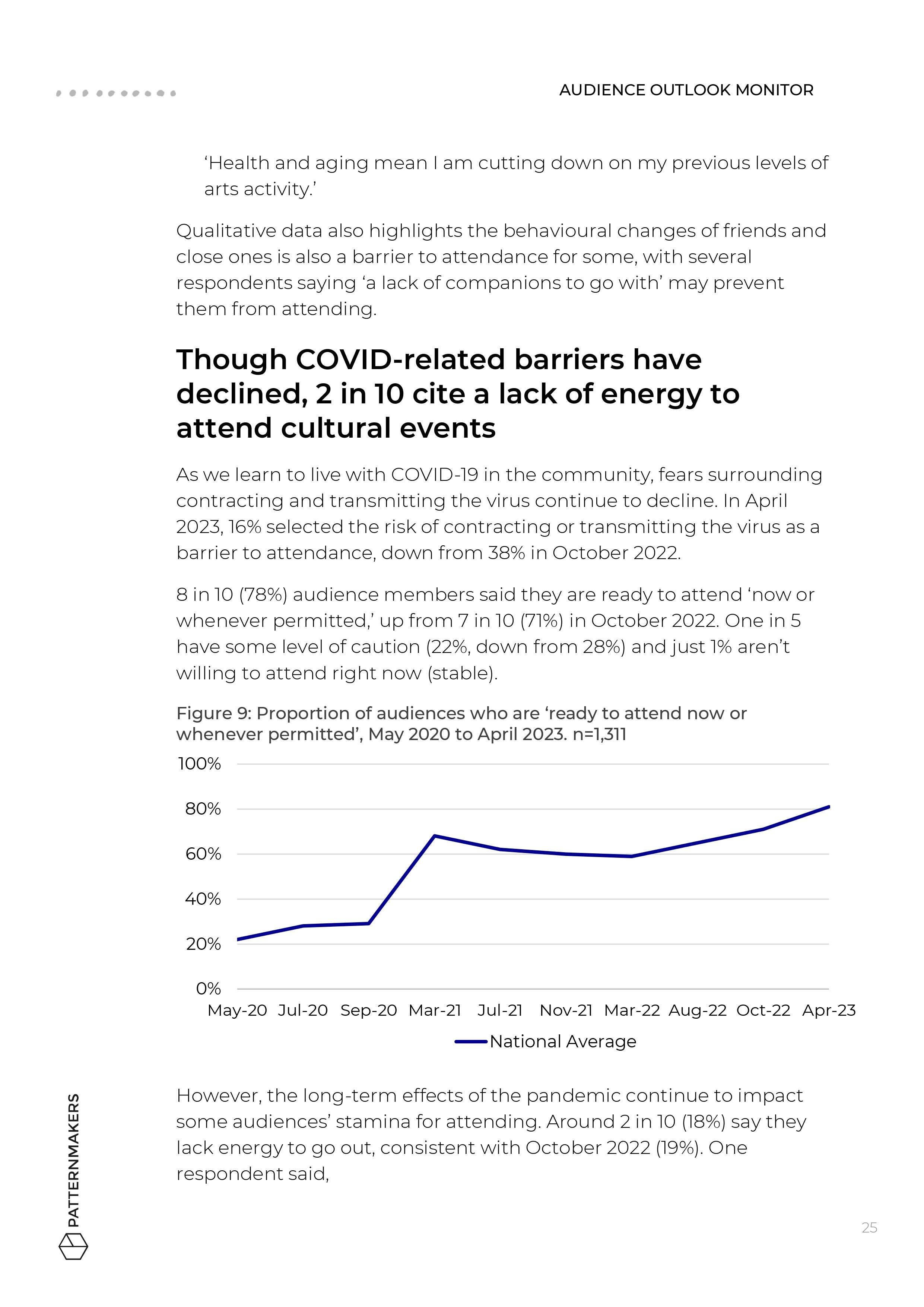

- 2024 1